Crypto Jumps, Stocks Dump’n’Pump As Cracks Appear In Global Financial System ‘Plumbing’

It’s almost difficult to remember now, but February started with a lingering focus on the Omicron wave of the virus and the expected business interruptions that COVID was again causing. The virus has since faded in the US although it still has a very real presence in Asia.

The realization that inflation does not appear to be temporary and may be more persistent than recent past bouts of higher prices has also caused markets to increase expectations for the number of rate hikes that the Fed is likely to initiate in the imminent hiking cycle.

And as we exit February, Goldman’s Chris Hussey notes that attention is now divided between what the Fed will say (and do) on March 16th and how the situation between Russia and Ukraine will evolve. Against this backdrop of rising inflation, rates, and geopolitical risk, Energy and Materials outperformed again in February.

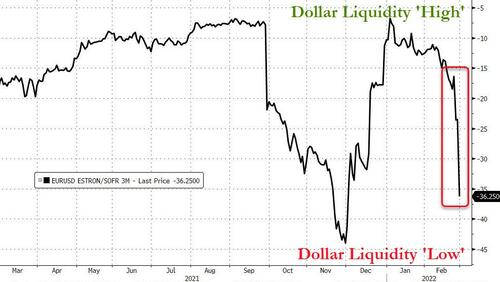

Most worryingly, cracks are appearing in the global financial system’s plumbing. The cost of dollar liquidity is suddenly rising fast…

Source: Bloomberg

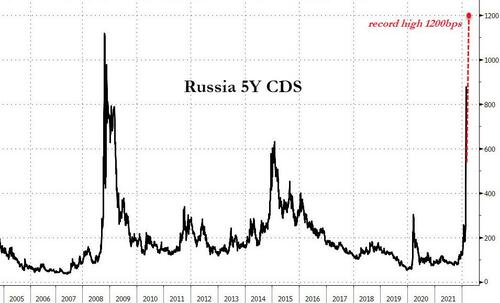

Russian default risk has exploded…

Source: Bloomberg

The Ruble has imploded…

Source: Bloomberg

Can Vlad and his oligarch mates dodge these sanctions bullets?

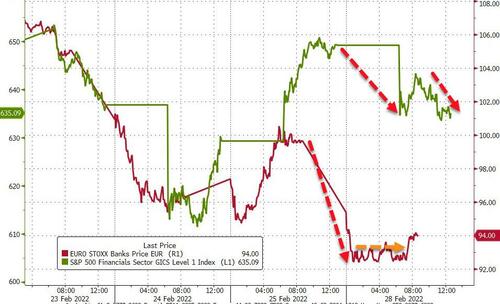

Bank stocks puked with Europe hit harder than US…

Source: Bloomberg

Safe-havens were bid with bond yields tumbling, gold spiking (then chopped around)…

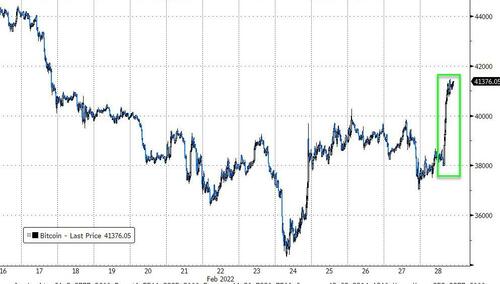

And crypto surging (Bitcoin tagged $42k)…

Source: Bloomberg

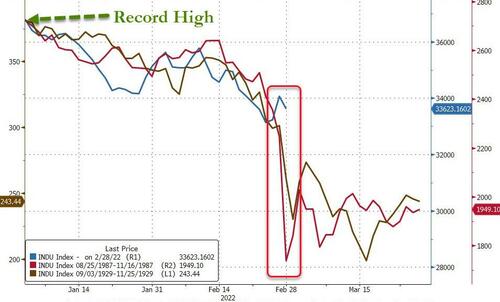

Equity markets traded chaotically but on the bright side, given it was the 55th day from the record high, we did not crash like in 1987 or 1929…

