Pozsar’s “Margin Call Doom Loop” Prediction Comes True As Trafigura Faces Billions In Margin Calls

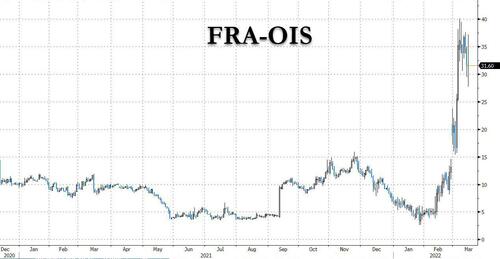

While there have been occasional stories of hedge fund blow ups (especially those trading Chinese stocks) amid the recent market volatility, so far we have yet to hear of a bank or any other “systematically important” market participant running into a solvency or liquidity crisis or needing a bailout, and yet a look at one of the most tangible funding market indicators – the FRA/OIS – has traded at very elevated levels in recent weeks, suggesting that there is indeed some funding trouble below the surface.

But if it is not the banks scrambling for liquidity, then who?

Recall what Zoltan Pozsar warned two weeks ago, when he said that “we could be looking at the early stages Of A Classic Liquidity Crisis” – according to the former NY Fed liquidity guru, none other than the commodity traders themselves, and their associated exchanges and clearinghouses, will be the drain of liquidity during this period of unprecedented commodity volatility, adding that “if you want to express all this in the credit space, look at what CDS spreads on some bigger commodity traders have done in the past few weeks.”

Sure enough, last week’s unprececented LME margin squeeze, where a 250% surge overnight in nickel prices nearly bankrupted Chinese tycoon Xiang Guangda whose Tsingshan Holding Group, the largest stainless steel maker, held a massive 150,000 tons nickel short and which resulted in $8 billion margin call which however even the collecting counterparties (one of which was JPMorgan) did not want to collect on knowing they would default Tsingshan, collect nothing and potentially push the LME itself into insolvency.

Another, more tangible example, comes from one of the world’s top oil and metal traders, which today we learn has been seeking funding from beyond its traditional group of bank private, approaching even equity investors, hoping to obtain $2 to $3 billion in fresh liquidity to meet what Bloomberg described as “margin calls in the billions of dollars” as oil prices surged to $139 a barrel and nickel soared 250% in little more than 24 hours. Precisely as Credit Suisse’s Zoltan predicted.

Now, another bank is on the trail of the source of liquidity crunch observed in unsecured funding markets.

In a note published overnight, Barclays strategist Joseph Abate desconstructs Zoltan’s key observation, and asks “could margin calls in commodity markets cause unsecured funding rates to rise as banks and investors scramble to meet demands for cash collateral?”

Taking a step back, Abate first notes that in his view, the pressure in unsecured funding pressure is driven principally by two factors: “a precautionary buildup of cash by banks that are uncertain about the geopolitical outlook and the maturity pileup of CP ahead of this week’s FOMC meeting.”

That said, and perhaps eyeing the tremendous sway Zoltan weekly views get, Abate writes that “each week brings a new explanation and a new cause for worry in funding markets. First it was the de-SWIFTing of Russian banks. Next it was fears of a “Lehman-like” spiral of secondary defaults tied to unobservable funding and borrowing linkages. The latest iteration ties the sharp increase in commodity prices to funding markets through margin calls.“

Reverse engineering Pozsar’s main point, Abate notes that the latest concern among markets is that “trading companies that are long the physical commodity and short derivatives as a hedge are experiencing steep margin calls from their exchanges” and Indeed, two central counterparty clearing houses (CCPs) have already raised their margins on energy contracts in the past week. To meet their requirements, Abate explains, these firms have to borrow large amounts of cash on very short notice, which puts strains on their bank lenders. And in order to raise the cash necessary to lend to the trading companies, their banks are tapping the CP market and pushing unsecured funding rates higher and spreads wider.

Yes, Abate may not want to admit it – after all mundane, boring explanations are far more palatable for institutional sellside strategists who would much rather not make waves (just please explain to your readers why your bank just decided to suspend share creation and make a mockery of its VXX ETN if nothing is wrong with the market), but Zoltan was right again.

* * *

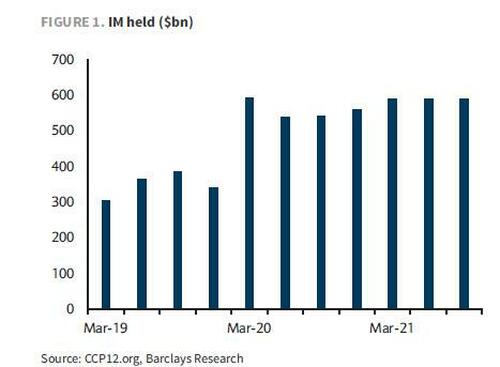

A little background here: CCPs collect margin or extra collateral to protect themselves and their members from potential losses in the event of a default. Initial margin (IM) protects against the risk that the counterparty to the trade will not meet its future contract obligations. CCPs impose IM requirements at the product level, as well as at the portfolio or firm level. Members can meet their IM requirements with cash or government debt, although in most instances, participants use cash. CCPs are required to have sufficient pre-funded resources to be able to survive the default of their largest member. IM requirements are model-based using historical data on market volatility, and they are regularly stress-tested. A global survey of the largest CCPs indicates that they held just under $600bn in initial margin at the end of September 2021.2 Of this amount, some $100bn is above their required minimum.

