Uber Jumps On Blowout Earnings Despite Disappointing Guidance

One day after pure-play ridesharing platform Lyft posted earnings that were mixed, if seen as disappointing and sending the stock lower on Wednesday before it staged a remarkably rebound and closing +6.8%, moments ago Uber reported earnings for the fourth quarter of fiscal 2021 and which while solid on a historical basis, were soft when it comes to guidance.

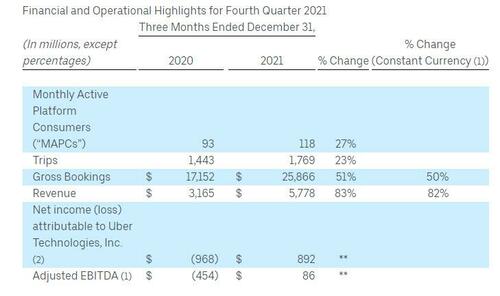

First, a look at the company’s Q4 2021 earnings:

- Revenue $5.78 billion, +83% y/y, beating the estimate of $5.35 billion

- Gross bookings, which encompass ride-hailing, food-delivery and freight, rose 51% Y/Y to $25.87 billion, beating the estimate $25.67 billion

- Delivery bookings $13.44 billion, +34% y/y, missing the estimate $13.62 billion

- Mobility bookings $11.34 billion, +67% y/y, beating the estimate $11.25 billion

- Freight bookings $1.08 billion vs. $313 million y/y, beating the estimate $685.6 million

- 4Q EPS 44c vs a Loss of 54c a year ago

- 4Q Net Income $892m vs a Loss of $968m a year ago; of note: net income includes $1.4BN net benefit (pre-tax) relating to Uber’s equity investments, primarily due to unrealized gains related to the revaluation of Uber’s Grab and Aurora equity investments, partially offset by unrealized loss related to the revaluation of Uber’s Didi equity investment

- Adjusted Ebitda $86 million vs. loss $454 million y/y, beating the estimate $63.6 million

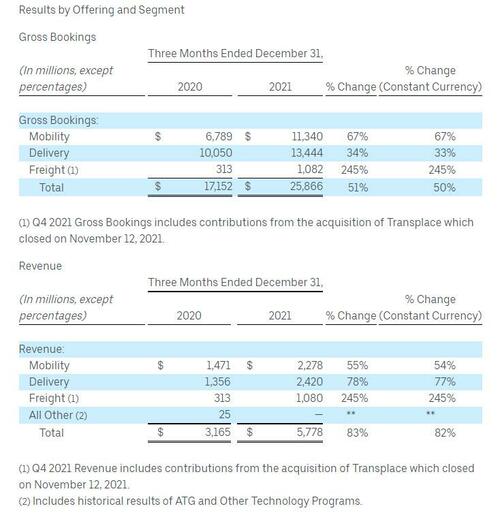

Result by segment showed that while mobility and delivery both posted solid results, it was freight whose $1.08 billion in booking blew away expectations of $686 million.

While Uber’s gross mobility bookings grew 67% from a year earlier to $11.3 billion, in line with analysts’ expectations, they are still about 16% lower than pre-Covid levels.

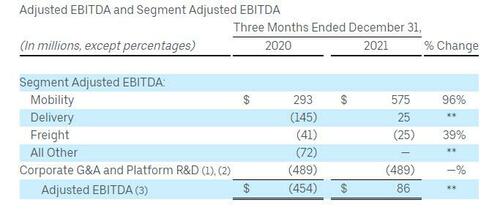

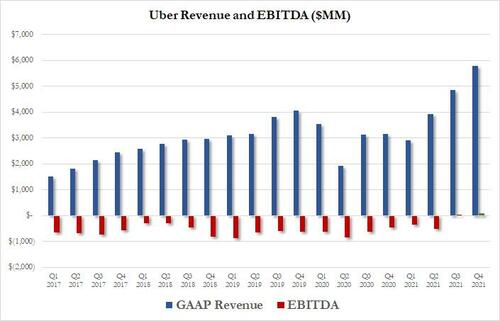

Still, thanks to sharply higher prices, this was the second quarter in its history that Uber report positive EBITDA, as shown below:

The company’s income statement history:

Looking at riders shows a mixed picture, with monthly users beating estimates, while total trips missed modestly:

- Monthly active platform consumers 118 million, +27% y/y, beating the estimate 116.6 million

- Total trips 1.77 billion, +23% y/y, missing the estimate 1.87 billion

On the expense side, the company predictably saw rising cost pressures:

- Total stock-based compensation $334 million, +42% y/y, more than the estimate $313.9 million

- Operations and Support Expense $31 million, +55% y/y, below the estimate $40.5 million

- Sales and marketing expense $24 million, +85% y/y, more than the estimate $20.4 million

- R&D expenses $180 million, +32% y/y, more than the estimate $169.9 million

- General and administrative expenses $99 million, +48% y/y, more than estimate $84.3 million

But while the company’s historical numbers were solid, there was a clear weakness when it comes to the future where both bookings and EBITDA forecasts missed:

- Sees adjusted Ebitda $100 million to $130 million, missing the estimate $150.2 million

- Sees gross bookings $25 billion to $26 billion, missing the estimate $27.25 billion

Commenting on the quarter, CEO Dara Khosrowshahi said that “in Q4, more consumers were active on our platform than ever before, Delivery reached Adjusted EBITDA profitability, and Mobility Gross Bookings approached pre-pandemic levels.”

