Stocks Extend Historic Short-Squeeze Melt-Up As Recession & Rate-Cut Odds Rise

Another quiet macro day (and everyone shrugging off The Fed’s Bullard & Daly’s hawkish comments) gave the algos the opportunity to run some more stops, pushing the S&P, Dow, and Nasdaq above key technical levels. S&P broke back above its 200DMA today and the rest of the majors held above their 50DMAs…

Nasdaq was the day’s big winner, and decoupled from the other majors around the EU close. This was the 5th day of gains in the last 6 days…

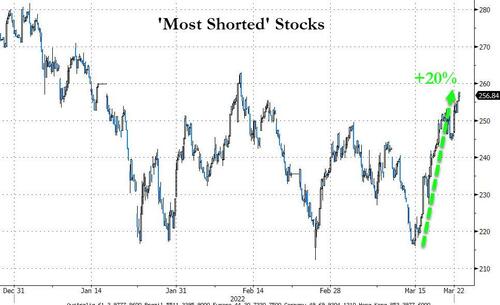

The historic short squeeze extended today with ‘most shorted’ stocks up 20% from pre-rate-hike lows last week (this is the most aggressive short squeeze since Jan 2021 – which actually marked the record high for the ‘most shorted’ index)…

Source: Bloomberg

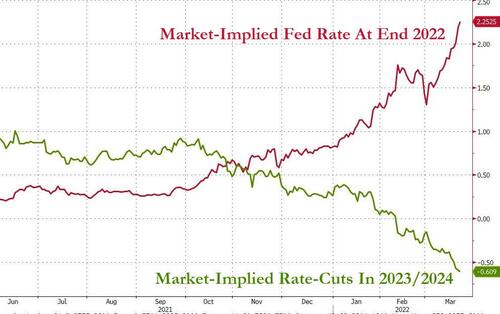

And this is happening as rate-hike expectations continue to rise AND rate-cut expectations next year also accelerate (perhaps the horizon the market is focusing on)…

Source: Bloomberg

Simply put, the more aggressive the rate-hikes this year (8 more hikes now priced in including 50bps hikes in May and June), the more guaranteed a recession becomes, and the more aggressive rate-cuts next year are priced in (more than two rate-cuts).

Treasuries were dumped once again with the longer-end underperforming this time (2Y +5bps, 10Y +9bps). The short-end remains the big laggard on the week though (2Y and 5Y up 25bps this week)…

Source: Bloomberg

The 3M2Y curve is at its steepest since Lehman (Sept 2008)…

Source: Bloomberg

…and at the same time 3s10s, 5s10s, and 20s30s are all inverted and flashing recessionary signals…

Source: Bloomberg

And as rates rise, bonds are trading at their cheapest to stocks since Nov 2018 (right before stocks began to crater into Powell’s tightening plans and eventual flip-flop)…

Source: Bloomberg

Is TINA dead? Or does this simply mean that when QE restarts, stocks will be super cheap?

The dollar slipped back lower after overnight gains today…

Source: Bloomberg

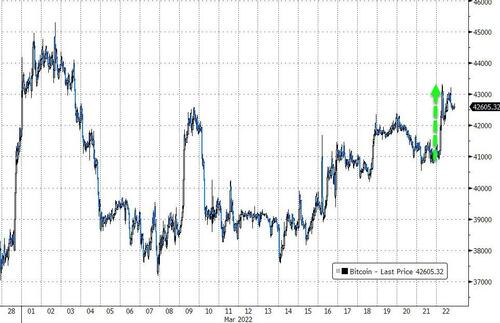

Cryptos rallied on the day with a big spike overnight lifting Ethereum back above $3000 and Bitcoin above $43000…

Source: Bloomberg

WTI drifted back below $110 ahead of tonight’s API-reported inventory data…

Gold also ended the day lower but well off the lows triggered after the US cash equity open…

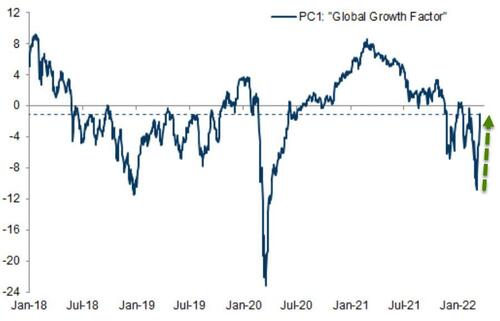

Finally, investor pessimism has faded materially – the GS Risk Appetite Indicator (RAI) is nearly neutral again

So, forget Putin-Hitler, forget Powell-Volcker… just ‘look through’ the global geopolitical crises and ‘hope’ for the next round of QE and rate-cuts to rescue the world again… stagflation fears be damned!

Tyler Durden

Tue, 03/22/2022 – 16:01

via ZeroHedge News https://ift.tt/0sWDzQR Tyler Durden