Futures Reverse Overnight Gains As Amazon Euphoria Fizzles

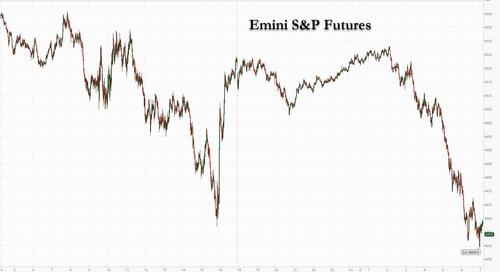

We warned last night that the surge in futures following the huge bounce in Amazon stock wouldn’t last (simply because a closer read of the company’s earnings left a lot to be desired) and sure enough, in the overnight (extremely illiquid) session, 500 futures erased gains of as much as 1.3% to trade 0.1% lower, or 10 points, to 4,460 as European stocks extend their decline as inflation and monetary tightening outweighed earnings optimism. Meanwhile, Nasdaq 100 futures pared much of their gains, trading just 0.5% higher after earlier rising more than 2%, one day after the index had the worst day since September 2020. The VIX increased for a third day Friday, hovering just below 26.

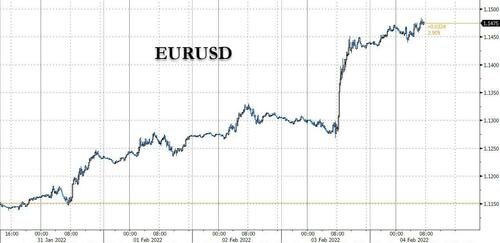

The dollar dropped as the EUR surge continued, following yesterday’s unexpectedly hawkish comments from Lagarde…

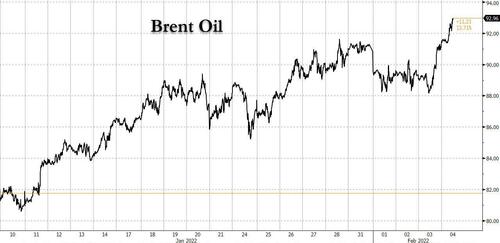

… while oil was on course for a seventh weekly advance with Brent rising

Relief, as brief as it was, was welcome after a 4.2% crash in the Nasdaq 100 Index on Thursday, its biggest since 2020, fueled by a 26% rout in Meta Platforms following disappointing results. The Nasdaq 100 has plunged 11% this year, and the S&P 500 is down 5%, amid normalization of Fed monetary policy and the prospect of rate hikes.

After soaring as much as 18%, Amazon pared its premarket gains to 11%, still implying an increase of $155 billion in its market capitalization if the stock rises by the same extent during regular trading hours. Amazon’s jump was driven by its price hike for Prime and buoyant sales over Black Friday-Cyber Monday. Snap soared as much as 57%, and Pinterest also jumped. Here are some of the biggest U.S. movers today:

- AC Immune (ACIU) shares rose 1% after the company said preclinical data of its amyloid-beta vaccine were published in peer-reviewed journal Brain Communications.

- Activision Blizzard (ATVI) shares are down 1% after the video-game company, which is being acquired by Microsoft, reported fourth-quarter results that missed expectations.

- Amazon.com (AMZN) shares are up 8% after the e-commerce company reported fourth-quarter results that sailed past expectations, lifted by strong results for its cloud-computing business.

- Bill.com (BILL) shares are up more than 8% after the software company reported second-quarter results that beat expectations and raised its full-year outlook. Analysts are extremely positive on the company and its growth potential.

- Estee Lauder (EL) rises 5% after Citi analyst Wendy Nicholson upgraded the stock to a buy from neutral, citing strong growth with more brands, channels and geographies.

- Gitlab Inc. (GTLB) gains 4% after RBC Capital Markets analyst Matthew Hedberg raised his recommendation to outperform from sector perform after a pullback in its shares.

- Hartford Financial (HIG) shares gained about 1% after the insurance firm reported revenue for the fourth quarter that beat the average analyst estimate.

- Mainz Biomed (MYNZ) gains 9% after announcing that it has started an international clinical study to evaluate the potential to integrate a portfolio of novel mRNA biomarkers into its detection test for colorectal cancer which is being commercialized across Europe.

- Snap Inc. (SNAP) surged 24% in premarket trading, but even that won’t be enough to recoup the social media stock’s year-to-date losses.

