Biden’s Oil Polices Are “Bat-Shi*t Crazy”, Creating “Turmoil” In Markets: USF Geology Professor

Submitted by QTR’s Fringe Finance

America’s energy policies, specifically those centered around oil and gas, are “bat shit crazy” and the Biden administration is doing nothing but creating “turmoil” in the oil markets, according to geologist and fossil fuel expert Dr. Marc J. Defant.

I’m excited to be welcoming my friend Marc back to the podcast in early April. But for now, his expertise in the world of oil and gas is so deep, I thought my readers would benefit from a preview of his takes on the current state of energy globally, the oil crisis that Europe and the U.S. are heading toward, the effects of Ukraine/Russia and the dollar on oil prices and the effects of Biden Administration policies on the price of oil.

Dr. Marc J. Defant is a professor of geology/geochemistry at the University of South Florida. He worked for Schlumberger Well Services and Shell Oil for three years, with two years at Shell working as an exploration geologist.

He has been funded by the National Science Foundation, National Geographic, the American Chemical Society, and the National Academy of Sciences, and has published in many internationally renowned scientific journals including Nature. He has written a book entitled Voyage of Discovery: From the Big Bang to the Ice Age and published several articles for general readership magazines such as Skeptic and Popular Science and appeared on the Joe Rogan Experience podcast. You can reach him via this contact form.

I had a chance to pick Dr. Defant’s brain this week about the rising cost of energy and his thoughts on what is exacerbating the situation. What follows is Dr. Defant’s take on our country’s oil crisis.

This blog post is being published without a paywall because I believe its content to be far too important not to share. If you have the means, and would like to support my work, you can subscribe here: Subscribe Here

Q: Hi, Marc. Can you start by giving a primer on how oil at the pump is priced and address the claims of “price gouging” by oil companies?

A: Oil is traded in US dollars and the price of oil is highly sensitive to the value of the dollar. Gasoline sold at the pump is made in refineries from crude oil. Therefore, the price of gasoline is directly impacted by the price of oil. Oil prices are set on the futures market, so speculation becomes very important in what we pay at the pump. It is a highly volatile market, as we have recently seen.

Oil prices increase when supply is negatively impacted. That is, demand by traders, not the oil companies, forces price fluctuations. Traders are highly influenced by what they perceive the future availability of oil will be. No sense selling oil today for low prices if they can wait and get higher prices. In other words, sellers ask higher prices when they perceive the supply will be low and the demand high.

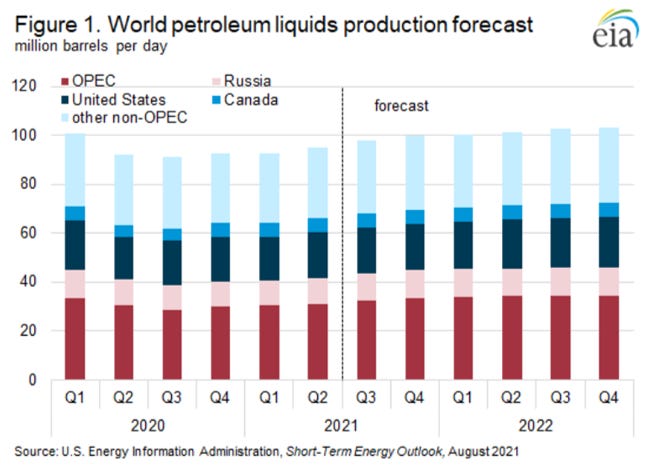

The Organization of the Petroleum Exporting Countries (OPEC) consists of 13 countries and produces about 40 percent of the world’s oil. They are considered by many to be a cartel because of their important influence on the price of oil and gas. In other words, they can impact supply which moves the price of oil. A few notable members are Iran, Kuwait, Saudi Arabia, the UAE, and Venezuela. Russia has worked on and off with OPEC to control supply particularly when oil prices were low.

There are two types of futures buyers – those that wish to hedge their bets and those that speculate in pricing. Hedgers are usually oil companies that buy futures to make sure they will not be negatively impacted by the volatile fluctuations in oil prices. On the other hand, oil speculators are traders that hope to make money on the change in oil price fluctuations.

Let’s take a look at an example.

US fracking (which I will discuss in detail) increased the amount of oil available between 2011 and 2014 from about 1 million to 4.8 million barrels per day (B/D). The market became gutted with oil and the price fell to $27 per barrel (/B). I might add that no one claimed the oil companies were gouging the public during these low prices. If the oil companies had control on the price of oil, why would the price fluctuate so extensively? Only when prices rise does anyone point fingers at the oil industry. But obviously, the oil companies have very little control over the price of oil, which is set by the futures market.

By 2019, due primarily to fracking, the US became the number one producer of oil and gas in the world. In fact, we became a net exporter of oil and gas.

Prior to Biden entering office, oil production of oil shales reached over 12 million B/D. but fell more than 1 million B/D during 2021. During this time, Russia became the world’s largest exporter of oil which helped fund their war effort in the Ukraine.

How did Biden’s policies impact the lower production of oil and gas?

Under Obama, the government came up with a dollar value called the social cost of carbon. It is supposedly an estimate by the government as to the environmental damage from everything from rising sea level to wildfires and floods from the release of one ton of carbon dioxide via fossil fuel burning. But scientists are still completely uncertain about the direct impact the burning of fossils fuels may have on the environment. I hope this causes you to suspect the number may be related to magic.

