ECB Preview: Expect Continued “Maximum Flexbility”

The ECB policy announcement is due this morning at 12:45GMT/07:45EST, with the press conference to follow at 13:30GMT/08:30EST. While the bank’s balance sheet is set to be unwound this year, the eruption of the Ukraine war will likely see policymakers avoid committing to a specific date at the upcoming meeting. As a result, talk of a 2022 rate hike by the ECB is likely to be put to one side for now. Economic projections will be subject to greater uncertainty than usual given volatility in the crude space.

Meanwhile, the war in Ukraine is moving rapidly – too rapidly for the European Central Bank to have a clear sense of how monetary policy should be altered in response at its meeting on Thursday, and Bloomberg Economics expects the Governing Council to stick to the path it previously set out – at least for now.

-

A sizable contingent of the Governing Council has suggested that it can’t yet take a definitive stance on how monetary policy should respond to Russia’s attack on Ukraine. Bloomberg calls for asset purchases to end in the final quarter of the year, although we have changed our forecast for the first interest rate increase of 25 basis points to June 2023 from December 2022.

-

Energy prices will be a major determinant of how the ECB eventually reacts. Another huge increase, together with shocks to sentiment, would depress demand in the economy. Expect the Governing Council to focus more on that than on the risks posed by higher inflation to wages, delaying rate hikes.

-

With the ECB’s forecasting round having closed before the invasion, the inflation projection for 2024 may be raised to 2%. President Christine Lagarde will probably emphasize that an updated assessment will eventually be required for the next decisions of the monetary authorities.

Courtesy of Newsquawk, here is a detailed preview of what to look forward to in today’s announcement:

OVERVIEW: The fallout from the February meeting set the Bank up for a more hawkish pivot at the March confab after President Lagarde refrained from ruling out a 2022 rate hike. Furthermore, source reports that followed shortly after revealed that APP purchases could be concluded at the end of Q3. Accordingly, markets priced in nearly 40bps of tightening by year-end with the first hike to come in July. Since early February, the main driving force for markets has been the conflict between Ukraine and Russia with the greatest impact being felt via the energy space with Brent crude rising from around USD 88/bbl at the time of the meeting to reach USD 139/bbl this week, while European natural gas prices hit record highs. From an economic perspective, the conflict will likely have a detrimental impact on growth prospects for the region and add further upside pressure to Eurozone inflation.

As such, the backdrop to the meeting is a complex one for the Bank with the economic forecasts underpinning its decision-making likely to be subject to greater uncertainty than normal. In terms of the policy announcements for the upcoming meeting, rates are set to be left on hold and some desks have suggested that talk of a 2022 by the Bank will likely be put to one side for now. However, policymakers will likely convey that the direction of travel for monetary policy is one of normalisation.

Therefore, it is likely that the ECB will hint that bond purchases under APP will be concluded at some point this year, although how specific the Bank will be on this remains to be seen. Overall, any policy guidance from the ECB will likely be heavily caveated and subject to great uncertainty particularly given the wild gyrations across the market place over the past few weeks.

PRIOR MEETING: As expected, the ECB opted to keep key rates unchanged whilst maintaining the parameters of its bond-buying operations, which will see PEPP wound down in March and APP beefed-up in Q2 before being trimmed down in Q3 and Q4. The statement carried little in the way of material changes other than policymakers removing the “either direction” reference when it comes to adjusting its policy instruments. At its post-meeting press conference, President Lagarde cautioned that inflation was likely to remain high in the near-term, with risks tilted to the upside, while there was unanimous concern about price pressures on the Governing Council. The key takeaway from the press conference was Lagarde’s unwillingness to push back on the prospect of a 2022 rate hike. When pressed further, Lagarde stated that the ECB would not hike rates until it had completed net asset purchases, and would carry out a thorough assessment at the March meeting, at which point it will be armed with updated staff economic forecasts and would be able to take a view on asset purchases for the remainder of the year. A Bloomberg report after the press conference suggested that a policy recalibration in March was a possibility and APP purchases could be concluded at the end of Q3. Sources cited by Reuters also noted that “a sizable minority” wished to change policy at the February meeting, whilst policymakers were more broadly expecting a policy change at the March meeting if inflation did not ease, with an adjustment to the APP seen as the first port of call.