- Unity Software (U) shares are up 9% after the 3D game-development company reported fourth-quarter results that beat expectations and gave an outlook that is seen as strong.

While the overall earnings picture in the world’s largest economy remains robust, concerns over Federal Reserve tightening lingers. And fears of stubborn inflation increased after data showed U.S. gasoline surged to the highest in more than seven years.

“Overall, the earnings outlook is still solid, with the global tech sector on track for earnings growth of around 15%,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “In our base case, we expect valuations to stabilize and for strong mid-teens earnings growth to be reflected in share prices over the next 12 months.”

While Meta’s sluggish numbers dominated the headlines on Thursday, the flurry of earnings releases showed they may be an exception rather than the rule. Of the 272 companies in the S&P 500 that have reported results, 82% have met or beaten estimates. Profits are coming in at 8.8% above projected levels. Still, volatility has become the hallmark of global markets this year. Investors are trying to come to grips with less favorable monetary conditions and a moderating global recovery amid stubborn inflation.

“The first half this year we are now experiencing a rates shock,” Tracy Chen, portfolio manager at Brandywine Global Investment Management, said on Bloomberg Television. “If the Fed and BOE and other emerging-market central banks are too aggressive in hiking interest rates, potentially we are going to face kind of a recession risk in the second half, or at least more slowdown in the economy.”

In Europe, the Stoxx 600 is down 1.2%, its biggest drop in a week; Makers of cars and parts were the worst-performing industry group, while gains for technology shares surrendered gains after a surprising hawkish turn from the European Central Bank. Better-than-expected earnings were not enough to offset reduced risk appetite. Expected data on Wednesday include non-farm payrolls, while Air Products, Bristol-Myers, Regeneron and Royal Caribbean are among companies reporting. Hawkish comments from European Central Bank President Christine Lagarde and a Bank of England interest-rate hike underlined risks from inflation. While a selloff in the region’s bonds eased, the mood in the stock market turned sour.

Earlier, an Asia-Pacific equity gauge pushed higher partly on a 3% jump in Hong Kong, which was catching up with global markets after reopening from a holiday. Asia’s equity benchmark headed for its biggest weekly advance since early September, boosted by a rally in Hong Kong stocks as they resumed trading after the Lunar New Year holiday. The MSCI Asia Pacific Index climbed as much as 1%, helped by consumer discretionary and financial stocks. Alibaba and Meituan were among the biggest contributors to the rise, as the Hang Seng Index surged 3.2% to post its biggest post-holiday jump since 2009. Asia’s tech sub-gauge edged higher following Amazon’s earnings release. The MSCI Asia Pacific Index is on track for a 2.8% climb this week, its first advance in three, as concerns ease over the pace of U.S. monetary policy tightening. The measure is set to outperform the S&P 500, which is contending with a plunge in Meta shares overnight — the biggest one-day wipeout in history. As the earnings season continues, traders are awaiting the U.S. payrolls report for January due later Friday for more cues on the health of the world’s-largest economy at a time of China’s growth slowdown. Benchmarks in South Korea, the Philippines and Australia rose, while Japan’s Topix had its best week since October. Markets in mainland China and Taiwan will reopen Monday. “At elevated valuation levels, disappointing earnings growth, higher inflation and interest rates we believe stocks with low valuations, strong balance sheet and safe dividends look more attractive,” Geir Lode, head of global equities at Federated Hermes, wrote in a note. “A larger outbreak of Covid in China would further constrain the global economic growth, limiting the upside in stocks.”

Japanese equities climbed, rebounding from Thursday’s slide to cap their best weekly gain since mid-October. Electronics makers and service providers were the biggest boosts to the Topix, which rose 0.6% for a weekly advance of 2.9%. Fast Retailing and Tokyo Electron were the largest contributors to a 0.7% gain in the Nikkei 225, which increased 2.7% on the week. “The price-to-earnings ratio for local stocks isn’t high when compared with U.S. equities, which makes the case easier for investors to buy here,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank. “But investors will find it challenging to push equities much higher until there’s more clarity on the pace of U.S. rate hikes.”

