Futures Rise As Torrid Oil Rally Pauses

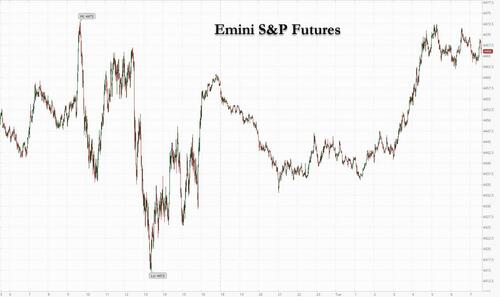

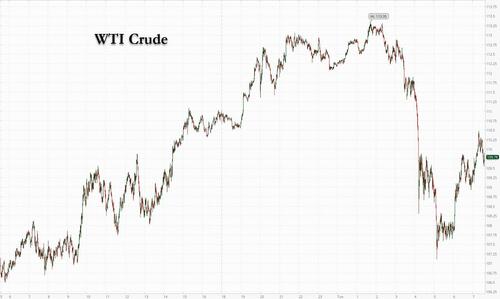

US equity futures reversed earlier losses and European stock markets rose as a sharp rally in crude oil stalled, even as a selloff in bonds deepened Tuesday after Fed Chair Powell signaled a stronger commitment to clamp down on inflation.

Futures on the S&P 500 and Nasdaq 100 flipped to gains from losses, the former trading 0.3% higher or 14 points to 4,466 while the latter was 0.25% in the green. The Stoxx Europe 600 Index marched 0.4% higher, led by banks and cyclical stocks like automakers, while the Hang Seng led gains in Asia, closing up 3.15% after Ali Baba raised its stock buyback by $10 billion. Treasury yields continued their ascent after short-dated rates posted one of the biggest daily climbs of the past decade on Monday.

In a mostly quiet session oil was the outlier, and after climbing 18% in three days, Brent futures initially rose as high as $119 before sliding sharply to $113 a barrel around the time Europe opened with WTI mirroring the move. Bloomberg reported that Germany and Hungary are putting the brakes on a potential embargo by the European Union on Russian oil, deepening differences in the bloc over how to further punish Moscow for its invasion of Ukraine.

“We have quite an unpleasant situation for markets currently in the sense that normally a Fed tightening cycle is at the early stages quite risk-on, and later on you worry about the financial conditions tightening driving a growth slowdown,” Christian Mueller-Glissmann, managing director of portfolio strategy and asset allocation at Goldman Sachs Group Inc., said in an interview with Bloomberg TV. “You now have this incredible urgency to tighten, you have a very steep hiking cycle and that puts the problem much earlier into investors’ minds that you might be facing a growth slowdown.”

In premarket trading, Nike rose more than 7% after reporting quarterly results that beat analysts’ expectations as the world’s largest athletic-wear retailer overcame struggles with its supply chain and the China market. Cryptocurrency-linked stocks gained in premarket trading as digital tokens from Bitcoin to Ether rise: Bitcoin climbs 3.3% to exceed $42,400 while Ether rises 3.2% to more than $3,000. Names benefiting from the move include Bit Digital +5.6%; Ebang +5.4%; Marathon Digital +5%; Riot Blockchain +4.5%; Coinbase +2.4%. Here are the other notable premarket movers:

- Alibaba (BABA US) shares jump 8.8% in U.S. premarket trading after the e-commerce giant announced an increase in its share buyback program to $25 billion from $15 billion. The move will enhance shareholder value and could be a signal that regulatory scrutiny by authorities is letting up, analysts say.

- Shares in Chinese stocks rally in U.S. premarket trading, boosted after e- commerce giant Alibaba upsized its share buyback to $25b, while tech stocks post broad gains. Baidu (BIDU US) +4.8%, JD.com (JD US) +5.5%.

- Tencent Music’s (TME US) shares rise as much as 6.7% in U.S. premarket trading following results. While the Chinese online music company reported a decline in year-over-year revenue, the figure met the average analyst estimate. The company also announced a plan to pursue a secondary listing in Hong Kong.

