The Fed, Inflation, Rates And Credit Markets

By Peter Tchir of Academy Securities

This week we will discuss:

-

The Fed, because I want my view to be loud and clear and we can’t discuss bonds and credit without having a picture of the Fed.

-

Inflation, because you can’t have a view on the Fed without a view on inflation.

-

Bond and Credit Markets. With so much dislocation, it is worth picking through the credit markets and identifying the best risk/reward trades out there.

After a week where we have seen companies gain and lose $200 billion or more of market cap within minutes of their after-hours earnings announcements, I figured I’d shift away from the “valuation re-valuation” theme, but I think that we will see new lows in stocks in the coming days and weeks. The rally that started on Friday the 28th and continued strongly into Monday last week was fueled by short covering, month-end, and start of month flows. While there is a new group of shorts to be covered, people piled into risk last week and I think that will contribute to what we called “Failure to Launch” last week. As we sit at levels similar to where we were last weekend, I don’t see the need to run through the same arguments as I think the theme is still valid.

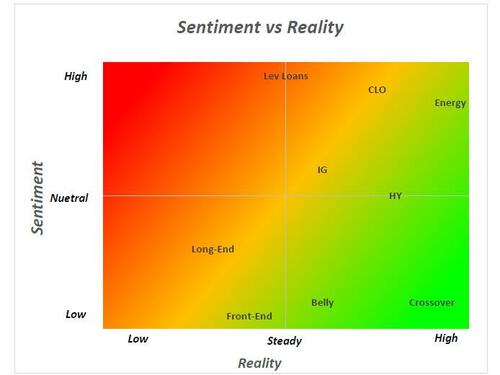

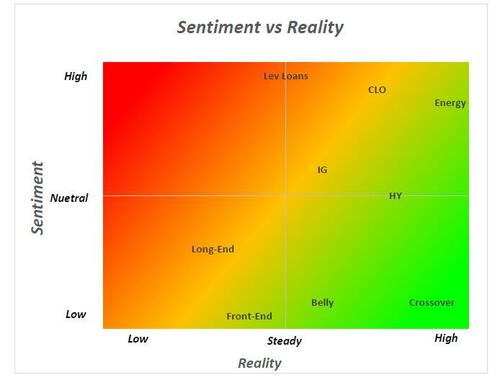

The goal of this weekend’s T-Report is for this chart, which I haven’t dug out in ages, to make sense by the time you are done reading. As I am attempting to be more “mature”, I call it Sentiment vs Reality, though I still prefer the Hopium vs Doomium title originally assigned to it. It is really about trying to identify outliers and being contrarian.

Inflation

From a longer-term perspective, I continue to believe that “this time is different” for two main reasons:

- China has gone from being deflationary, to at best neutral. This is a radical shift from the past 20 or so years and is tied to the “Re-Centralization” of China thesis that we continue to pound the table on and see more and more evidence supporting this on an almost daily basis.

- ESG is inflationary. I would not pound the table on this partly because I’m tired of doing so (the recent Inflation, Like Greed, Is Good and ESG Fueled Inflation from last March are relevant). Also, so many people have picked up on the theme that I don’t really need go over it again (I cannot believe I missed coining the term “greenflation”).

Having said that, I think that inflation, like everything else, will be somewhat volatile. It feels like we spent almost a year fighting the use of the word “transitory” and now everyone sees inflation for as far as the eye can see, which might not be correct.

- Housing. The methodology for calculating Owner’s Equivalent Rent (OER) institutes “lag” into the number. Only a subset is repriced each month, so we have months of rising inflation on this key component because much of what already happened isn’t yet reflected in the data.

