Alibaba Shares Soar As SoftBank Denies Speculation To Sell Massive Stake

Alibaba Group Holding Ltd. soared in Hong Kong Wednesday after SoftBank Group Corp. denied reports it was involved in the Chinese e-commerce firm’s filing of additional American depositary shares (ADS), according to Bloomberg.

On Feb. 4, Alibaba Group filed a 6F filing detailing the registration of 1 billion new ADSs. Citigroup Inc. analysts drummed up speculation that Masayoshi Son’s SoftBank was preparing to cut its Alibaba holdings.

The filing was surprising to many Wall Street analysts, and speculation ran wild in the investment community, sending Alibaba shares in New York and Hong Kong spiraling lower. By Tuesday, SoftBank executives calmed fears and said they weren’t responsible for the share registration.

“The registration of the ADR conversion facility (F6 filing, which was filed by Alibaba), including its size, is not tied to any specific future transaction by SBG,” SoftBank said in an emailed statement on Wednesday.

Masayoshi told analysts in the call that his firm “holds about 25% of Alibaba having converted a tiny amount to cash. We still hold 90-something-percent of our Alibaba stock.”

Jefferies analyst Atul Goyal quoted Softbank heads who “were as surprised as everybody else by the filing.”

Citigroup Inc. analysts, including Alicia Yap, provided some clarity into the 6F filing, saying it will facilitate investors who want to convert Hong Kong shares into ADSs.

The news SoftBank wasn’t disposing of its massive Alibaba stake was a relief as shares traded higher, as much as 7% in Hong Kong and 6% in premarket hours in New York.

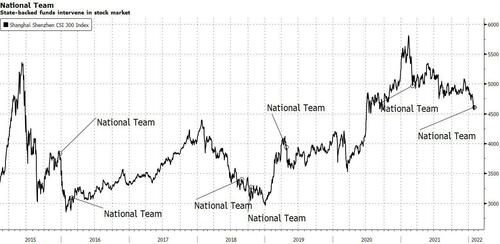

A combination of factors has returned optimism to Chinese stocks, trading on the mainland, Hong Kong, and ADRs after news of China’s “National Team” (the local plunge protection team) intervened in equity markets to stem losses on Tuesday. This is the second time in weeks market interventions have been seen. We reported on Jan. 27 that seven of China’s ten largest fund-management companies, including E Fund Management Co. and GF Fund Management Co., are shoring up equity markets with massive buying programs. Also, state-owned Securities Times called upon the investment community, such as brokerage firms, fund managers, insurers, and other institutions, to “stiffen the spine” and support capital markets amid surging volatility.

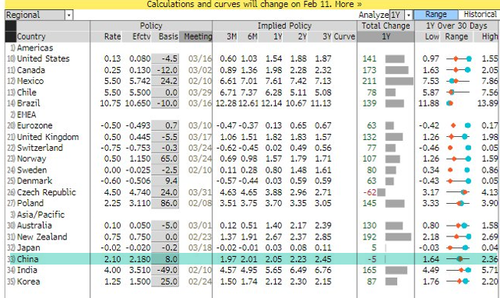

Verbal intervention shows authorities are concerned about capital markets and are increasing support following several rounds of central bank easing. China is one of the only central banks easing globally.

Asia equity strategist at JPMorgan Mixo Das recently noted, “Within Asia, if you just follow policy, China is definitely the place to be,” adding the investment bank had upgraded Chinese equities to overweight just weeks ago.

… and something our premium subs have been following, China’s all-important credit impulse finally bottoms and is setting the stage for a possible power credit impulse bounce.

Tyler Durden

Wed, 02/09/2022 – 07:34

via ZeroHedge News https://ift.tt/lhra9EG Tyler Durden