- Stocks related to cryptocurrencies gain in premarket trading as digital tokens from Bitcoin to Ether rise. Bit Digital (BTBT US) +5.6%; Ebang (EBON US) +5.4%.

- Okta (OKTA US) shares drop 8.5% in U.S. premarket trading, amid worries over a potential data breach after hacking group Lapsus$ claims it has gained internal access to the tech firm’s system privileges.

- HireRight Holdings Corp. (HRT US) jumped 11% postmarket after the employment background screening company provided a 2022 forecast that beat estimates. 4Q revenue increased 32% from a year ago.

- Dave Inc. (DAVE US) advanced in after-hours trading as the company announced a partnership with West Realm Shires Services and reported fourth-quarter results.

Commodity-market disruptions stemming from the Ukraine war have increased pressure on the Fed and some other key central banks to tighten monetary policy. Powell said the Fed is prepared to raise interest rates by 50 basis points at the next policy meeting if needed. His comments led to a deepening selloff in bond markets. Many investors welcomed the Fed’s strong will to combat inflation, said AcivTrad’s Pierre Veyret. However, “flattening yield curves suggesting rising concerns of an economic slowdown to come in the longer run, associated with the lack of any clear breakthrough in Ukraine-Russia diplomatic talks in the short-term, could be seen as a sign market volatility and large swings in prices may not be over yet,” he said.

The Fed hiked by a quarter-point last week and signaled six more such moves this year. Derivative traders Monday priced in about 7.5 quarter-point rate hikes at the remaining six Fed meetings this year, effectively making provision for more than one half-point rise. Overnight, Goldman Sachs economists said they now expect the Fed to raise interest rates by 50 basis points at both its May and June policy meetings. Economists led by Jan Hatzius said the Fed will likely raise by 25 basis points in the four remaining meetings in the second half of the year, with three quarterly hikes in the first nine months of 2023.

“Our best guess is that the shift in wording from ‘steadily’ in January to ‘expeditiously’ today is a signal that a 50 basis points rate hike is coming,” they wrote adding that “the Russian invasion of Ukraine and the possibility that financial conditions could tighten more aggressively in response to a faster pace of Fed tightening both present downside risks to our new forecast.”

European equities trade well, led by banks, insurance and auto names. Euro Stoxx 50 rises as much as 1% before stalling. FTSE MIB outperforms. Here are some of the biggest European movers today:

- Nemetschek shares gain as much as 13%, the most since October 2020, after the firm delivered 2022 guidance ahead of estimates which should trigger up to high single-digit upgrades to consensus Ebitda numbers, Baader Helvea (add) writes in note.

- Softcat shares rally as much as 12%, the most in a year, after saying full year results will be ahead of expectations. Jefferies boosts its price target, saying first-half results are “strong” and the IT reseller is managing supply chain constraints in a “healthy way.”

- Dermapharm shares rise as much as 7.2%, the most since Feb. 9, with Berenberg (buy) saying the pharmaceutical manufacturer’s margins topped estimates.

- Casino shares rise as much as 3.6% on renewed takeover speculation after a BFM Business report saying CEO Jean-Charles Naouri wants to play a role in French grocer consolidation.

- Trustpilot shares fall as much as 24%, the biggest intraday decline on record, after full-year results that Morgan Stanley says highlights the consumer-review platform’s intention to accelerate investments. Broker estimates the company is guiding to an Ebitda loss of $15m-$20m in 2022.

- Shares in equipment-parts supplier Diploma drop as much as 5.5% after JPMorgan analyst Oscar Val Mas cut the stock to underweight from neutral, citing “unfavourable” risk-reward at current levels.

- CRH share fall as much as 2.1% in Dublin. Valuation looks “undemanding but uncompelling” as higher costs and weaker growth in Europe look set to dent recent margin gains, Redburn analyst Will Jones writes in a note, downgrading the construction materials supplier to neutral from buy. CRH .

