Why So Few See The Last Chance To Exit

Authored by Charles Hugh Smith via OfTwoMinds blog,

When the crash can no longer be denied, the drop is widely recognized as having been obvious and inevitable…

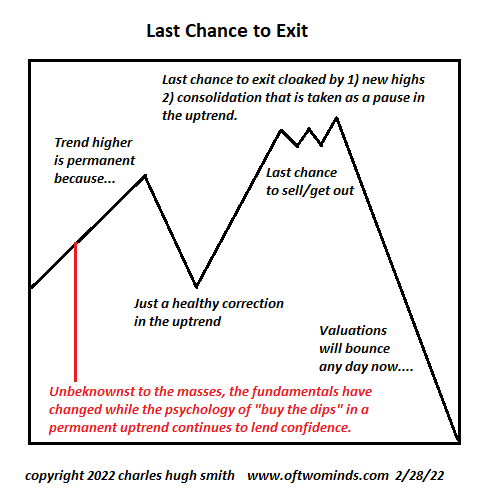

The last chance to exit is well-known in stock trading circles, but the concept can be applied much more broadly. The basic dynamic at work is a mismatch between the fundamentals (i.e. the real world) which are deteriorating due to structural changes and the psychology of participants which continues to be confident and upbeat.

A wide spectrum of emotions and human traits are in play, but the core dynamic is our desire to discount signs of trouble rather than deal with a long-term change in the tides. The long uptrend supports confidence that the uptrend will continue moving higher more or less permanently, and the desire to keep minting money by staying fully invested in the uptrend encourages cherry-picking data to support the idea that the fundamentals are still solid.

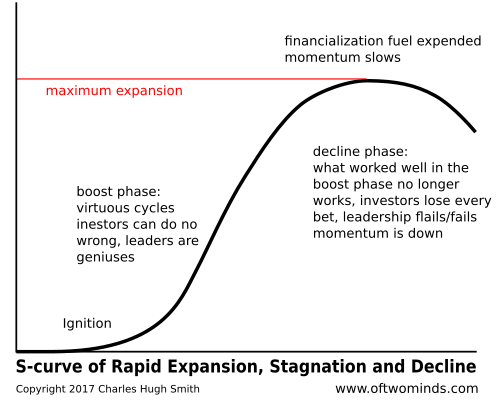

Selection bias, denial, complacency and greed all play parts in this continuation of the psychology of an uptrend even as the S-Curve has shifted from growth to stagnation as the fundamentals have deteriorated beneath the surface.

This asymmetry between the fundamentals of valuation and the psychology of valuation cloaks the change in trend so few recognize it as the last chance to exit. Participants, so well trained by years of profits to “buy the dip” and anticipate future gains, see the initial dip as an opportunity to buy rather than as a warning sign.

This complacency is reinforced by the prompt reversal of any dip and a new high in valuations. Again, this dynamic is not limited to stocks; the ascent of housing valuations feeds the same complacency and selection bias: housing can’t go down because…the litany of supportive narratives is always long and illustrious.

The last chance to exit is also present in states, cities, industries, jobs, institutions, groups and neighborhoods. The decay is ignored as everything seems to remain glued together and the rot is papered over by various pronouncements and policies.

There is typically a period of consolidation that further supports a complacent confidence that the present is immutable: the uptrend is permanent. But this consolidation is misleading: it’s not a continuation of the uptrend, it’s the result of first-movers selling to True Believers in the immutability of the present and getting out of Dodge.

When the S-Curve rolls over, the rapidity of the descent surprises True Believers, who assure themselves that the rebound will start any day. They find reasons to ignore the acceleration down as those who had hesitated to sell suddenly hit the sell button, list the house for sale, etc.

When the crash can no longer be denied, the drop is widely recognized as having been obvious and inevitable. Hindsight is 20/20, but the damage done to those who didn’t sell at the the last chance to exit cannot be repaired; the losses are too deep.

* * *

My new book is now available at a 10% discount this month: Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $8.95, print $20). If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Tyler Durden

Mon, 02/28/2022 – 16:20

via ZeroHedge News https://ift.tt/Vvrq3M7 Tyler Durden