As trading volumes increase or market volatility rises, CCPs demand more IM from their members. Because most members use cash to satisfy their IM requirements, this increases the demand for liquidity. By contrast, variation margin – which also rises with market volatility – redistributes margin cash from those with underwater positions to those with appreciating ones

In March, margin requirements jumped sharply as the first wave of the pandemic caused significant market volatility. At the time, the bid-ask spreads on off-the-run Treasuries were 30x larger than pre-pandemic levels, and although Treasury trading volumes increased, market liquidity was extremely thin. CCPs moved quickly to protect themselves and their members from default by increasing IM requirements. The increase in IM created demands on hedge funds and other investors that exacerbated the “dash for cash” and contributed to the increase in funding spreads.

Several studies have looked at the connection between margin calls and market stress, and most have focused on a margin call “doom loop” in which higher margin requirements force fire sales into an already illiquid market where prices were gapping lower, which in turn triggered more margin calls, and so on. At the same time, these assets become harder to finance in repo, and with less access to financing, investors are forced to sell assets, which in turn increases the market dislocation, re-triggering the asset price and funding loops.

Absent a central bank liquidity injection “circuit breaker”, such a self-reinforcing doom loop could have catastrophic results.

* * *

What about the cash collected by the CCPs?

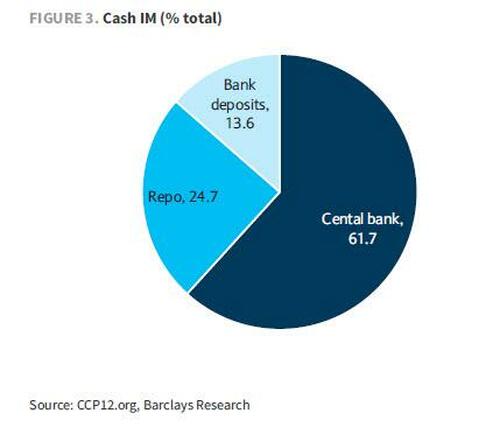

According to Abate, the margin cash collected by CCP does not sit idle, and instead – just like petrodollars used by oil exporters – is recycled in the form of investments in short-term assets and bank deposits (as shown in the chart above, these recycled balances are quite large and well over half a trillion dollars). Globally, cash IM is typically invested in repo, bank deposits, or at the central bank

Thus, margin cash collected from investors does not fully leave the funding ecosystem. Instead, it returns to the market in the form of repo and bank deposits. It is only when CCPs deposit the margin cash at the central bank that it leaves the funding ecosystem.

Since the start of the pandemic, the portion of IM that is globally recycled into funding markets has fallen as the share held at central banks has risen to 62%. This is also true in the US.

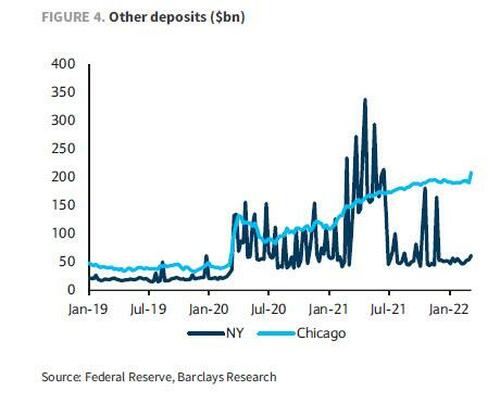

As part of Dodd-Frank (2010), systemically important financial market utilities (SIFMUs) have been able to deposit their margin cash at their local Federal Reserve branch. These balances are paid IORB. While the Fed does not break out deposits by owner separately on its balance sheet, our sense based on the participating SIFMUs is that most of this money is held at the Chicago Fed. Some balances are held at the New York Fed, but the Fed lumps these balances in with the unremunerated balances that the GSEs use to disburse their principal and interest payments. Like the global data, the increase in the Chicago Fed’s other deposits suggests that more margin cash has flowed onto the Fed’s balance sheet since the March 2020 “dash for cash”.

What are the implications? According to Abate, so far “evidence of margin pressure on funding rates is somewhat weak” and he points to the $15 billion increase in deposit balances at the Chicago Fed over the past two weeks, which suggests that CCPs’ risk aversion has not climbed to the point at which they are no longer recycling margin cash.

However, this may be merely a lagging indicator, because as more instances of multi-billion margin calls by the likes of Trafigura – which its bankers are diligently hoping will be contained without sparking a broader funding squeeze, similar to what happened at Tsingshan – become public, CCPs will soon find themselves scrambling to contain dozens of small fires which eventually will all coalesce into a giant one, and where only the Fed can step in and halt it.

Meanwhile, from a geopolitical standpoint, one can argue that it is precisely this margin call “doom loop” that Putin hopes to spark and propagate across the financial system now that virtually everything – from food, to energy, to finance, to economics – has been weaponized… not to mention that China is now also hoping to usher in the petroyuan as it seeks to eventually displace the petrodollar from global circulation. And since we are now in a state of financial warfare, absent a ceasefire in Ukraine, expect much more commodity volatility, and many more multi-bilion margin calls, until eventually the big one is triggered, one which leads to a near default not of the LME but of a far bigger clearinghouse, a topic which none other than the world’s (formerly) biggest hedge fund bear, Russell Clark has been spending night and day discussing on his blog in recent weeks.

Tyler Durden

Tue, 03/15/2022 – 16:40

via ZeroHedge News https://ift.tt/VltB1FR Tyler Durden