Earlier in the session, stocks also rose in the Asia-Pacific region, helped by Alibaba’s increased buyback program and a lift for Japanese exporters from a weaker yen. The MSCI Asia Pacific Index jumped as much as 1%, with Alibaba the biggest contributor to gains in the regional benchmark as well as the Hang Seng Index after the e-commerce giant expanded its share-repurchase program to $25 billion from $15 billion. The Topix advanced for a sixth straight day as the Japanese market reopened after a holiday. The gains came even amid weakness in U.S. equities after Federal Reserve Chair Jerome Powell said he is prepared to raise interest rates by a half percentage-point at the next meeting if needed to fight inflation. Asian financial stocks climbed as bond yields surged on Powell’s comments. Shares in India and South Korea also gained as the rally in oil prices paused. Still, inflation concerns, the Russia-Ukraine war and China’s growth slowdown remain a weight on regional stocks, with the MSCI Asia Pacific Index down more than 7% year-to-date. “Given the sell off we have seen thus far, it is only natural that investors try to identify if the market is at an inflection point,” said Justin Tang, the head of Asian research at United First Partners

A Bloomberg Intelligence gauge of China property shares rose as much 3.2% as market watchers say more cities have rolled out easing policies, such as lowering mortgage rates. Property stocks lead gains on the Shanghai Composite Index; Shanghai Stock Exchange Property Index rises as much as 3.8%. China Fortune Land jumps by the 10% daily limit; Seazen Group rises as much as 9.3%, Country Garden Holdings +7.6%, Greenland Holdings +6.6%, Yuzhou +6.1%. Mortgage rates in major cities have dropped more than 10 basis points in March compared to the previous month, says Geng Xinxin, an analyst at ZhiXin Investing Research Institute.

Japanese equities rose for a sixth-straight day, with electronics and auto makers among the drivers as the yen continued to weaken. The Topix gained 1.3%, with financials and energy-related stocks also gaining. Tokyo Electron and KDDI were the biggest contributors to a 1.5% rise in the Nikkei 225. The yen slid 0.8% against the dollar, pushing its loss to 4.9% since March 4. Yields jumped as hawkish comments from Federal Reserve Chair Jerome Powell caused a slide in Treasuries. Oil surged on signs the European Union may be edging closer to a ban on Russian crude imports. “With the dollar-yen pair approaching the key 120 mark, it’s going to be a tailwind for export-related stocks,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities. “As crude oil future prices rise, trading companies and other resource-related stocks could be bought.”

Australia’s S&P/ASX 200 index rose 0.9% to 7,341.10, closing at the highest level since Jan. 20. The materials and energy sectors rose the most. Mineral exploration company AVZ Minerals Limited advanced for a fourth day to end at a record high. Mobile payment solution company Block fell, snapping four days of gains. In New Zealand, the S&P/NZX 50 index rose 0.2% to 12,204.69

In Rates, treasuries added to Monday’s steep declines during Asia session and European morning, sending yields across the curve to new YTD highs, with the 10Y TSY briefly rising above 2.30%. Benchmark Treasury yields added four basis points to Monday’s 14-basis point jump after Powell said the central bank is prepared to raise interest rates by a half percentage-point at its next meeting, if needed. Yields remain cheaper by 3bp-5bp, with most curve spreads slightly flatter on the day. 2-year TSY yields top at 2.195%, highest since May 2019, and remain cheaper by ~6bp on the day; 10-year higher by ~5bp at ~2.34%, cheapening by ~1.5bp vs comparable bunds and gilts. Fed-dated OIS price around 43bp of rate hikes — or 72% of a 50bp move — into the May meeting. In Europe, fixed income trades heavy with bund and gilt curves all bear flatter on the session. Peripheral spreads only marginally tighter to core. Focal points for U.S. session include potential for another busy corporate issuance slate; Monday’s caused choppy price action in swap spreads; also, three Fed speakers are scheduled, following hawkish comments from Chair Powell Monday.