India’s benchmark equity index completed its biggest weekly gain since early this year, amid optimism that the government’s plan to ramp up spending will help revive growth in Asia’s third-largest economy. The benchmark S&P BSE Sensex climbed 2.5% this week, the most since the five days ended Jan. 7. The gauge fell 0.2% on Friday to 58,644.82, while the NSE Nifty 50 Index slipped 0.3%, after swinging between gains and losses several times during the session. “Global markets, especially the U.S., have turned extremely volatile during the earnings which are impacting sentiment in our markets as well,” Ajit Mishra, vice president research at Religare Broking Ltd. said. “We recommend maintaining a cautious stance and keeping a check on leveraged positions.” Fourteen of the 19 sub-indexes compiled by BSE Ltd. fell on Friday, led by a gauge of realty stocks. Finance Minister Nirmala Sitharaman earlier this week announced plans to increase capital spending by 35% to 7.5 trillion rupees ($100 billion) in the next financial year, seeking to bolster the economy’s recovery after disruptions from the pandemic. On the earnings front, out of the 34 Nifty 50 companies that have announced results so far, 18 either met or exceeded analyst estimates, 14 missed and two can’t be compared.

Australian stocks advanced, capping the best weekly gain since August. The S&P/ASX 200 index rose 0.6% to close at 7,120.10 in Sydney, lifted by bank and industrial shares. The benchmark added 1.9% since Monday, for its best week since early August. News Corp was among the top performers Friday after its 2Q earnings exceeded analysts’ expectations. Nufarm was among the worst performers, pulling back from Thursday’s 20% surge. Boral also dropped as it traded ex-dividend. In New Zealand, the S&P/NZX 50 index fell 0.5% to 12,279.56.

In rates, Treasuries gained from belly out to long-end of the curve as S&P 500 futures give back late-Thursday gains driven by Amazon’s earnings report. Treasuries richer by ~3bp across long-end of the curve with 2s10s, 5s30s spreads flatter by 2bp-3bp; 10-year ~1.815% tightens more than 4bp vs German 10-year to narrowest spread since September; U.S. 2-year is little changed with German 2- year higher by 5bp on day, 33bp on week. Front-end lags, following short-dated German yields higher as EUR swaps reprice for ~50bp of ECB rate hikes this year. January jobs report at 8:30am ET is focal point of U.S. session. German 5y yields turn positive for the first time since 2018. Peripheral spreads widen with 5y Italy underperforming. USTs bull-flatten a touch ahead of today’s payrolls release.

In FX, Bloomberg dollar spot index is near flat. Commodity currencies are the weakest in G-10, EUR outperforms, cable stalls near 1.36.

In commodities, West Texas Intermediate hit a fresh seven-year high and touched $92 a barrel while Brent rose above $93 after surging 19% this year and banks including Goldman Sachs Group Inc. forecast it’ll reach $100. Spot gold rises ~$9 near $1,813/oz. Most base metals trade in the green; LME lead rises 1.2%, outperforming peers

Looking at the day ahead now, and the main highlight will be the aforementioned US jobs report for January. And over in Europe releases include Euro Area retail sales, German factory orders and French industrial production for December, the German and UK construction PMIs for January. From central banks, speakers include the BoE’s Broadbent and Pill, and the ECB’s Villeroy. Finally, earnings releases include Bristol Myers Squibb and Aon.

Market Snapshot

- S&P 500 futures down 0.1% to 4,460

- STOXX Europe 600 down 0.2% to 467.59

- MXAP up 0.8% to 188.00

- MXAPJ up 1.1% to 615.27

- Nikkei up 0.7% to 27,439.99

- Topix up 0.6% to 1,930.56

- Hang Seng Index up 3.2% to 24,573.29

- Shanghai Composite down 1.0% to 3,361.44

- Sensex down 0.2% to 58,660.41

- Australia S&P/ASX 200 up 0.6% to 7,120.21

- Kospi up 1.6% to 2,750.26

- Brent Futures up 1.6% to $92.53/bbl

- Gold spot up 0.3% to $1,809.92

- U.S. Dollar Index little changed at 95.31

- German 10Y yield little changed at 0.16%

- Euro up 0.1% to $1.1457

Top Overnight News from Bloomberg

- The Bloomberg Dollar Spot Index inched lower and was set for its worst falling streak since April even as the greenback advanced versus most of its Group-of-10 peers

- The euro led gains among G-10 currencies, rising above $1.1450 with the currency’s volatility skew shifting higher across tenors compared to a week ago as topside demand gets a fresh boost following the latest ECB policy monetary meeting

- German bonds tumbled on Friday, pushing the yield on five-year notes above zero for the first time in over three years as markets braced for the ECB to scale back its accommodative monetary policy

