These Are The Global Banks With The Largest Exposures To Russian Sanctions

Following Zoltan Pozsar’s blueprint for how the US/UK/EU sanctions unveiled over the weekend could lead to problems in the “plumbing” of the global financial ecosystem, we have seen several cracks appear already.

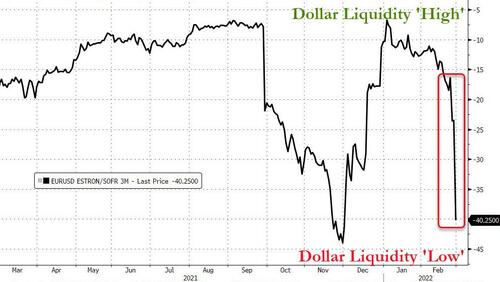

Dollar liquidity is drying up – and thus getting more costly – especially against the Euro…

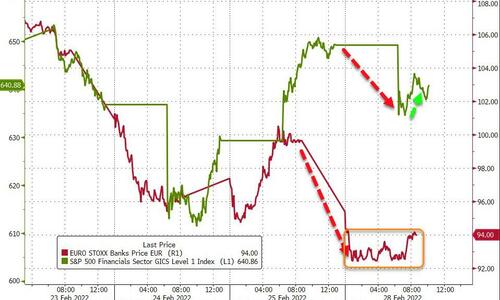

And while both US and European bank stocks were clubbed like a baby seal today, we note that US bounced back modestly while Europe’s financials couldn’t managed much (despite the overall indices rebounding from deep losses)…

So, the question is – which banks are most exposed to the ongoing (and escalating) threat of sanctions on Russia?

Specifically, among other more arcane details, the sanctions relate to:

(1) freeze of assets,

(2) capabilities of certain largest Russian banks to process transactions and

(3) proposed ban of certain payment avenues (SWIFT).

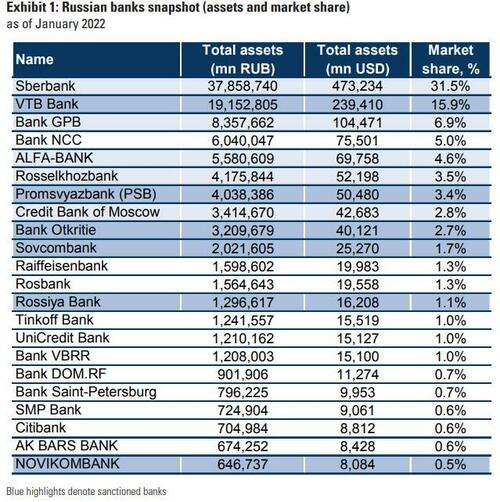

While the Russian banks have been in freefall recently (most especially the sanctioned ones)…

In their latest report, Goldman Sachs attempts to calculate the exposures that US and European banks face to these threats.

European banks exposure

In assessing exposure to Russia we use data from the latest EBA transparency exercise (June 2021); we acknowledge that certain banks have disclosed more recent figures and that the aggregate picture may have changed since June 2021 – but we use EBA data for the purpose of comparability. This data shows that (i) overall Russia exposure of European (EU/EEA) banks is small at €66bn – this is equivalent to 0.25% of banks aggregate exposure amount, (ii) concentrated among three banks (RBI, SG and UCG) and (iii) the impact on these groups is diluted owing to geographic diversification (Russian exposure is <5% of group loans for all banks apart for RBI at 9%). The direct exposure is therefore limited, in our view.

The EBA data shows that the banks with the largest exposure to Russia are (as at 06/21):

-

UniCredit: Total exposure of €13.7bn (of which €1.2bn is Government, €12.6bn is Retail & Corporate) equivalent to 1.6% of total exposure.

-

Société Générale: Total exposure of €14.3bn (of which €2.5bn is Government, €11.8bn is Retail & Corporate) equivalent to 1.7% of total.

-

Raiffeisen Bank International: Total exposure of €14.3bn (of which €2.4bn is Government, €11.9bn is Retail & Corporate) equivalent to 9.3% of total exposure.

EBA data only covers EU/EEA entities and omits country exposure outside the top-10 for each institution – the bank-by-bank exposure disclosed accounts for 67% of the total Russia exposure (c.€22bn outstanding). We therefore cross-check EBA data with the latest BIS country-level disclosure (Q3-2021). The BIS data outlines exposure to Russia at $25bn for both France & Italy, $15.5bn for Austria, $6.6bn for The Netherlands and $3bn for the UK.

We expect much of the focus of current geopolitical tensions for European banks to be on (1) outlook for yield curve progression, e.g. potentially flatter yield curve and slower/later lift off of the rate hiking cycle and (2) impact potentially higher energy prices have on consumer behavior.

US banks exposure to Russia

US bank exposure to Russia is limited with only Citigroup that has any material exposure, at $5.5bn, which equates to only 30bps of total global exposure for C. This breaks down as follows: $2.3bn in ICG loans, $0.7bn in GCB loans, $0.8bn of unfunded commitments, $1.6bn of investment securities, and $100mn of trading account assets (as of 3Q21).

While other large cap US banks do not size exposure to Russia, disclosures provide their top 20 country exposures, and Russia is not on the list for any of them. Based on these country exposures, we know 4Q21 exposure is <$4.9bn for JPM, <$3.5bn for BAC, <$2.6bn for MS, <$1bn for WFC.

We believe the market will be more focused on broader second order effects, such as: 1) the impact of sanctions on the Central Bank of Russia and Russian commercial banks; 2) disruptions to payments and the possibility of technical defaults of banks that cannot use the SWIFT network; and 3) central bank policy implications.

Tyler Durden

Mon, 02/28/2022 – 14:05

via ZeroHedge News https://ift.tt/7hT6GmM Tyler Durden