Source: Bloomberg

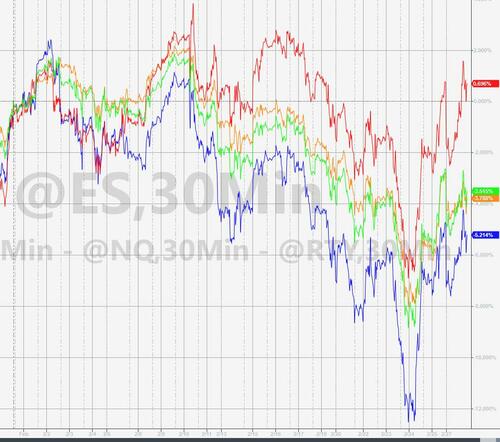

To quote one trader who was trading the last time the Ruble collapsed, “what a f**king day!” US equity futures opened down hard – giving up all of Friday’s gains – and then were met by the now ubiquitous momo ignition that somehow levitated Small Caps, then Nasdaq, then the S&P 500 (briefly) into the green for the day. Then… Russia-Ukraine talks ended around 1200ET (just around the time of the European market close) and things went south in US equities. The last hour saw a bid return, making some wonder if were seeing some rebalancing flows… The last hour was just insanely volatile minis swings in all the major indices, desperately trying to get back to even…Nasdaq outperfomed in the end (green like Small Caps) with the S&P and Dow red. Nasdaq swung 4% from its lows…

Tech was twatted on the month…

Source: Bloomberg

Inflation expectations accelerated in February, with US 5Y Breakevens hitting record highs…

Source: Bloomberg

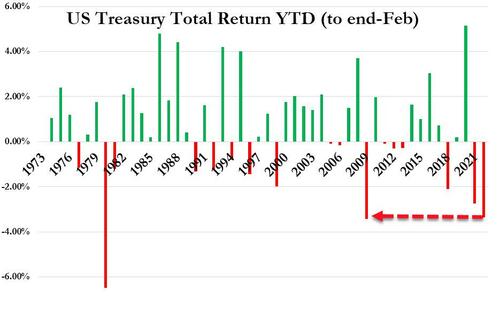

As February comes to an end, 2022 has seen the US Treasury market suffer the 3rd worst start to a year ever…

Yields were higher across the curve in Feb with the short-end dramatically underperforming…

Source: Bloomberg

Notably the 10Y yield tried and failed numerous times to get back above 2.00%…

Source: Bloomberg

Real yields utterly collapsed today (10Y real yield dropped 20bps (catching up to gold’s recent rise)…

Source: Bloomberg

Forward inflation expectations suggest Ethereum has another leg higher to come…

Source: Bloomberg

The Nasdaq has seen the worst first two months of a year since 2008 (S&P worst since 2009).

It was an ugly month for most stocks with Nasdaq leading the charge lower, down over 12% at one point (and Small Caps somehow battling back to unchanged)…

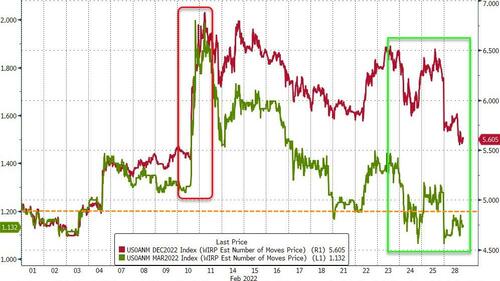

Rate-hike odds were shocked higher by The Fed’s Jim Bullard then pushed lower by geopolitical chaos but while the odds of a 50bps hike in March dropped modestly (just 13% or so now), the odds of a 6th rate-hike in 2022 went up from around zero to over 60% (even with the recent dovish push)…

Source: Bloomberg

And at the same time, the odds of a rate-CUT (in 2024) have soared…

Source: Bloomberg

The dollar ended the month very modestly lower, after surging on the start of war but being unable to make any more gains since…

Source: Bloomberg

Cryptos managed modest (for crypto) gains on the month, thanks in no small part to today’s surge in prices following Putin’s ban on foreign FX transfers…

Source: Bloomberg

Commodities were all higher on the month with the geopolitical chaos of the last week or so sending Russia-specific assets (oil, nattie, wheat, aluminum) soaring the most. Copper lagged as precious metals also surged…

Source: Bloomberg

Brent closed above $100 today for the first since 2014.

Gold held above $1900…

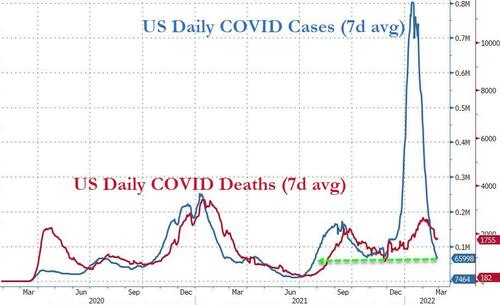

Finally, the best news of all in February, COVID cases have collapsed…

Source: Bloomberg

So the only excuse The Fed has now is ‘geopolitical concerns’ – which in and of themselves will actually cause inflation to worsen!

Tyler Durden

Mon, 02/28/2022 – 16:01

via ZeroHedge News https://ift.tt/e9pYDCc Tyler Durden