- Commodities. Remember the “base” effect concept that was so much a part of the “transitory” argument, i.e., the equivalent of companies facing “easy comps”? In March 2020 oil traded in the low 20’s. By March 2021 it was in the 60’s (tripled). Now the front contract is at 91, so up 50%, still high, but the comparisons get more and more difficult over time (and at the start of December it was as low as 65 – i.e., barely higher). I don’t claim to know where oil is headed next (despite being an energy bull), but it isn’t obvious the recent rally will continue unabated. For commodities, it would be remiss if I don’t follow my own advice on The Be Skeptical of Commodity Futures Narratives and examine some longer dated futures contracts. The 20th oil futures contract (almost 2 years out) barely got below $35 at the time of the crisis, and was 55 in March of last year and is “only” $74 now, though was at $62 back in December. That tells us that we should look through some of the volatility on the front contract (which gets 99.999999% of the media’s attention) and look for the bigger trends. Inflation? Yes. Out of control? Not so much. Remember when we heard about lumber prices every day? Would it surprise you to know that they are flat year on year and are about to go up against some really high comps? I wonder if we don’t hear about that now because it doesn’t fit the narrative? The “certainty” expressed around commodity inflation seems overdone. We might get it, but whenever everyone gets so one-sided, it is worth examining. I can be convinced that we are in a commodity super cycle (maybe), but that doesn’t mean it is a one-way street.

- Wage inflation is real. We are seeing that. Friday’s job report was great from the perspective of a worker (which is why I’m on the “Inflation is Good” kick).

- Savings and stimulus waning. We’ve seen deposits decline, have seen some reports showing that “excess” saving is on the decline, and all the additional stimulus that was helping fuel spending is also gone. This could be a drag.

- Inventory hangover. Most figures linked to retail sales are showing declines. Most figures linked to inventories are showing increases. As supply chains recover from Omicron and as the pandemic turns endemic, we could see more of that. I’m not looking for a prolonged problem, but I expect to be talking about overstocked inventories rather than supply chain issues at some point this year (I think as early as this quarter). Personally, I’m betting used car prices will be lower by the end of this year than they are now, because I need a “new” used car soon!

I’m in the higher inflation (3% to 4%) for longer (3 to 5 years) camp, but even that longer-term call is questionable as D.C. failed to deliver some stimulus and there is no reason to believe that even if I’m correct, the path will be that smooth.

I fully expect to see periods later this year where the inflation story gets called into question (which isn’t that hard to believe when as late as last November, consensus was still leaning to the transitory side).

The Fed

Powell said “data dependent” in about 10 different ways at his press conference! There is no reason to doubt that, so unless you think inflation is guaranteed, you may want to take a step back on how aggressive they will be. Since I think that people have become too optimistic (or pessimistic, depending on your viewpoint) on inflation, we may see plenty of opportunity for the Fed to be cautious on tightening. If the politicians move on to another soundbite, which seems likely, since the half-life of a soundbite in D.C. seems about 4 months long (I’m being generous), then we could see the Fed dial back their inflation fighting rhetoric. They want jobs and growth more than they fear inflation.

In any case I have an extremely strong view on the Fed in 2022:

- Fewer hikes. One in March for sure. Almost certainly only 25 bps. Maybe they go 50 bps, but that would be out of character and would diminish the chances of a May hike. If we get 25 in March, then possibly 25 more in May. After that, I think it is a wait and see approach.

- The Fed knows more about how the economy responds to rate hikes than they do about QE or QT. There is typically a three to six month lag between the hikes and when it is felt in the economy. So, they’ll hike and then wait and see and let the data develop.

- The Fed knows that hikes are ineffective and maybe even counterproductive on supply side issues. Whether it is supply chains or underinvestment in traditional energy production, there is little good that a rate hike does to fix those issues.

- There is a big stigma attached to hiking and then having to cut. The Fed does NOT want to go through a series of rapid hikes only to find it necessary to cut. The onslaught of the Coronavirus forced the Fed’s hand in 2020. They can accept an outside event as a reason to reverse course, but hiking “too much” causing the economy to slow “too much” resulting in a cut (without a major shock) would be highly embarrassing.

- Hikes likely flatten curves. Unless everyone gets on the extreme growth bandwagon, it seems likely that hikes will flatten curves, which isn’t the signal the Fed wants to send.