Like Lyft, Uber’s progress toward reaching pre-pandemic ridership was thwarted by omicron. This is what the CEO said: “While the Omicron variant began to impact our business in late December, Mobility is already starting to bounce back, with Gross Bookings up 25% month-on-month in the most recent week.”

The companies’ fortunes have ebbed and flowed along with Covid-19 infection rates and restrictions, which impact demand for rides as well as meal delivery. Lyft reported fewer riders than analysts expected in the fourth quarter, but also recorded its highest ever revenue per rider.

CFO Nelson Chai chimed in, noting that the company “outperformed our quarterly guidance and delivered $540 million of Adjusted EBITDA improvement compared to Q4 of last year,” adding that “moving forward, we are poised to continue to grow at scale while expanding profitability.”

This is what the company said were the big highlights for its three main segments:

Mobility

- Gross Bookings of $11.3 billion: Mobility Gross Bookings grew 67% YoY on a constant currency basis. On a sequential basis, Mobility Gross Bookings grew 15% quarter-over-quarter (“QoQ”), with sequential growth in all geographic regions with APAC outpacing segment trends.

- Revenue of $2.3 billion: Mobility Revenue grew 3% QoQ and grew 55% YoY. Mobility take rate of 20.1% declined 220 bps QoQ and 160 bps YoY. The sequential decline was driven by typical seasonal trends during Q4 and the roll-off of the UK accrual release in Q3 while the YoY decline was driven by ongoing driver supply investments in certain markets.

- Adjusted EBITDA of $575 million: Mobility Adjusted EBITDA increased $31 million QoQ and $282 million YoY. Mobility Adjusted EBITDA margin was 5.1% of Gross Bookings, compared to 5.5% in Q3 2021 and 4.3% in Q4 2020. Mobility Adjusted EBITDA margin as a percentage of Gross Bookings declined sequentially from Q3 as a result of higher driver incentives to meet seasonal demand, and higher driver incentives in certain markets that reopened from lockdowns in Q4. On a YoY basis, improvement in Adjusted EBITDA margin as a percentage of Gross Bookings was primarily driven by better cost leverage from higher volume, more than offsetting higher driver incentives.

Delivery

- Gross Bookings of $13.4 billion: Delivery Gross Bookings grew 33% YoY on a constant currency basis. On a sequential basis, Delivery Gross Bookings improved 5% QoQ, with strong growth in U.S. & Canada and EMEA offsetting declines in APAC.

- Revenue of $2.4 billion: DeliveryRevenue grew 8% QoQ and 78% YoY. Take rate of 18.0% grew 60 bps QoQ and grew 450 bps YoY. Business model changes in some countries that classify certain payments and incentives as cost of revenue benefited Delivery take rate by 410 bps in the quarter (compared to 400 bps benefit in Q3 2021 and 100 bps benefit in Q4 2020).

- Adjusted EBITDA of $25 million: Delivery Adjusted EBITDA improved $37 million QoQ and $170 million YoY, driven by higher volumes, reduced incentive spend, and improved network efficiencies. Delivery Adjusted EBITDA margin as a percentage of Gross Bookings reached 0.2%, compared to (0.1)% in Q3 2021 and (1.4)% in Q4 2020.

Freight

- Freight delivered strong growth and improved EBITDA margins: With the acquisition of Transplace in November, Freight revenue grew 245% YoY, to $1.1 billion and Freight Adjusted EBITDA by 39% YoY. Excluding Transplace, the organic Freight business revenue grew 27% to $396 million. Freight improved Adjusted EBITDA margins as a percentage of Gross Bookings by 10.8 percentage points YoY to (2.3)% driven by enhanced marketplace efficiency and density of our digital platform, and continued automation of the load life cycle, as well as positive contributions from Transplace.

As Bloomberg notes, the pandemic has fundamentally changed Uber’s business composition, forcing it to bolster its delivery unit when demand for rides plummeted. The company expanded offerings to include grocery, alcohol and convenience items, which have contributed to bookings in the delivery segment, eclipsing mobility even if mobility EBITDA remains shaprly higher. As noted above, Uber said its delivery business recorded its first profit on adjusted Ebitda basis of $25 million during the quarter.

A key challenge to a recovery in for Lyft and Uber has been a shortage of drivers to meet customer demand. The imbalance has resulted in higher wait times and fares.

In kneejerk reaction, the stock initially dipped from session highs, before bouncing sharply higher as the market focused on the strong Q4 earnings while dismissing the guidance that missed Wall Street estimates on both gross bookings and EBITDA.

Tyler Durden

Wed, 02/09/2022 – 16:37

via ZeroHedge News https://ift.tt/zNuL4X3 Tyler Durden