In FX, the dollar initially climbed against all its G-10 peers as hawkish rhetoric from Federal Reserve Chair Jerome Powell propelled U.S. yields higher, however it then dipped in early London trade . The yen slid to a six-year low: a surge in dollar demand into the Tokyo fix pushed USD/JPY above 120 for the first time since February 2016, traders said. The greenback’s haven appeal got a boost after U.S. President Joe Biden said Russia had deployed a hypersonic missile against Ukraine and warned about new indications of possible cyberattacks. “The dollar looks to be finding the support from a hawkish Fed outlook that it really should have seen after the FOMC meeting last week,” said Sean Callow, senior currency strategist at Westpac Banking Corp. “It seems markets needed to be told twice by Powell what he planned to do on rates and where the risks lie to the baseline view”

In commodities, Crude futures decline. May WTI futures decline as much as 2.5%, back near $108. Base metals are mixed; LME nickel trades down over 9%, but remains within exchange limit. Spot gold falls roughly $11 to trade near $1,925/oz.

Bitcoin is bid, but off highs, having surpassed last week’s peak of USD 42,392 in a short-lived foray above the USD 43k mark.

Looking to the day ahead now, and data releases include the Richmond Fed’s manufacturing index from the US for March, as well as UK public sector net borrowing for February. Central bank speakers include ECB President Lagarde, Vice President de Guindos and the ECB’s Villeroy, Panetta and Lane, along with the Fed’s Williams, Daly and Mester, and BoE Deputy Governor Cunliffe.

Market Snapshot

- S&P 500 futures up 0.3% to 4,467.75

- STOXX Europe 600 up 0.4% to 456.81

- MXAP up 1.0% to 179.08

- MXAPJ up 1.2% to 585.14

- Nikkei up 1.5% to 27,224.11

- Topix up 1.3% to 1,933.74

- Hang Seng Index up 3.1% to 21,889.28

- Shanghai Composite up 0.2% to 3,259.86

- Sensex up 1.2% to 57,953.59

- Australia S&P/ASX 200 up 0.9% to 7,341.10

- Kospi up 0.9% to 2,710.00

- German 10Y yield little changed at 0.49%

- Euro down 0.2% to $1.0998

- Brent Futures down 0.6% to $114.96/bbl

- Gold spot down 0.4% to $1,927.22

- U.S. Dollar Index up 0.19% to 98.68

Top Overnight News from Bloomberg

- Federal Reserve Chair Jerome Powell said the central bank is prepared to raise interest rates by a half percentage-point at its next meeting if needed, deploying a more aggressive tone toward curbing inflation than he used just a few days earlier.

- The yen fell to a six-year low against the dollar, reflecting expectations of a growing divergence in monetary policy between the U.S. and Japan.

- Fed Chair Jerome Powell on Monday weighed in on a major topic of debate in the bond market: where to look to determine the chances for a U.S. recession.

A more detailed breakdown of global markets from Newsquawk

Asia-Pac stocks were mostly positive with the region shrugging off the higher yields and oil advances. ASX 200 was led higher by strength in the commodity-related sectors including energy after further gains in oil. Nikkei 225 gained as exporters benefitted from a weaker currency and amid stimulus speculation. Hang Seng and traded higher with outperformance among the blue-chip tech stocks including Shanghai Comp. Alibaba after it boosted its share buyback to USD 25bln from USD 15bln and with oil majors underpinned. China is to hold a press conference on Tuesday night regarding the latest updates of the crashed China Eastern Jet, according to State Media.

