European EM Funds ‘Gated’ As Russian Default Risk Soars To Record High

The cracks are starting to show as the effects of sanctions on Russia begin to filter through the rest of the global financial markets.

While US equities are rebounding, European banks are struggling to stage any comeback and under the surface the pipes are creaking.

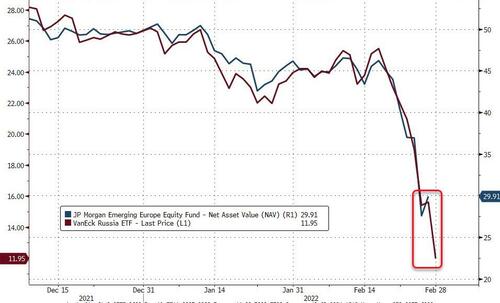

As Bloomberg reports, JPMorgan Chase and Danske Bank were among asset managers to freeze funds with exposure to Russian assets amid a plunge in markets.

As JPMorgan write in a letter to investors this morning, the Emerging Europe Equity fund and wouldn’t accept any orders to buy or sell shares in the fund.

“Due to the escalating conflict between Russia and the Ukraine, local market trading conditions are not currently operating as they normally would do,” JPMorgan said in the letter.

“We understand that being unable to deal in the fund is frustrating and we will take the decision to lift this suspension as soon as we consider it is in the best interests of existing shareholders to do so.”

“Frustrating” is right!

While not directly related, we do note that VanEck’s Russia ETF continues to trade, and given the recent correlation, the JPM EM EU Fund NAV would be dramatically lower…

And amid the utter lack of liquidity, forced selling pressure from redemptions could drive asset values even lower.

Bloomberg reports that more funds are expected to follow suit and shut their doors to redemptions.

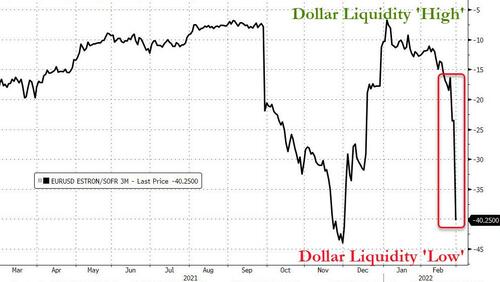

Meanwhile serious stresses are starting to appear in the “plumbing” as Zoltan Pozsar warned over the weekend, with the ‘costs’ of finding dollar liquidity soaring…

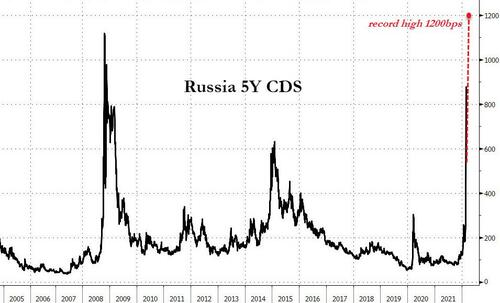

And the market is now pricing in around a 55-60% chance of a Russian sovereign default, as 5Y CDS soars to a record high. IHS Market reports that 5Y CDS trades at 1200bps (up from a tumble to 573bps on Friday)

As we previously noted, the last time we saw this kind of volatility in the Ruble and Russian assets, LTCM was collapsing, and as Nomura’s Charlie McElligott warned this morning, something, somewhere within the global banking ecosystem will most likely inevitably “break” off the back of the Russian SWIFT exclusion and frozen Bank of Russia assets – potentially in the form of transactions related to the sprawling Russian commodities trade, perhaps with a European subsidiary of a Russian bank being unable to pay liabilities as these “knock-on” throughout the system.

Tyler Durden

Mon, 02/28/2022 – 12:05

via ZeroHedge News https://ift.tt/Xkeq3oi Tyler Durden