Fed Liquidity Drain Is Coming

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Inflation is running hot, and the Fed is projecting seven rate increases this year alone. As if that is not concerning enough for bond investors, the Fed hints at draining liquidity via balance sheet reduction, i.e., Quantitative Tightening (QT).

At Jerome Powell’s post-March 16, 2022, FOMC press conference, he stated: “it’s clearly time to raise interest rates and begin the balance sheet shrinkage.” Based on further comments, Powell wants to start normalizing the Fed’s balance sheet and drain liquidity as early as May.

Since March of 2020, the Fed has bought about $3.5 trillion in U.S Treasury securities and $1.5 trillion in mortgage debt. The gush of liquidity from the Fed’s QE program helped the U.S. Treasury run massive pandemic-related deficits. Buying over half of the Treasury’s debt issuance in 2020 and 2021 limited the supply of bonds on the market and upward pressure on interest rates.

Equally important to the Fed, QE comforted investors in March of 2020 and further boosted many asset prices throughout its existence.

With QE finished and QT on the horizon, we answer a few questions to help you better appreciate what QT is, how it will operate, and discuss how the Fed draining liquidity will affect markets.

What are QE and QT?

Quantitative Easing (QE) is the process in which the Fed purchases Treasury and Mortgage bonds from banks. In exchange, the banks receive reserves from the Fed. These reserves are not cash but are the basis by which banks can lend money. All money is lent into existence. As such, there is an indirect connection between QE and money printing.

Via QE operations, the Fed removes assets from the markets. The supply reduction creates a supply-demand imbalance for the assets they buy and the entire pool of financial assets. As a result, QE tends to help most asset prices. For this reason, QE has become the Fed’s most important tool for fighting market instability and thereby boosting investor confidence.

For more on how QE supports asset prices, we suggest reading our article- The Fed is Juicing Stocks.

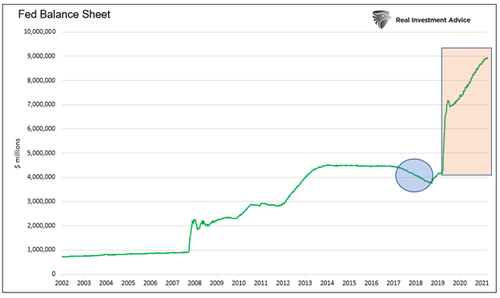

Quantitative Tightening (QT) is the opposite of QE. During QT, the Fed shrinks its balance sheet. QT has only been attempted once. In 2018, the Fed embarked on QT, as circled in the graph below. At the time, they ultimately reduced the balance sheet by $675 billion. Ironically, the liquidity drain forced the Fed to return to QE in 2019 as hedge funds ran into liquidity problems. QT exposed the fragility of our overleveraged financial system and its reliance upon easy money.

Perspective on QE 4

Before we progress, it’s worth providing perspective on how massive the pandemic round of QE (QE4) was compared to prior rounds of QE. Eric Parnell sums it up nicely:

-

For example, it took the Fed more than a year to deploy $300 billion in Treasury purchases as part of QE1. In response to COVID, the Fed purchased $300 billion in Treasuries in just three days.

-

It took the Fed nearly eight months to carry out $600 billion in Treasury purchases as part of QE2. During the COVID outbreak, the Fed made $600 billion in Treasury purchases in six days.

-

And it took the Fed 22 months to carry out $1.5 trillion in Treasury purchases as part of QE3, which until COVID was considered the epic QE program. But during COVID, they matched this $1.5 trillion in Treasury purchases in just over a month.

-

And then they continued gobbling up Treasuries at a rate of $80 billion per month, or nearly $1 trillion a year, for the next year and a half through late 2021 before FINALLY starting to wind the program down.

How Much QT Might The Fed Do?

The rectangle in the graph above highlights the massive $5 trillion increase in the Fed’s balance sheet over the last two years. With the Fed Funds rate now on the rise and inflation the number one enemy of the Fed, numerous Fed members have made it clear they want to normalize the Fed’s balance sheet.

Does “normalizing” mean they will reduce the $5 trillion they recently increased it by?

To help us guesstimate what normalization entails, we lean on Joseph Wang and his blog Fed Guy. Joseph was a senior trader on the Fed’s open market desk responsible for executing QE and QT. As such, he understands the mechanics of QE and QT better than just about anyone else.

In his more recent article The Great Steepening he states:

“Chair Powell has sketched out the contours of the upcoming QT program through a series of appearances. He noted at a recent Congressional hearing that it may take around 3 years to normalize the Fed’s $9t balance sheet. The Fed estimates its “normalized” balance sheet based on its perception of the banking system’s demand for reserves. A conservative estimate based on the pre-pandemic Fed balance sheet size and taking into account growth in nominal GDP and currency, arrives at a normalized balance sheet of around $6t. This would imply QT at rate of ~$1t a year, roughly twice the annual pace of the prior QT.”

How Will They Do QT?

The Fed has two options to drain liquidity and reduce its balance sheet. It can let bonds mature. It can also sell bonds to the market.

