Brent Soars Above $120 Amid Short Squeeze As Trafigura Says Oil “Will Hit $150 This Summer”

Oil pushed higher ahead of high-level meetings that may result in fresh sanctions on Russia, and as a vital Black Sea terminal may be disrupted for weeks following storm damag.

Overnight, Reuters reported that Russian and Kazakhstan oil exports via the Caspian Pipeline Consortium (CPC) from the Black Sea may (read: will, now that all commodities are weaponized) fall by up to 1 million barrels per day (bpd), or 1% of global oil production, due to storm-damaged berths, a Russian official said on Tuesday.

Pavel Sorokin, a deputy energy minister, said the second berth could also turn out to be damaged after initial information about one of the three being damaged by a storm.

Sorokin said the maintenance could take up to two months, which could lead to exports falling by up to 1 million bpd.

There’s a number of reasons why U.S. demand is robust, even with prices above $100/bbl; Brent will likely hit $150/bbl this year, according to veteran trader Doug King.

Meanwhile, speaking at the FT Commodities global summit, Trafigura’s co-head of oil trading Ben Luckock said that increasingly tight balance of supply and demand will mean oil prices are going to keep going up, adding that oil prices are not only justified at this price, but they’re going to continue higher.

“I think you’ll see a huge backwardation and I do think you’ll see $150 this summer”

And in a stinging blow to the Fed’s hopes that by crushing demand with an induced recession oil prices will tumble, Luckock said that all that counts at the moment is the supply side.

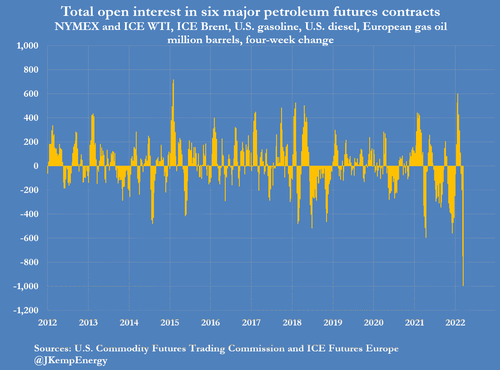

After WTI tumbled as low as $95 last week, and Brent trading below $100, as hedge funds puked, selling and shorting more than 1 billion barrels in the past month…

… today we are seeing the reversal, as funds squeeze and oil soars, with Brent last trading around $121, and WTI last seen just shy of $115.

Expect much more upside as the world realizes what Putin has known all along: the world can live without Russian oil…it just has to brace for energy hyperinflation.

Tyler Durden

Wed, 03/23/2022 – 09:57

via ZeroHedge News https://ift.tt/6Szs8Ym Tyler Durden