RECENT DATA: Headline Y/Y CPI rose to a record 5.8% in February as surging energy prices and goods inflation continued to drive pressures, the core metric (ex-food & energy) also jumped to a lofty 2.9%. ING notes that food prices are also on the march higher as a result of the Ukraine-Russia conflict and as such concerns are mounting over elevated inflation for the months ahead. Since the prior meeting, Q4 Q/Q GDP was confirmed at 0.3%, however, this will be regarded as very much in the rear-view mirror given recent events. On the PMI front, the February survey from IHS Markit saw the composite metric rise to 55.5 from 52.3 with the report noting that “data for February depict a eurozone economy that was regaining robust growth momentum ahead of the invasion of Ukraine”. However, “energy and other commodity prices, notably agricultural goods, are spiking higher again due to the conflict in Ukraine”. On the employment front the January unemployment rate saw a further decline to 6.8% from 7.0%.

RECENT COMMUNICATIONS: Since the prior meeting, President Lagarde (Feb 10th) cautioned that raising rates would not solve any of the Eurozone’s current problems, adding that the ECB does not want to choke off the recovery and she was confident that inflation would fall back over the course of 2022. In a follow-up speech (Feb 25th) following the Russian invasion of Ukraine, Lagarde stated that the Bank will do everything in its power to ensure the stability of prices and the financial system in the Euro zone, however, she did acknowledge that inflation is likely to be further bolstered by increasing energy costs. Pre-Russia invasion of Ukraine, Chief Economist Lane (Feb 10th and Feb 25th) was relatively dovish in his remarks by noting that inflation will return to its trend without a need for a significant adjustment in monetary policy, later adding that the ECB should not “over-react” by combating near-term inflation with excessive monetary tightening. More recently (2nd March), Lane stated that “the schedule for the March staff projections exercise has been revised in order to take into account the implications of the Russian invasion of Ukraine”. He also suggested that the ECB could respond with new policy instruments in the pursuit of its price stability objective. Source reports (Feb 25th) stated that Lane has drawn up several scenarios for the impact of the Ukraine conflict on the Eurozone in which there will be a significant increase to the 2022 inflation forecast and a “middle scenario” in which 0.3-0.4ppts would be shaved off GDP this year. Germany’s Schnabel (Feb 24th) stated that Inflation is unlikely to fall back below the 2% target this year, whilst cautioning that price pressures are broadening. Interestingly, she noted that “changes in sovereign bond market conditions could challenge our sequencing”. Austria’s Holzmann delivered hawkish remarks on Feb 23rd by suggesting that the Council should consider two rate hikes this year and sees the neutral rate at 1.50% by 2024 as realistic. However, the day after (day of the Russian invasion of Ukraine) he cautioned that although the ECB is still moving towards normalisation, the Ukraine conflict could delay the exit from stimulus. Italy’s Panetta who sits at the more dovish end of the spectrum, (Feb 24th) acknowledged that the ECB currently faces a “two way risk” on inflation; something which Rabobank suggests that he has not done before. Panetta, as well as the likes of Portugal’s Centeno, Finland’s Rehn and Greece’s Stournaras have also touted the possibility of stagflation as a result of the Ukraine-Russia conflict.

RATES/TIERING/TLTRO: The key takeaway from the press conference was Lagarde’s unwillingness to push back on the prospect of a 2022 rate hike. Accordingly, this prompted a marked shift in rate hike bets with pricing at the end of the meeting suggesting nearly 40bps of tightening by year-end with the first hike to come in July vs. pre-meeting expectations of around 20bps of hikes priced in by year-end with the first hike expected in September. Thereafter on Feb 18th, Bloomberg sources reported that ECB officials were edging towards a 2022 hike to stem inflation. The report also noted that policymakers were concerned about widening government bond spreads in the Eurozone. However, since then, the Russian invasion of Ukraine has prompted a re-evaluation by the market on the ECB’s rate hike prospects. As it stands (in what has been a volatile few weeks for market pricing), markets anticipate around 20bps worth of tightening by year-end. According to Reuters News, 33/45 surveyed analysts expect a rate hike in 2022 with 27 of the 33 looking for an increase in the “last months of this year”, whilst 6 of the 33 expect a move in Q3 (down from 16 in the prior poll); analysts are particularly split in their views on how large a move the ECB will carry out this year. Given the uncertainty posed by the Ukraine/Russia situation, some desks have suggested that talk of a 2022 hike by the Bank will likely be put to one side for now. With the ECB set to wind down its balance sheet in 2022, one option available (as suggested by Nordea and Danske Bank) to the ECB which would help ensure flexibility in tightening could be for policymakers to remove the word “shortly” in its current guidance which states that APP will “end shortly before it starts raising the key ECB interest rates”. Note, analysts such as those at Cap Eco who anticipate a 25bps hike in December after APP is wound down at the end of Q3, suggests that such a move is not warranted. In terms of other policy measures, Danske Bank suggests the Bank could launch a 1yr LTRO operation at the upcoming meeting with a formal end to the TLTRO discount to be set for June 2022. UBS suggests an adjustment to the Bank’s tiering system will be likely at some stage “to ensure that rising amounts of excess liquidity do not lead to excessive costs for Eurozone banks”