Top Asian News

- Evergrande Unit Starts Probe as $2.1 Billion of Cash Seized

- Kishida Likely to Respond Before BOJ as Yen Breaches 120

- Tycoon-Led Group Said to Win Approval to Buy Singapore Press

- Japan Rushes to Avoid Tokyo Blackout as Snowfall Hits City

European bourses have been erring higher after a contained open, Euro Stoxx 50 +0.9%, with upside occurring as crude and bonds slipped further. US futures are in-fitting directionally but magnitudes more contained, ES +0.2%, with a slew of Central Bank speakers ahead. Sectors features defensive names as the current underperformers while Consumer Products is bolstered post-Nike earnings. EU leaders could endorse taxing windfall profits of energy firms, according to a draft summit statement

Top European News

- Fortum Exits Oslo Heating Company Valued at $2.3 Billion

- Sunak Given Budget Boost as Borrowing $34 Billion Below Forecast

- U.K. Government Prepares to Take Over Gazprom Retail Arm

- EToro Clients’ Missing Russia Stock Shows Risk in Market Tumult

In FX, the dollar extends gains as Fed chair Powell delivers hawkish speech at NABE, underlining 50bps hikes at one or more meetings, a potentially higher terminal rate and QT kicking off in May perhaps/ DXY gets to within a whisker of 99.000 before waning. Yen extends slump as BoJ Governor Kuroda says any exit from ultra accommodation would be premature, USD /JPY now testing 121.00 after breaching a key Fib just over 119.50 and 120.00 with little resistance. Kiwi and Aussie bounce as risk appetite picks up, former back above 0.6900 and latter on the 0.7400 handle again. Loonie lags as oil prices retreat, USD/CAD over 1.2600. Pound and Euro derive some traction from corrective gains in Gilt and EGB yields; Cable close to 1.3200 and EUR/USD tests 1.1000 where 1.35bln option expiries start and end at 1.1010.

In commodities, WTI and Brent are pressured, but off lows, as the benchmarks are hit amid China’s COVID updates and reports of further support in the EU for an energy price cap. WTI and Brent May contracts have slipped from intraday highs of USD 113.30/bbl and USD 119.48/bbl to current lows of USD 107.10/bbl and USD 112.64/bbl, respectively. France and “several eastern EU countries” reportedly back the idea of energy price caps with Germany and the Netherlands left to be convinced, according to Journalist Keating; Germany/Netherlands argue that refusing to pay market price could mean suppliers go elsewhere. Subsequently, a Senior German official says that Berlin’s opposition to energy sanctions is “unlikely to unless Russia uses “chemical or nuclear weapons”, according to Eurasia Group’s Rahman. Adds, “One change” idea would see a “coalition of the willing” – member states with less Russian energy dependency, move first” – Note, it is unclear if this is the journalists’ view or an official. Japanese government says power supply is tightening in the Tohoku region amid low temperatures. Spot / are pressured, though off lows, amid what appears to be a outflow from “havens” with core-debt gold silver and JPY pressured. LME CEO says price limits should prevent a repeat of the squeeze seen in Nickel, via Bloomberg. At the open, LME Nickel -12%, at USD 27,600/T.

US Event Calendar

- 10am: March Richmond Fed Index, est. 2, prior 1

Central Bank Speakers

- 9:10am: New York Fed’s Wuerffel Discusses a Post-Libor World

- 10:35am: Fed’s Williams Takes Part in BIS Panel Discussion

- 2pm: Fed’s Daly Speaks at Brookings Institution Event

- 5pm: Fed’s Mester Discusses Economic Outlook and Monetary Policy

DB’s Jim Reid concludes the overnight wrap

Whilst Ukraine undoubtedly remains the most important news story right now, central bank comments dominated the market agenda once again yesterday, with a fresh aggressive bond sell-off occurring before and after Fed Chair Powell signalled that the Fed wouldn’t shy away from tightening policy in order to curb inflation. It was especially telling that the Chair indicated nothing would stop the Fed from hiking in 50bp increments if they needed to. Surely they would have gone 50bp last week but for the uncertainty of events in Ukraine. Indeed, it’s increasingly dawning on investors that this is going to be a very different hiking cycle from its predecessor back in 2015, and yesterday Fed Funds futures moved to price in more than 200bps worth of hikes for 2022 for the first time (including the 25bps we saw last week). In turn, that served to turbocharge the losses among sovereign bonds and led the S&P 500 to turn from positive territory before he spoke to close ever so slightly lower (-0.04%) and end a run of 4 consecutive gains. Yields exploded up too with the 10yr yield up +14.0bps to its highest level since 2019, at 2.29%. Around a half of the gains post Powell showing that momentum was moving in that direction anyway. We’ve moved another +4bps this morning in Asia.

