Here’s How Big Tomorrow’s New CPI Adjustments Will Be

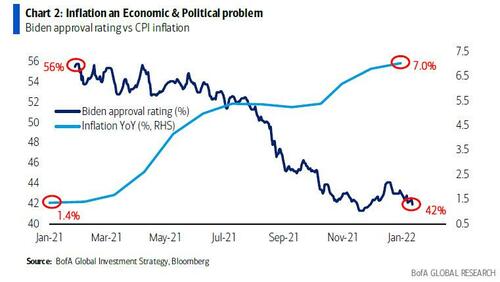

Earlier today, when previewing tomorrow’s critical inflation number, which JPM said it was hearing “whispers that [it] will print below expectations”, and which Biden – whose approval rating is imploding as fast as inflation is soaring…

… will do everything in his power to show the lowest possible (or impossible) reading, we joked that if the BLS is forced to use the nuclear option once it gets the tap on the shoulder, it may just get a little crazy in revising the January 2022 CPI weights which we previewed back in December, is set to take place tomorrow (similar to last week’s magical payroll “seasonal adjustments“).

Joking aside, it appears our speculation that the seasonal and weights adjustments could have a material (political) impact on tomorrow’s unadjusted number has sparked quite a firestorm within the investing community, and as Goldman’s economics team writes late on Wednesday, “ahead of tomorrow’s CPI release, many clients have asked how the biennial change in category weights and annual seasonal factor update will affect inflation in January and the remainder of 2022.”

Before we share Goldman’s answer, a little background:

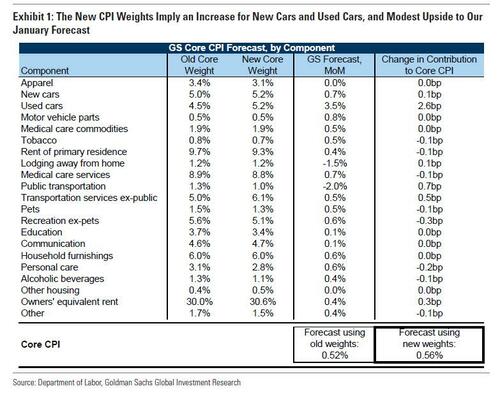

Every two years the BLS updates the category-level weights used in the calculation of the consumer price index (CPI). These weights—which are based on expenditure data collected in the Consumer Expenditure Survey—were last updated in January 2020, and tomorrow’s release will be the first to incorporate consumer expenditure data from 2019-2020 (vs. 2017-2018 previously). Tomorrow’s report will also incorporate updated seasonal factors, as is typical in January.

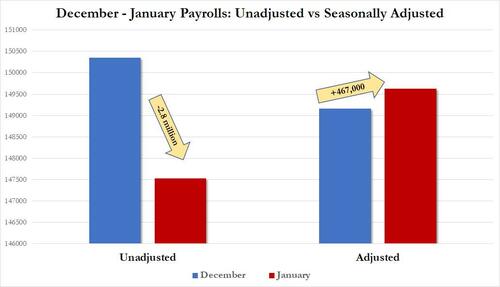

With that in mind, and following our recent concerns that the BLS may once again make generous use of seasonal adjustments to paint the Biden administration in the best possible light, similar to what it did last Friday with the laughable January payrolls report…

… Goldman’s Jan Hatzius writes that “many clients have speculated that the changes in the category weights may be larger than normal due to the pandemic, particularly because the BLS had previously announced that they would not adjust their methodology in response to the atypical spending patterns—namely, the shift in spending towards durable goods—in 2020.” Almost as if the BLS was told to scrap its previous plans and to revise inflation 10 months ahead of the midterms.

Adding to the complexity of tomorrow’s revision, the directional implications of the weight changes were hard to predict according to Goldman, since the standing CPI weights already reflect a spending shift towards categories like durable goods that experienced relatively high price growth since the weights were last updated.

Perhaps to avoid accusations of data manipulation, the BLS has posted updated weights and seasonal factors on their website ahead of tomorrow’s report.

So what to expect from tomorrow’s revisions, which similar to the payrolls adjustments will likely smoothen out the recent spike in inflation data series making recent outlier prints appears much more mild in retrospect? Well, nobody knows for sure until the BLS reveals its latest gimmick, but Goldman has tried to estimate the adjustments.

As shown in the first and second columns of the chart below, changes in weighting are generally modest but imply a larger share of spending on private transportation services (+1.1pp), used cars (+0.7pp), OER (+0.6pp), and new cars (+0.2pp), and lower spending on recreation (-0.5pp), public transportation (-0.4pp), personal care (-0.4pp) and rent (-0.3pp).

Combining these changes with Goldman’s component forecasts for January, the bank has modestly upgraded its January core CPI forecast by +4bps to +0.56%, mainly reflecting a larger contribution from used cars and similarly upgraded the bank’s headline CPI forecast by +3bps to +0.53%, raising year-over-year core CPI forecast to +6.01% and year-over-year headline CPI forecast to +7.33%. In addition to further upward pressure from auto prices, the Goldman forecast also assumes a boost from start-of-year price hikes that should help offset an Omicron-driven drag on virus-sensitive service prices.

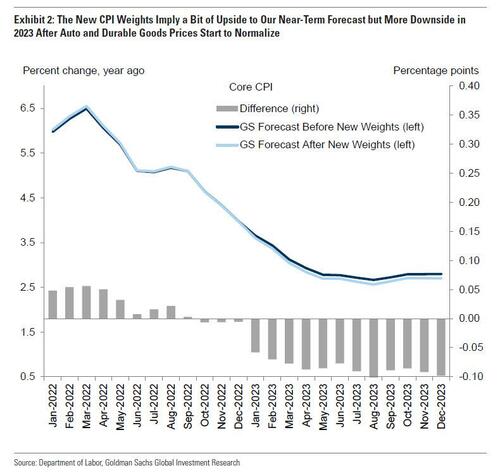

The implications for Goldman’s medium-run year-on-year core CPI forecast are also fairly modest, with the new weights implying a peak upward revision of +6bps this spring due to the increased weight on auto prices, but essentially no change at end-2022 and a -10bps downward revision at end-2023 due to a larger drag once auto and durable goods prices start to normalize.

As Goldman concludes, “while the changes in weights have modest implications for our CPI forecast, it is worth noting that there is no read-through for PCE inflation since PCE spending weights are updated each month to reflect the current composition of spending.”

The other implication is that if the BLS’ weight and seasonal adjustments should not amount to almost nothing – as Goldman previews – and if tomorrow’s CPI print ends up being as shocking as what the BLS unveiled in last Friday’s payrolls report, and the CPI print is not just a small miss but an outright collapse designed to somehow make Biden look good, then it will finally become obvious that the fix is in and that no data the US government publishes has any credibility.

Tyler Durden

Wed, 02/09/2022 – 22:50

via ZeroHedge News https://ift.tt/CEvskhF Tyler Durden