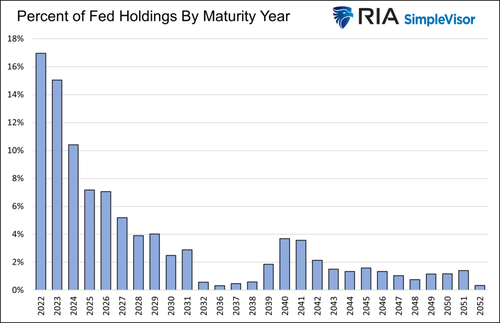

The graph below shows that over half of the Fed’s bond holdings mature within four years. The preponderance of shorter maturity bonds allows the Fed to rely on maturation easily. Only 25% of the bonds mature in ten years or more. Also, note the x-axis is missing the years 2033-2035. This is because they do not hold any bonds with those maturities.

Despite many short, dated bonds, the Fed could instead select to sell bonds. Doing so would allow them to manage the yield curve. For instance, if they announced a program to replace all maturing issues with new short-term bonds and instead sell longer-term bonds to help them drain liquidity, longer maturity yields would rise and shorter maturity yields would fall.

Creating a steeper yield curve, as such an action might do, might be advantageous to banks that tend to lend long and borrow short. It would also help the government with lower borrowing rates. The Treasury relies heavily on shorter-term bonds to fund its deficits. As of the end of 2021, over half of the Treasury debt outstanding matures in three years or less.

The Fed is Limited What It Can Do

Some Fed watchers say the Fed may sell bonds and use QT to affect the yield curve. While we would put nothing past them, the limited number of longer-term bonds they have for sale makes any meaningful yield curve control unlikely.

We think they will avoid selling longer-term bonds. Yields have risen significantly over the past few months. With mortgage rates near 5% and corporate yields rising sharply, the fed will likely want to limit any additional economic harm higher rates will cause.

Can they solely rely on bond maturities to accomplish $1 trillion a year of QT?

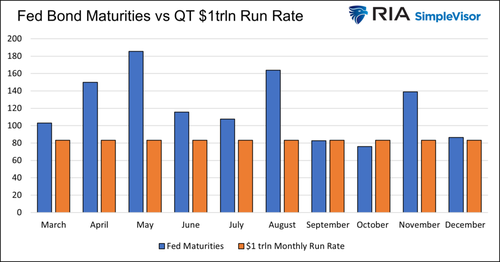

The graph below compares a $1 trillion QT run rate ($83.33 bn per month) versus the Fed’s bond maturities for the remainder of 2022.

As we show, there are only two months, September, and October, in which the amount of bonds maturing is less than the $1 trillion run rate. In both cases, the differences are minimal. Also, note that the Fed will have to buy bonds in the remaining months.

For example, in April 2022, $150 billion in bonds will mature. If the Fed limits balance sheet reduction to $83 billion, they will have to buy about $67 billion in bonds.

In 2023, assuming they are still doing QT, there are five months in which they will need to sell bonds. The largest being $20 billion. That said, purchases in 2022 could easily cover those gaps by 2023.

What are the Consequences?

The most considerable effect of QT will likely be on Treasury supply and financial markets.

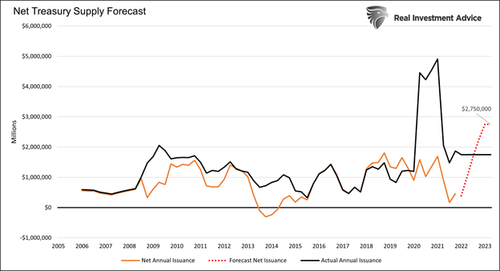

The graph below shows that if the Fed follows a $1 trillion per year QT path, the net supply of Treasury debt will be significant. The black line plots annual issuance. The orange line subtracts Fed purchases to arrive at a net issuance/supply amount. The net issuance (after Fed purchases) was about $1.5 trillion during the Pandemic. The Fed absorbed a large portion of the massive fiscal stimulus.

The red dotted line projects the net supply/issuance in the future. Assuming $1.75 trillion in annual borrowing and $1 trillion a year of QT, investors will have to absorb $2.75 trillion of Treasury bonds. That is well above the levels of 2020 and 2021 and nearly 3x the amount in the years before the Pandemic. On its own, such a jump in supply is a recipe for higher yields.

The Fed may want to normalize its balance sheet, but it may not be possible without causing problems in the Treasury market.

QT will also be problematic for many other asset markets. As discussed earlier, removing assets from the global asset pool helped increase asset prices. The extra bonds on the market via the Fed and new Treasury supply require draining liquidity from other assets to fund the U.S. Treasury. Just as QE helped asset prices, QT should equally hurt them.

Summary

The Fed attempted QT in 2018 in what is generally considered a failed attempt to normalize the balance sheet. As they learned, the markets are too overleveraged to drain enough liquidity to normalize the Fed’s balance sheet.

Today, the Fed has grander QT plans despite higher asset valuations than in 2018 and more financial leverage throughout the economy. The odds of the Fed fully normalizing the balance sheet by $3 trillion are slim to none. It is more likely the financial markets cry uncle, and the Fed comes to the rescue once again.

QE 5 is closer than most investors think!

Tyler Durden

Wed, 03/30/2022 – 08:50

via ZeroHedge News https://ift.tt/rN6yEVi Tyler Durden