Carbon, Crypto, & Corn – Some Non-Energy Commodity Observations

Via Peter Tchir at Academy Securities,

While energy prices have grabbed the attention since the Russian invasion of Ukraine, there are some other concerning and interesting things occurring across the commodity space.

Agriculture

Corn, Soybean and Wheat prices have all gone up significantly. While WTI is up 8% and Brent is up 6%, Corn is up 7%, Soybean Oil is up 8%, Wheat is up 11% to 15% (depending on which contract) and something called European Milling Wheat is up 25% – in just 5 days!

Broad based agriculture inflation is a consequence of this invasion, that isn’t getting much attention, but should.

Gold versus Bitcoin

Gold is up just over 1% while Bitcoin is up almost 20%.

While we have seen a rebound in tech (QQQ and ARKK) bitcoin has outperformed. Whether that is a direct consequence of people putting money into crypto to avoid sanctions, or whether it is investors betting that shutting down SWIFT, even on a limited basis, will encourage more investors to seek out crypt remains to be seen.

The move is eye-catching enough that it is likely catching the eye of central bankers and policy makers.

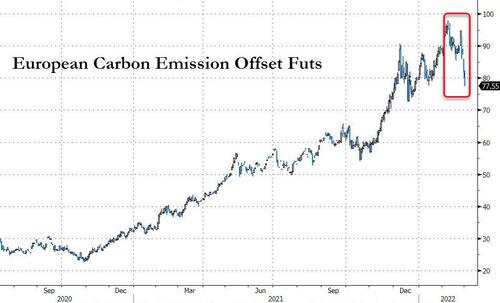

European Carbon Emission Offsets are down 16% in a week!

I don’t know enough about this contract, and maybe it is as simple as more supply coming on line, but it seems worth thinking about why the need for carbon emission offsets in Europe has dropped so much?

Is the economy slowing faster than we realize?

More questions than answers, but some things I found interesting.

Tyler Durden

Tue, 03/01/2022 – 10:10

via ZeroHedge News https://ift.tt/DMcgpFT Tyler Durden