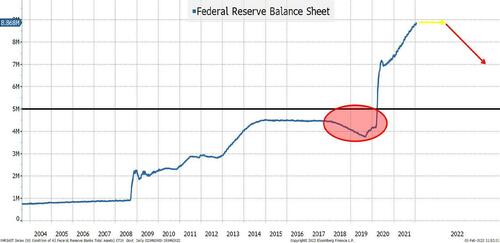

Balance Sheet Reduction. This will be the main policy tool! Although Powell seemed to downplay it during the press conference, their implementation notes singled out their mortgage holdings (hardly evidence that they haven’t been focused on balance sheet reduction). If anything, this is evidence that they might be forced to sell mortgages if the run-off is too slow!

The Fed knows less about how QT impacts the economy. While I think QT is worse for risk assets than rate hikes, the Fed does not necessarily agree with that. I believe, and I think the Fed might too, that QT is less harmful for the economy. That would make it the preferred choice. o The Fed is less sensitive about changing course on QT. Since we all know less about QT in practice, it is easier to change midstream if the results aren’t what was expected in theory.

QT likely steepens curves. We don’t know for sure, but that is the theory and that is a signal the Fed wants to send.

The Fed’s balance sheet (on the Treasury side) has:

- $320 billion in bills, with about $50 billion maturing in the 2nd half of the year.

- $760 billion of bonds maturing this year, with $400 billion maturing in the 2nd half of the year.

- $800 billion of bonds maturing in 2022 and $530 billion in 2024.

- There is some lumpiness to relying solely on maturing bonds, so they will have some monthly maximum, but they could shrink it rapidly, just on Treasuries.

The Fed is a “Profit Machine” for D.C. The Fed runs an accrual accounting profit machine. They fund overnight (primarily) and hold longer dated bonds. That generated $108 billion in 2021 (the Fed pays their profits back to the government). While I might be a bit simplistic, every rate hike erodes their profits (which I’m sure D.C. likes to get) and at some point, it becomes a potential loss. On a simple, back of the envelope calculation, their NIM (net interest margin) is probably about 1.5% or less (makes sense given where rates have been while they accumulated their portfolio). While their profits won’t drive their decisions, it seems likely to influence them. Rate hikes hurt their profit far more than run-off.

The balance sheet has never been this large and we’ve never attempted to reduce it as much as we are likely to try (I say try, because I think it will fail at some point, but it will get going). I put a line at $5 trillion, just so we could see that, though I doubt we try and get the balance sheet quite that low. My “guess” is something towards $6 trillion by the end of 2024 – a fast pace from today’s almost $9 trillion number, but plausible with the existing maturity schedules, without resorting to selling (which they will try and avoid, though their hand might be forced on the mortgage side). I have spared you the charts showing the stock market lined up with the balance sheet because you can find them easily enough on your own (and because they are a bit contrived), but not to be completely ignored.

Bottom line is that I think the market is underappreciating their focus on the balance sheet and is heavily overestimating their willingness and ability to hike!

Bond and Credit Markets

Let’s start with this chart again.

This chart attempts to identify where the sentiment deviates from the reality. What asset is the market pricing for one thing, when the reality is very different.

Front-End Yields. Given my view that “the Fed will not hike as often as is being priced in” suggests buying the front-end as markets have gotten ahead of themselves. This is directly correlated to rate hikes and is not affected much by QT.

The Belly of the Curve. This may be an even better buying opportunity than the front-end. It will benefit from fewer hikes while not being hurt much by QT (though it should have an influence). The 1 year to 5-year curve is reasonably steep and could flatten as people stretch out the rate hikes and determine that a lower terminal rate is also the likely outcome.

Long-End Yields. I’m less sanguine about this here. The flattening has been extreme, so they’ve almost ‘benefitted’ from rate hike chatter on a relative basis (which is not the case for the front-end nor the belly). They are no longer universally hated, which would also add to the potential to see a rise. Kind of neutral here, but with a slight tilt towards higher yields.

Investment Grade Credit. Despite a recent rise in spreads, the asset class still has a lot of demand and outflows slowed significantly, even with recent weakness.

Spreads are tight, historically, but companies are very healthy and the “equity” cushion supporting most credit is very strong in the IG space. With a Federal Trade Commission that seems ill disposed towards large M&A, we should see less supply than we might otherwise get. This has been largely a repricing of credit risk, rather than a reassessment of credit risk. In the IG space, the widening has been correlated to equity prices dropping, concerns about rates, etc., but not really because anyone is suddenly worried about risk to the economy or to earnings in a way material enough to affect IG credit. The market seems to have this one “about” right.

