Stocks, Gold, Cryptos Soar As Fed Hawkish Surprise Triggers Countdown To Policy Error And Next Recesssion

What a mess.

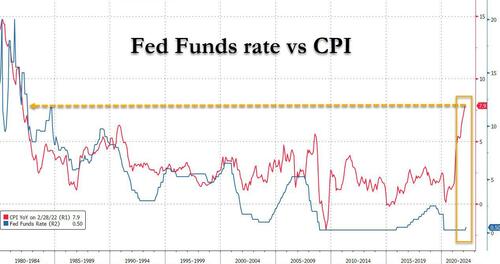

After some early volatility, when stocks moved with every fake news headline either out of the FT, Ukraine or Russia, traders put World War III on the backburner to read the FOMC statement and listen to Powell. Initially there were no surprises when the Fed announce a 25bps rate hike, just as expected, a move which is woefully behind the curve as the last time CPI was 7.9%, the Fed funds was 13%…

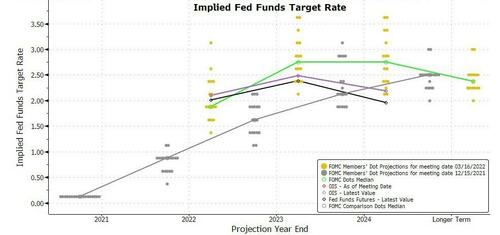

… but the Fed also boosted its dots so high it effectively confirmed what the market had been saying all along: the Fed now expects 6 more rate hikes in 2022, or one rate hike at every meeting!

As a result, risk assets, gold, oil and all risk assets tumble as did yields.

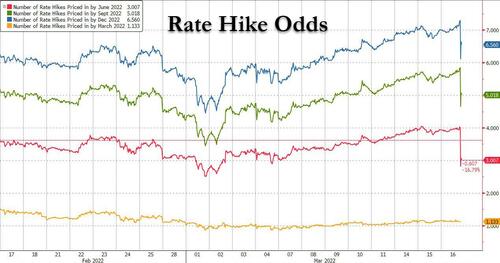

Hilariously, seven hikes is precisely what the market had been saying all along. However, once the Fed confirmed that the market was right, guess what happened? Well, rate hike odds tumbled.

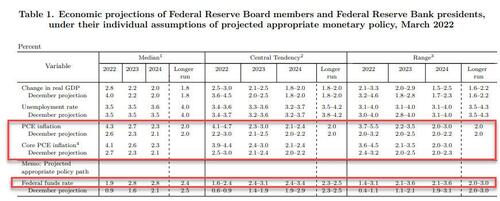

Why? Because with even the Fed now forecasting a big slowdown to growth coupled with a surge in inflation…

… the most likely outcome now is stagflation. This immediately manifested itself in a plunge in 30Y yields…

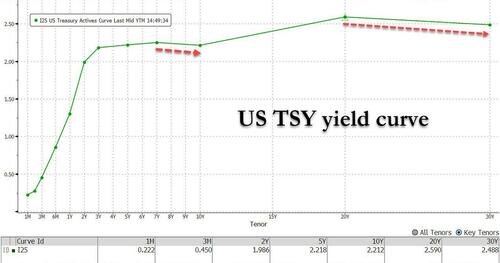

… as the entire yield curve pancaked…

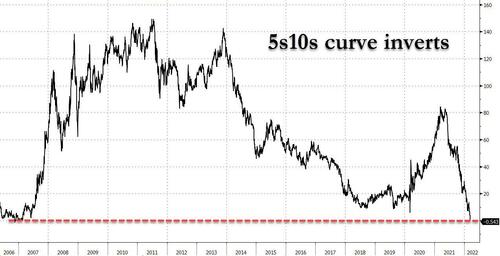

… culminating with the 5s10s inverting, a clear sign that a recession – the same recession which the Fed hopes to induce to crush commodity demand – is now coming.

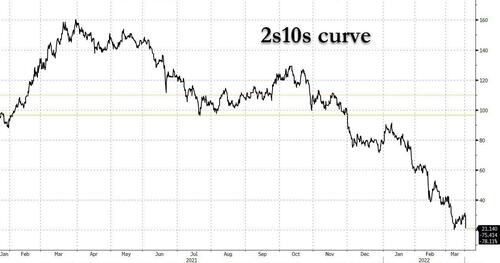

And while the 2s10s curve still has about 20bps before it too inverts and begins the countdown to the next recession…

… one look at the 3Y1Y – 1Y1Y OIS fwd shows that markets are now pricing in almost two rate cuts in the next 3 years…

… confirming that the Fed, which was trapped long before today’s rate hike, will be forced to ease and/or resume QE in the not too distant future even as inflation continues to rage. Translation: policy error.

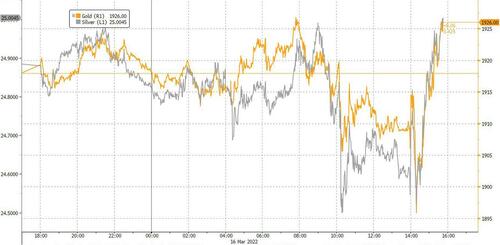

And while oil did indeed drop (not for long – just wait for the market to remember that 3MM bbls of Russian oil are now gone from circulation) on the Fed’s policy error as economic slowdowns traditionally lead to less demand, the policy error was not lost on either gold, which after dropping in kneejerk reaction to the hawkish FOMC statement, has since bounced to session highs in anticipation of the coming easing…

… or cryptos which similarly rebounded strongly after tumbling after the FOMC.

It certainly wasn’t lost on stocks, which after tumbling initially, reversed sharply once it emerged that the market is now pricing in rate cuts, and recovered more than 100 points from session lows…

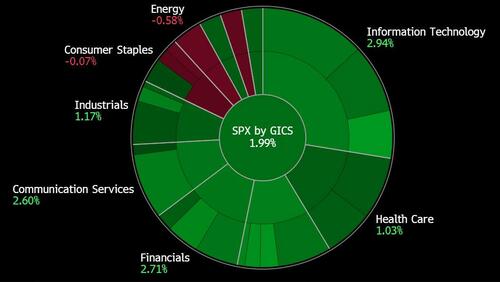

… led by – what else – the growth, deflation and slowdown sectors: IT and Comms.

What happens next? Well, as we said earlier, the Fed is trapped, and while Powell really has no choice but to keep hiking in the coming months in hopes he will induce a modest recession to crush commodity demand, every incremental rate hike will invert the curve that much more (unless the Fed actively start selling 10 and 30Y TSYs, at which point all VaR hell will break loose), and the market will price in even more rate cuts.

In short, the more hawkish Powell gets, the bigger the liquidity firehose he will have to unleash in a few months when the economy plummets into an all out recession, if not depression.

Tyler Durden

Wed, 03/16/2022 – 16:02

via ZeroHedge News https://ift.tt/3l9QnrX Tyler Durden