2022 Could Be “Even Crazier” Than 2021 For Supply Chains

Submitted by QTR’s Fringe Finance

This is part 1 of an exclusive Fringe Finance interview with shipping analyst (and friend of mine) J Mintzmyer, where we discuss the state of the supply chain in the country, the developments with Canadian truckers, logistics, the effects of Covid and what shipping names he likes for 2022.

J is a renowned maritime shipping analyst and investor who directs the Value Investor’s Edge (“VIE”) research platform on Seeking Alpha. You can follow him on Twitter @mintzmyer. J is a frequent speaker at industry conferences, is regularly quoted in trade journals, and hosts a popular podcast featuring shipping industry executives.

J has earned a BS in Economics from the Air Force Academy, an MA in Public Policy from the University of Maryland, and is a PhD Candidate at Harvard University, where he researches global trade flows and security policy.

Q: J, last time we talked was in Fall 2021. How has the supply chain changed since then? Where are the bottlenecks, if any, now?

Despite all the nonsense across the mainstream media about the supply chain “normalizing” or “recovering,” by and large we are in a very similar situation as last fall.

This period of time (January-April) is typically the weakest part of the year since we are post-Holidays in the US and Europe and China also slows production around the Lunar New Year, so we would otherwise expect freight rates to crash and congestion to ease. Instead, we are seeing freight rates hold up firm (actually rates are higher than November-levels right now, which is wild!), and throughput numbers out of LA and Long Beach have been very low even as the ship backlog keeps piling up.

If these ports fail to clear the backlog and congestion by June/July, then Fall 2022 could be even crazier than last year, I’m watching this closely.

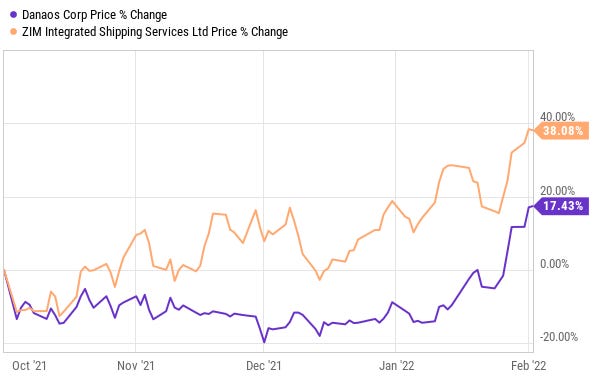

Both DAC and ZIM, which you pointed out last fall, are up significantly since you first pointed them out. Are you staying with these names?

It’s a timely question! I have made life-changing returns from both Danaos Corp (DAC) and Zim Integrated Shipping (ZIM) and I still have long exposure; however, I have trimmed DAC substantially around the $90-$95 mark and I have trimmed a lot of ZIM in the mid/upper-$60s.

My personal ‘fair value estimate’ is $120 for DAC and $77.50 for ZIM, but I often take profits on rallies. A common mistake I see from traders and investors is an ‘all-or-nothing’ approach (i.e. “when should I sell it all?”). I prefer to layer in and layer out. During the December slump in ZIM I was loading the wagons. I was also loading the wagons in DAC in very-early January in the low- to mid-$70s.

At this exact time (February 2, 2022), I personally prefer both Atlas Corp (ATCO) and Textainer Group (TGH) as top trades.

Given the recent Canadian trucker rally, inform my readers how crucial trucking is to the supply chain? Is this a trend you can see catching on in the U.S.?

Trucking is absolutely essential to the overall supply chain and especially for our nationwide food supply!

There are some clear political challenges here and the US is already short an estimated 50-100K truck drivers, so we cannot afford to lose any more.

However, so far the protests have been fairly limited in scale (the pictures and video seem large, but we are talking about a fraction of 1% in a niche route), and the US dropped the Federal mandate, which reduced potential friction there.

Vaccines are mandated for border crossing to Canada and Mexico, which is something to watch for sure.

Last time we talked you said peak rates were October 2021. Do you feel the same now?

I was looking at pure seasonality and I expected the average per FEU rate would likely dip to around $5k/FEU by February or March just due to seasonal patterns.

As of February 2nd, the Freightos FBX global average is $9,625/FEU, which compares to $10-$11k in September/October peaks and compares to about $4k last year. These rates are absolutely unprecedented and $9,600 in February is actually far more impressive than $10-$11k last fall when you consider the seasonality.

Again, this is a period of time when rates should be rapidly falling, yet prices are actually up 5-10% from last November/December.

When’s your realistic “back to normal” estimate for supply chains, if ever?

It depends how you define “normal.” The containership industry went through a period of global oversupply for nearly a decade straight, and particularly bad rates from 2014-2018, so what many people believe is “normal” was actually a bearish aberration. If we take a more 20-30 year normalized freight rate as ‘normal,’ then that is higher than almost anything we saw in the entire 2010s.

I expect we will eventually head back towards more normalized levels, but it all depends on levels of congestion and levels of total consumer spending. My best guess is that peak rates are behind us in Sept/Oct 2021; however, full year 2022 rates and earnings will likely end up higher than 2021 because the first half of 2022 is shaping up to be way stronger than 1H-20221.

This is merely my educated guess as of February 2nd, and readers should note that I have been wrong for over a year straight in terms of being way too conservative/cautious.

That might seem odd because I’m a huge investor and bull on the sector, but I tend to model my macro expectations on the conservative side. Overall though, I expect strong rates through 2022 and at least parts of 2023. We should be back to ‘normalized’ rates (i.e. but still higher than 2012-2018 levels) by 2024 due to substantial vessel deliveries and hopefully the world will be past COVID by then!

Part 2 of this interview will be found here.

—

If you have the means and would like to support my work by subscribing, I’d be happy to offer you 22% off for 2022: Get 22% off forever

DISCLAIMER:

I have not personally vetted J’s returns — it is up to readers considering his service to do so. I own ZIM and DAC, as I’m sure does J, as disclosed. I’ll likely own ATCO and TGH at some point soon, too. J already does. None of this is a solicitation to buy or sell securities. It is only a look into our personal opinions and portfolios. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe.

MORE DISCLAIMER:

These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot. If I am here listing things I got right or things I think will happen in the future, note that there are likely twice as many things I got wrong over the same period of time. I’m not a financial advisor, I hold no licenses or registrations and am not qualified to give advice on anything, let alone finance or medicine. Talk to your doctor, talk to your financial advisor or your therapist. Leave me a alone and do your research elsewhere. If you can find somewhere to rate this Substack one star, please do so as to save future readers from the misery of my often wholly incorrect prognostications.

Tyler Durden

Sun, 02/06/2022 – 08:45

via ZeroHedge News https://ift.tt/YJPyh8I Tyler Durden