BALANCE SHEET: With regards to bond purchases, PEPP is still anticipated to be wound down in March. On APP, at the December meeting it was decided that as of Q2 2022, monthly purchases will be beefed up to EUR 40bln from EUR 20bln and then subsequently lowered to EUR 30bln in Q3 and then back down to EUR 20bln in Q4 “for as long as necessary to reinforce the accommodative impact of its policy rates.” Sources after the February meeting revealed that APP purchases could instead be concluded at the end of Q3. However, as with other decisions at the Bank, the Ukraine /Russia conflict has clouded the outlook. Polling by Reuters News suggests that there is no clear consensus over the precise month the ECB would conclude its asset purchases. However, two-thirds of those surveyed expect purchases to be concluded by September with all but one economist anticipating that bond purchases will cease by the end of 2022. A separate survey by Bloomberg News suggested that a commitment on winding down asset purchases is unlikely to come at the upcoming meeting with June seen as a more opportune time for such a decision. ING suggests that the ECB could bolster APP to EUR 40bln from EUR 20bln in Q2 as planned whilst refraining from presenting targets for Q3 and Q4 and then proceed to taper net asset purchases by EUR 5-10bln per month as of May. ING suggests that at this stage, the ECB will want to avoid pre-committing to end dates for bond purchases in order to retain flexibility.

PROJECTIONS: The original cut-off date for the upcoming round of staff economic projections preceded the Russian invasion of Ukraine. As such, up until last week desks were of the view that the projections would offer very little insight into the Eurozone outlook. However, given the shift in economic conditions, on March 2nd, Chief Economist Lane announced that “the schedule for the March staff projections exercise has been revised in order to take into account the implications of the Russian invasion of Ukraine”. This also meant that the Feb flash CPI print of 5.8% would be included in the forecasts. As context it is also worth noting that Lane reportedly presented a scenario analysis on Feb 25th in which a “mild” scenario (unlikely) would see no impact on 2022 Eurozone growth, a “middle” scenario would lead to 0.3-0.4ppt being shaved off GDP and a “severe” scenario whereby GDP would be hit by almost 1ppt. However, given the escalation of the conflict since, Capital Economics suggests that the “middle” scenario is likely to be more downbeat than the one presented on Feb 25th. Capital Economics now anticipates 2022 growth of 3.5%, 2023 at 2.0% and 2024 at 1.5%. On inflation, the consultancy expects HICP to average 5.5% in 2022, 2.5% in 2023 and slipping to 2.0% in 2024.

In terms of the broader market consensus, the latest survey from Reuters (March 4th) is as follows:

-

GDP Growth Projections: 2022 3.8%, 2023 2.5%, 2024 2.0%.

-

Inflation Projections: 2022 4.5%, 2023 2.0%, 2024 2.0%.

-

Please see below for the December Staff Projections:

-

GDP Growth Projections: 2022 4.2% (prev. 4.6%), 2023 2.9% (prev. 2.1%), 2024 1.6%.

-

Inflation Projections: 2022 3.2% (prev. 1.7%), 2023 1.8% (prev. 1.5%), 2024 1.8%

Note, given the fluidity of the Ukraine/Russia situation and the volatility seen across markets (particularly crude, which underpins the inflation forecast), the projections are to be viewed with greater uncertainty than usual with ING of the view that “the new uncertainty, as well as the direct economic implications of the war, are simply too hard to model into numbers”.

* * *

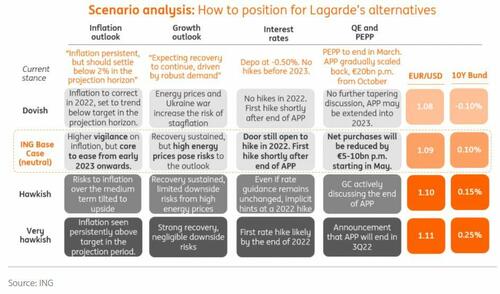

Finally, in terms of market reactions, we end with the always helpful scenario matrix from ING Economics, in which the bank also expects the ECB to retain “maximum flexibility” at today’s meeting. This is largely priced in by the markets but still leaves the euro vulnerable.

Tyler Durden

Thu, 03/10/2022 – 07:30

via ZeroHedge News https://ift.tt/NQgzMsS Tyler Durden