Significantly as well, there was a noticeable flattening in the yield curve, with the 2s10s curve closing beneath 20bps (17.0bps) for the first time this cycle after the 2yr yield (+17.9bps) flew past 2% for the first time since 2019 as well, closing the day at 2.12% but now 2.175% in Asia with the curve now at c.15bps as I type.

As mentioned at the top, the speech also triggered a reappraisal in the future path of monetary policy, with Fed funds futures pricing an additional 186bps of hikes this year (on top of the 25bps we saw last week), which would take the total tightening this year beyond 200bps if realised, and implies a +50bp hike at some point this year. Even in Asia trading this morning we’ve seen an additional quarter of a hike added which is a pretty big move for an overnight session. Bear in mind that the last time we saw more than 200bps of hikes in a calendar year was all the way back in 1994 (when rates rose +250bps), so again a pace of tightening that’s potentially faster than anything else in the last 3 decades. Rate hikes were added into money markets beyond this year, which had 5yr Treasuries (+17.8bps) moving in lockstep with the 2yr tenor, inverting the 5s10s yield curve (-3.3bps).

In terms of the headlines, there were a number of hawkish comments made by Powell in his speech, including that “the labor market is extremely tight, significantly tighter than the very strong job market just before the pandemic”, whilst he also acknowledged that “forecasters widely underestimated the severity and persistence of supply-side frictions”. Furthermore, he said that the Fed would “take the necessary steps to ensure a return to price stability”, and that they would be willing to move by more than 25bps per meeting and also shift policy into restrictive territory if necessary. That said, he (unsurprisingly) struck an optimistic tone on the odds of lowering inflation via a soft landing, noting that in 1965, 1984 and 1994 the Fed was able to raise rates without triggering a recession, and pointed out that others (such as the pandemic recession in 2020) were not induced by monetary policy. Powell also downplayed the importance of my favourite cycle indicator, namely 2s10s, preferring to look at the shorter part of the yield curve to get a cleaner read on near-term Fed policy expectations, as ostensibly longer duration assets contain more drivers that confound the read-through to the policy outlook. Those shorter yield curves are still quite steep, indicative of the sharp Fed hiking cycle ahead. Despite near-term steepness, markets are nevertheless pricing in peak policy rates and subsequent cuts as soon as the second half of next year, and it remains the case that every post-war recession has been preceded by a 2s10s inversion.

With Treasury yields climbing to multi-year highs, we saw a similar pattern in Europe yesterday, with 10yr yields on bunds (+9.6bps), OATs (+9.7bps) and gilts (+14.2bps) all seeing significant increases. For bunds, that takes the 10yr yield up to the heady heights of 0.46%, which is a level not seen since late-2018, whilst the 4yr bund yield also closed in positive territory for the first time since 2015. That came as Bundesbank President Nagel said that an end to ECB bond-buying in Q3 “opens up the possibility of raising interest rates this year, if needed”, although unlike for the Fed we didn’t see that echoed in future ECB pricing, with the amount of hikes expected by the December meeting seeing a modest fall of -2.2bps yesterday. This growing divergence between an aggressive Fed and a more cautious ECB has been evident in market pricing elsewhere, with the gap between 2yr yields on US and German debt widening to 240.6bps yesterday, which we haven’t seen since 2019. On top of that, the relative differences in the US 2s10s (at 17.0bps) and the German 2s10s (at 76.4bps) is also the widest gap we’ve seen since 2019 too.

