What ‘Vibrancy’: NYC Hit By Surprisingly High Jobless Rate As Workers Fail To Return

The percentage of white-collar workers in New York City office buildings remains abysmal. Workers aren’t returning, and it’s crushing the local economy.

NYC’s 7.6% unemployment rate is shockingly high compared with the rest of the country (nationwide average of 3.8%) as an economic recovery is slow to materialize, according to Bloomberg. There could be a muted recovery without five-day-a-week commuters because their impact on the local economy is substantial.

Keycard swipes tracked by security company Kastle Systems show NYC offices are about 36% occupied, far below pre-COVID levels. Even as companies announced return-to-office dates, many implemented a hybrid work model that allows white-collar workers to work remotely part of the time. Some companies have entirely reduced their corporate footprint and enforced remote working for some employees.

According to the latest survey by The Partnership for New York City business group, only 16% of top NYC firms say daily attendance in their Manhattan office was above 50%. The poll showed that about 75% of employers delayed return-to-office plans due to a spike in COVID infections year, and 22% said they don’t have a timeline on when offices will be full again.

On Oct. 29, 2020, we noted that NYC’s recovery will be a “long slog” from here as the downturn will last well into 2023 and lag the rest of the nation. It seems we’re right, and the source of a lackluster recovery is directly related to workers that aren’t returning to offices.

Mark Vitner, a Wells Fargo senior economist, said the city is “enduring a slower recovery because it is so dependent on the office and entertainment sectors.”

“Cities that were quicker to reopen following the initial lockdowns at the start of the pandemic have also tended to see stronger recoveries,” Vitner said. What may have damned the metro area were public officials and their inability to lift health mandates that crippled the local economy, forcing tens of thousands of people, if not more, out of the area and to suburbia or Florida.

Newly elected Mayor Eric Adams has argued that remote and hybrid work situations are crushing service-oriented businesses in the city that solely rely on white-collar workers, such as the food and entertainment industry.

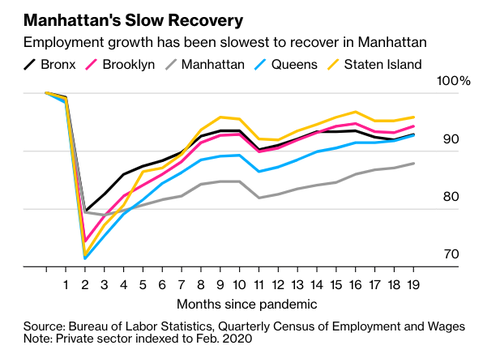

Quarterly Census of Employment and Wages data shows there are 275,000 fewer paychecks in just Manhattan compared to pre-COVID times. Manhattan jobs account for a whopping 57% of the city’s overall economy.

“Manhattan is an enormous economic and social driver,” said Andrew Rigie, the New York City Hospitality Alliance executive director.

Manhattan’s unemployment rate is the lowest among the boroughs. The Bronx has had the slowest employment growth.

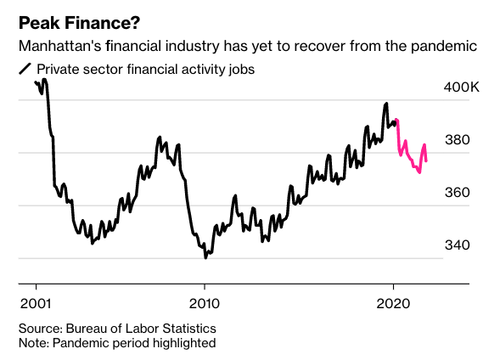

As firms fled Manhattan during COVID to places like Florida and Texas, the borough’s financial industry has likely seen another peak in jobs. Also, factor in the increasing amount of automation in the financial sector, and the job situation in Manhattan looks even bleaker.

NYC leads the way in lackluster employment gains.

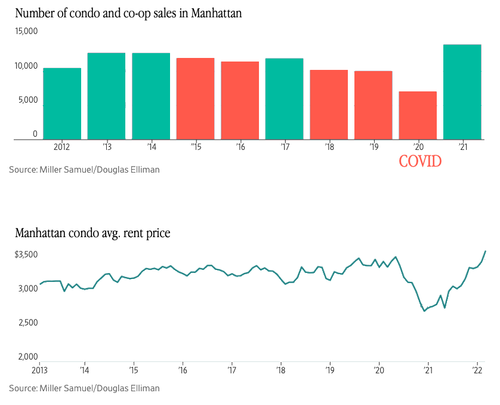

Meanwhile, the Manhattan housing market has been on fire as the number of sales spike and median rents soar.

An economic revival in NYC will lag the rest of the country as long as remote work persists. So what happens to all the empty commercial-office buildings?

Tyler Durden

Tue, 03/22/2022 – 23:05

via ZeroHedge News https://ift.tt/4LFyVfW Tyler Durden