As Oil Hits $90, High Cost Shale Basins Are Hurriedly Coming Back Online

Energy companies are once again starting to “kick the tires and light the fires” at high-cost shale basins, which have once again become economically feasible thanks to oil’s dramatic rise in price over the last 12 months.

The same projects that were shuttered during the beginning of the pandemic are once again “buying properties and adding rigs and frack crews”, according to Reuters.

This is as benchmark oil prices rose over $93 last week, marking a stunning 65% move higher in a year and the highest prices since 2014. The report notes that this has catalyzed U.S. producers to spend “at double-digit rates as fuel demand has soared and fears have waned that OPEC will again punish them by flooding the market with crude”.

Executives are calling the economics of the industry “the best in years”.

Chris Wright, chief executive officer of Liberty Oilfield Services, told Reuters: “Drilling economics today are better than they’ve ever been since the shale revolution started.”

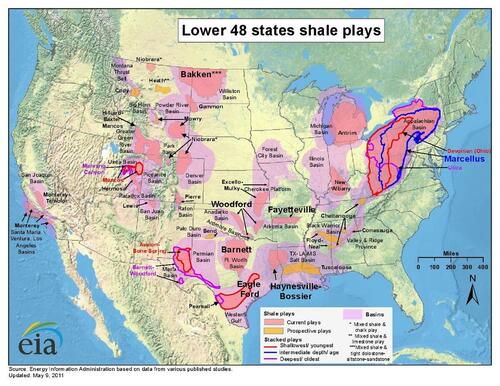

Names like Colorado’s DJ Basin, Wyoming’s Powder River, Louisiana’s Haynesville and North Dakota’s Bakken shale have all seen new activity in the last few months.

Budgets for U.S. oil producers have rise about 13% year over year, Cowen noted.

Bob Phillips, chief executive of energy pipeline company Crestwood Equity Partners, added: “When you look at the oil prices in the Bakken, the prompt price is close to $90 a barrel. That doesn’t happen very often.”

The economics have spurred mergers and acquisitions, as well, Reuters noted:

Crestwood completed a $1.8 billion deal to purchase Oasis Midstream Partners’ oil, gas and gas-processing assets in North Dakota and Texas as part of a plan to become a top-three midstream operator in the Bakken, Powder River and Permian shale fields.

Oil M&A specialist Andrew Dittmar stated: “Most of the selling private companies are ones that bring inventory as well as production to the table.”

“The DJ has been particularly profitable,” said Ben Dell, interim CEO at Colorado’s Civitas Resources.

In fact, gains are happening so quickly that production forecasts for some areas have been too low. For example, there are 42 active rigs in Haynesville, beating estimates of ~40 rigs that were made by analysis firm East Daley Capital.

Rob Wilson, a vice president at East Daley, said: “There is further upside to our current forecast.”

Tyler Durden

Wed, 02/09/2022 – 20:30

via ZeroHedge News https://ift.tt/08QTYEb Tyler Durden