On Ukraine, the headline risk around the stilted negotiation progress continued. Following from the weekend’s news that Ukraine refused to surrender Mariupol and that the battles would continue, yesterday’s tone was more negative, as the Kremlin indicated progress in talks had been less than they would have liked, and no agreements had been reached as of yet. The more negative rhetoric around Ukraine saw oil prices added to their gains at the end of last week, with Brent Crude (+7.12%) closing at $115.62/bbl, whilst WTI saw a similar +7.09% increase to $112.12/bbl. As I type this morning, Brent futures are up a further +2.28% while WTI futures are advancing +1.96%. In contrast, European natural gas futures fell -8.32% yesterday, their lowest in three weeks, and are now -72.52% below the peaks reached during the height of the supply fears from the invasion earlier in the month.

Overnight in Asia, equity markets are mostly trading even as markets aggressively reprice the Fed. The Nikkei (+1.63%) is leading gains across the region after yesterday’s holiday driven by gains in financial stocks, as the yen weakened against the dollar. The Hang Seng (+1.13%) is advancing, reversing earlier session losses after Hong Kong listed shares of Alibaba rose more than +3% after the company ramped up its share buyback size from $15 billion to a record high $25 billion to prop up its beaten-up shares. This is the second time Alibaba has upsized its buyback programme in a year. Mainland Chinese stocks are trading mixed with the Shanghai Composite (+0.14%) higher whilst CSI (-0.08%) trading fractionally lower this morning. Meanwhile, Coronavirus-related developments continues to be monitored, following Hong Kong’s move to gradually lift its Covid-19 restrictions.

Moving ahead, stock futures in the US indicate a negative start with contracts on the S&P 500 (-0.29%) and Nasdaq (-0.43%) lower after rate fears continue to rise. Indeed, yesterday the S&P 500 came off its best week since November 2020. That saw the S&P 500 only lose -0.04% but the more interest-sensitive tech stocks saw bigger declines, with the NASDAQ down -0.40% and the FANG+ index down -0.65%. Europe also put in a subdued performance, with the STOXX 600 up +0.04%. However, that masked divergences at the country level, with the UK’s FTSE 100 (+0.51%) adding to its YTD gains, whereas the CAC 40 (-0.57%) and the DAX (-0.60%) both ended the day in negative territory.

It’s taken a back seat given the other global developments recently, but it’s worth noting that we’re now less than 3 weeks away from the first round of the French presidential election on April 10. Since the Russian invasion of Ukraine, President Macron has seen a notable bounce in the polls, and now stands at 30%, according to Politico’s polling average, up from 25% prior to the invasion. If realised, that would build on the 24% he scored in the first round back in 2017. President Macron’s second-round challenger in 2017, Marine Le Pen of the far-right Rassemblement National, is also currently in second-place this time around at 18%, and behind them are the far-left Jean-Luc Mélenchon (13%), the conservative Valérie Pécresse (11%) and the far-right Eric Zemmour (11%).

There wasn’t much at all on the data front yesterday, although a notable exception was the German PPI reading for February, which rose to +25.9% on a year-on-year basis (vs. +26.2% expected). I looked at this on a historical perspective in my chart of the day yesterday (link here) and it’s the highest producer price inflation since the aftermath of WWII, and on par with the highest peacetime levels on record. Even excluding energy, PPI is now running at +12.4%, which is the highest since the mid-1970s. Let me know if you want to be added to my CoTD.

To the day ahead now, and data releases include the Richmond Fed’s manufacturing index from the US for March, as well as UK public sector net borrowing for February. Central bank speakers include ECB President Lagarde, Vice President de Guindos and the ECB’s Villeroy, Panetta and Lane, along with the Fed’s Williams, Daly and Mester, and BoE Deputy Governor Cunliffe.

Tyler Durden

Tue, 03/22/2022 – 08:03

via ZeroHedge News https://ift.tt/Bhq8AUu Tyler Durden