But that never stopped the Obama administration from coming up with a solid amount of $57. Trump reduced the number to $7, but Biden revised the number to $51. The number is important because it gave the Biden administration the leverage to restrict oil and gas production based on supposed environmental and economic threats from greenhouse gasses (i.e., reduce permitting on federal lands).

As might be expected, gas-producing states fought back by challenging the social cost of carbon in court, and a judge issued an injunction preventing the administration from using the metric. But rather than submit to the judge’s ruling, the Biden administration simply decided to stop new permits on federal lands blaming the judge for the action – sigh. But Biden has been slow-walking permitting since he became President. He is the only President in 20 years not to have an onshore lease sale in a given year (2021).

We should not be surprised by Biden’s actions. During his campaign he promised to end drilling on federal lands to fight climate change. As much as 25% of oil and gas production comes from federal lands.

Finally in November of last year, the Department of the Interior, which is required by law to have quarterly lease sales, opened its first Gulf of Mexico oil lease auction which generated $190 million from oil companies. But alas, a green Obama-appointed judge vacated the auction after [environmentalists] Earthjustice out of San Francisco sued.

The ruling effectively ended new drilling in the Gulf, where some of the world’s environmentally friendly oil resides. There are some state representatives that claim the Biden administration went ahead with the auction knowing full well it would be vacated. As you might imagine, the Department of the Interior will need a great deal of time to review the environmental impact of drilling in the Gulf (wink wink).

Bloomberg reported that an oil executive mused:

“Biden is signaling that his environmental goals trump energy security and consumer prices… that’s not lost on public companies or banks they rely on.”

Ultimately, investment in the oil industry increases when roadblocks to making a return on investment are removed. Biden’s actions have scared off many potential investors further reducing oil production. Press Secretary Jen Psaki’s oft repeated statement that 9.000 leases have been permitted is at the very least disingenuous considering the impediments to drilling the Biden administration has created.

Psaki frequently claims that the Keystone XL Pipeline has no impact on oil prices because it will take two years to complete (only one year now if they had not shut it down). But Psaki is undermining (purposely in my opinion) the importance of the supply chain.

For example, the oil that would come through the pipeline has to be shipped by train. Recent train crashes demonstrate the danger of transporting oil via this method. And it obviously costs a lot more to ship via rail. But in a real head scratcher, Biden waved sanctions on the Nord Stream 2 pipeline from Russia to Germany. Why is this acceptable, but the XL is not? Russian oil is notoriously dirty (high sulfur content).

One would think Biden would be doing everything he could to send American oil and gas to Europe rather than making them more dependent on Russian oil. Ultimately, the Biden administration has intentionally raised significant barriers in permitting supply of oil to the US. Infrastructure is extremely important to the supply of cheap and clean oil to the American economy.

The production of oil and gas in America is highly regulated – it’s the cleanest in the world both in lack of contaminants like sulfur which pollute and the way the industry protects against leaks.

The invasion of Ukraine by Russia created fears about the future of oil supplies which, in turn, pushed oil prices to record highs. And although the US buys less than 10 percent of its oil from Russia, Biden’s decision to stop buying oil from Russia, created more turmoil in the markets.

But perhaps the most irrational decision ever made by a President is Biden’s pursuit of [the] Iranian (and Venezuelan) nuclear deal to get access to Iran’s oil. They are the foremost sponsor of terrorism in the world and yet we are willing to sign a very one-sided treaty with them to gain oil which is extremely dirty (high sulfur).

We will pay them just as Obama did, with the helicopter carrying billions of dollars. And those payments will make it easier to develop delivery systems once they finally develop a nuclear bomb. On top of this, we are helping them build an nuclear power plant that will give them clean energy but not us.

Finally, I ask you to remember, gasoline prices were rising quickly way before the war in Ukraine broke out not only due to Biden’s interference in our oil production but the inflation caused by his huge spending bills. Now we are going to buy oil from Iran instead of enabling our own industry to supply America’s needs. It is the very definition of “bat-shit crazy.”

This blog post is being published without a paywall because I believe its content to be far too important not to share. If you have the means, and would like to support my work, you can subscribe here: Subscribe Here

For a preview of my upcoming podcast, here’s Marc explaining why the U.S. was the largest oil and gas producer in the world in a 30 minute presentation:

Dr. Marc J. Defant has also been Editor of Geology and an Associate Editor of the Journal of Geophysical Research. He was also invited by the Chinese Government to be a keynote speaker at a symposium on the continental crust and has given invited talks at Massachusetts Institute of Technology, Columbia University, Universitè de Bretagne (Brest, France), University of California at Los Angeles, University of Georgia and Tennessee, and Woods Hole Oceanographic Institution, as well as many others. Defant was one of the first American scientists allowed to work on volcanoes in the isolated and militarily sensitive area of Kamchatka, Russia, when it was still part of the old Soviet system through a cooperative joint grant between the Soviet Academy of Sciences and the National Science Foundation. He has presented a TedX talk on Why We are Alone in the Galaxy. He has also done research on volcanoes in Costa Rica, Greece, Indonesia, the Lesser Antilles, Panama, and the Philippines. Defant has been a consulting geologist on diamonds and gold for de Beers, Placer Dome, Falconbridge, Anglo American, Aurcana Gold, Diamond Fields, along with several others in West Africa and the Soviet Union/Russia.

He can be reached via this contact form.

Tyler Durden

Tue, 03/22/2022 – 20:45

via ZeroHedge News https://ift.tt/kyio8I1 Tyler Durden