Traders Buy Bonds, Stocks, Crypto, & Commodities Ahead Of CPI ‘Event Risk’

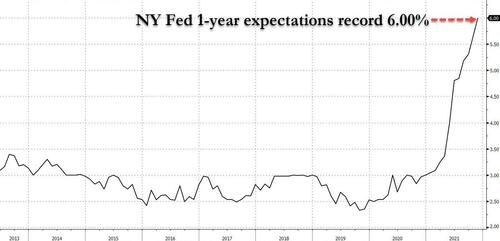

“Buy all the things” was the message from on-high today as bonds, stocks, gold, crude, copper, and crypto all rallied on JPM initiated rumors that tomorrow’s CPI may come in light and the reassuring words of Cleveland Fed’s Mester who said – with a straight face that “long-run inflation expectations are still well anchored”… despite The Fed’s own data mocking her…

Source: Bloomberg

“You keep using that word. I do not think it means what you think it means.”

Building on the last-hour ramp yesterday, US equities were almost a one-way street higher today with Nasdaq (up 2%) and Small Caps outperforming (there was another last-hour trend shift)…

Nasdaq rallied back into the green for Feb (joining the rest of the majors (Small Caps up over 2% in Feb)…

S&P ramped up to its 100DMA and stalled

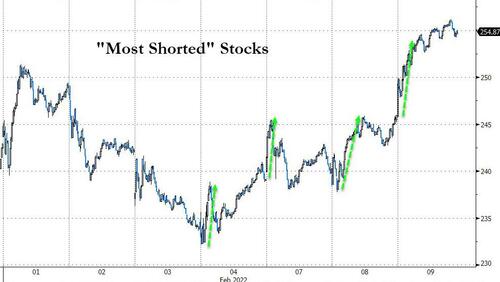

“Most Shorted” stocks are up 4 straight days, up over 9% – the biggest squeeze since late October…

Source: Bloomberg

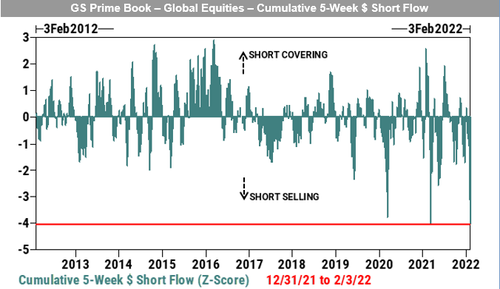

And what’s most worrisome is the scale of short positioning is rip for a huge squeeze…

Treasury yields were mixed today with the short-end underperforming (2Y +2bps, 10Y -2bps) even with some late-day selling pressure…

Source: Bloomberg

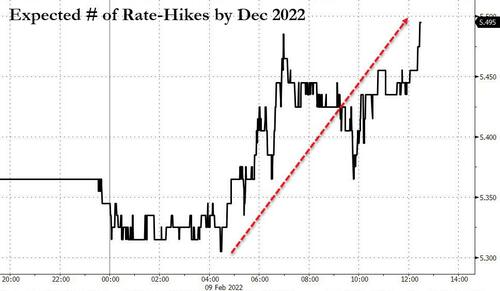

Interestingly, given that the CPI rumors were ‘blamed’ for the rally today, potentially easing the aggressive hawkish needs of The Fed to act soon, STIRs actually shifted in a more hawkish manner with a 50% chance of a 6th rate-hike now priced in…

Source: Bloomberg

The dollar slipped again today, erasing all of the post-payrolls gains…

Source: Bloomberg

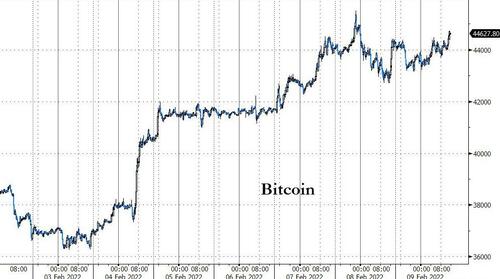

Bitcoin rallied again today – up 7 days in a row – pushing back above $44k…

Source: Bloomberg

This is the 20th time it has achieved such a run since the pandemic roiled markets. The mean return over over three days, five days and 20 days is 4.1%, 5.3% and 18.5% respectively after such stretches, according to data compiled by Bloomberg.

Copper ripped higher today, breaking out to its highest since Oct 2021…

WTI ended higher after a bigger than expected inventory draw (topping $90 intraday)…

Gold continued its slow and steady rise (up 8 of the last 9 days), heading back towards a ‘Golden Cross’ in its averages. Gold has almost erased all the post-Fed losses…

Finally, for asll those who still believe the ‘market’ is about ‘fun-durr-mentals’, shit’s about to get real as multiples collapse with central bank liquidity…

Brace! Or pray for Powell to get back to work.

Tyler Durden

Wed, 02/09/2022 – 16:02

via ZeroHedge News https://ift.tt/nTJvorZ Tyler Durden