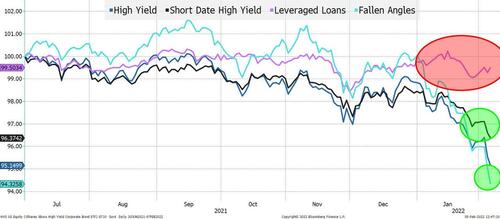

This is where things get interesting (I’ve used ETFs, HYG, SJNK, BKLN, and FALN for the chart). Leveraged loans are virtually unchanged. There are two important things to take away from this:

- There isn’t a credit concern. If investors were concerned about credit risk, you would see leveraged loans get hit hard as well! Even though the loans are secured, you would expect to see more selling pressure, much more in line with high yield. (You can see the same thing if you look at CCC credits, which would normally underperform in times of credit stress, but haven’t been doing poorly).

- The “rate” mistake might be getting compounded in leveraged loans. Yes, leveraged loans are floating rate, but that is a bit simplistic. I’m told that about 59% of loans have Loan Floors with an average floor of 76 bps. So, loan income will increase as the Fed raises rates, but not on every loan. Once we start getting to 100 bps of hikes, then the leveraged loan market as a whole benefits from rate hikes, but at the moment, only a portion does. Loans are virtually all callable, which doesn’t mean much right now while the high yield market is in disarray, but as that stabilizes, and rate fears grow, some issuers will look to re-optimize their capital structure.

So, I’d be reducing exposure to leveraged loans – too little upside, and too much priced in on the rate hike front.

If credit risk isn’t a problem (leveraged loans and CCC bonds are telling us that it isn’t) then high yield looks very attractive. But I’d wade into shorter dated high yield bonds because:

- They should have performed much better versus the overall market than they have.

- While high yield does carry risk, it is easier to estimate what the company will look like in the near-term than the long-term, so those bonds should trade better as there is less uncertainty around the companies’ futures in the short-term.

- It fits my view on yields very well (fwiw, I generally stick to the view that the best rate hedge for owning high yields bonds is owning Treasuries, because they are much more of a risk-asset than a yield asset, although that has not been the case these past few weeks).

Then, to channel my inner Jim Cramer (which every pundit has), I want to hit the BUY BUY BUY button on “crossover” credits!

Coming into this year, owning “upgrade candidates” was a smart but crowded trade with decent upside. It is still smart, isn’t as crowded, and has MORE upside! I really like the upgrade candidates. Nothing about the Fed action is going to impact the economy so badly that the upgrade stories take a hit! This is all about positioning! That is my highest conviction trade here.

The CLO market behaved quite responsibly during the past month, which puts it at neutral (at best) from a risk/reward perspective. Leveraged loans did well and there is no credit deterioration, so CLOs should have traded ok. The problem is that other spread assets, from IG to HY got cheaper, so I’d reduce some exposure to CLO’s here as I think there are better risk/reward trades out there (thinking 3-7 year maturity, BB with upgrade prospects, bonds).

Energy. I wanted to highlight energy risk, because despite it being wildly popular, there is still more potential upside. I think that we are going to have to aggressively expand into new fields as existing fields seem to be drying up faster than expected in many cases. This is great for smaller exploration companies and the servicers!

Munis, structured products, and mortgage-backed securities. Quite frankly, these markets haven’t been part of what I live and breath so far in 2022 (it has been a crazy start to the year). I will work to correct that. My gut would be that munis are interesting as retail has gone for the rates trade, hook, line, and sinker, and that mortgages might have some more spread widening in the coming weeks as we learn more about how the Fed will handle them in their balance sheet reduction efforts.

In any case, hopefully the sentiment vs reality (Hopium vs Doomium) chart makes sense now and let’s hope markets give us a few more minutes to breathe this week because the current pace of volatility is exhausting!

Tyler Durden

Sun, 02/06/2022 – 12:00

via ZeroHedge News https://ift.tt/FjSIiu1 Tyler Durden