- Money markets have priced in around 50 basis points of ECB tightening for December, which would be enough to end seven years of negative deposit rates. The move builds on wagers from Thursday triggered by ECB President Christine Lagarde’s press conference, where she said policy makers are no longer ruling out an interest-rate hike this year

- The pound fell against both the dollar and euro as the Bank of England’s hike on Thursday failed to quell doubts over the sustainability of a tightening cycle and the possibility of a policy error

- New Zealand dollar rose over its Australian peer on leveraged demand as New Zealand reported a slowdown in omicron cases. Yields of both nations’ bonds advanced with other risk assets

- Japan’s benchmark 10-year and five-year yields rose to a six-year high amid speculation the Bank of Japan will end up joining developed-market peers in normalizing monetary policy. The yen steadied

A more detailed look at global markets courtesy of Newsquawk

Asian stocks eventually traded mostly positive with early indecision seen after the tech-related turbulence in US. ASX 200 (+0.6%) lacked direction for most the session before a late surge lifted the index above 7,100. Nikkei 225 (+0.7) was initially contained by a pullback in USD/JPY, although earnings continued to drive price action. Hang Seng (+3.2%) outperformed on return from a three-day closure with autos underpinned by a jump in deliveries and sports brands bid heading into the official start of the Beijing 2022 Winter Olympics.

Top Asian News

- Lavrov Denies U.S. Video Claims; Putin, Xi Meet: Ukraine Update

- Hong Kong Security Police Arrest 75-Year-Old Democracy Activist

- Carlsberg CEO Downplays Risk of Russia, Ukraine on Business

- Tesla’s Call for Tax Breaks Rejected by India in Fresh Blow

European equities have drifted lower from the mildly positive cash open despite a lack of news flow. European sectors have tilted to a more defensive bias, but Energy outpaces as crude prices remain firm.

Top European News

- Saras Rises; Barclays Double Upgrades on Refining Margins

- Boris Johnson’s Key Aides Quit, Leaving Premier on the Brink

- Ousted Orpea CEO Got 2020 Bonus Even After Missing Growth Target

- Holcim Cut to Sell on Change in Future Strategy: Berenberg

In Fixed Income, core EGB benchmarks came under further pressure in early-European hours on further hawkish repricing. Action that sent the German 5yr yield positive and the 10yr to a test of 0.20%. The Periphery remains hampered with spreads widening further and focus turning to potential looming 30yr syndication via Spain.

In FX, DXY is contained with a negative-bias in pre-NFP trade, while EUR continues to outpace but GBP pullsback on EUR/GBP action. Antipodeans lag following a dovish RBA SOMP, but NZD is somewhat cushioned by AUD/NZD. JPY remains resilient with USD/JPY holding below 115.00. NATO Chief Stoltenberg will be appointed as Governor of the Norges Bank, via Daily VG; Deputy Governor. Bache will be the acting Norges Bank Governor from March 1st until Stoltenberg takes over.

In commodities, WTI and Brent continue to grind higher in a continuation of yesterday’s upward momentum, focus remains very much on geopolitics this morning. Brent-WTI arb continues to contract amid China-Russian deals and the ongoing Texas freeze. Citi recommended selling December 2022 Brent crude futures on expected inventory builds this year and it targets up to 20% downside in Brent December 2022 prices during H2. Spot gold and silver are modestly firmer but remain in recent ranges and near multiple DMAs

US Event Calendar

- 8:30am: Jan. Change in Nonfarm Payrolls, est. 125,000, prior 199,000

- 8:30am: Jan. Change in Private Payrolls, est. 32,000, prior 211,000

- 8:30am: Jan. Change in Manufact. Payrolls, est. 20,000, prior 26,000

- 8:30am: Jan. Average Weekly Hours All Emplo, est. 34.7, prior 34.7

- 8:30am: Jan. Unemployment Rate, est. 3.9%, prior 3.9%

- 8:30am: Jan. Underemployment Rate, prior 7.3%

- 8:30am: Jan. Labor Force Participation Rate, est. 61.9%, prior 61.9%

- 8:30am: Jan. Average Hourly Earnings MoM, est. 0.5%, prior 0.6%; YoY, est. 5.2%, prior 4.7%

DB’s Jim Reid concludes the overnight wrap

Tyler Durden

Fri, 02/04/2022 – 08:05

via ZeroHedge News https://ift.tt/dk3eZs7 Tyler Durden