US Driving Rebound Intensifies Pressure On Oil Supplies: Kemp

By John Kemp, senior market analyst at Reuters

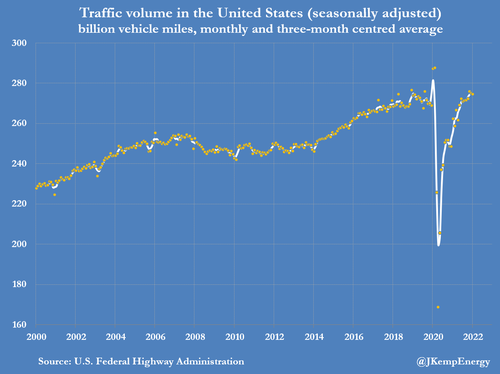

U.S. road traffic volumes have recovered to pre-pandemic levels as businesses have re-opened, commuting has resumed in most cities and leisure trips return.

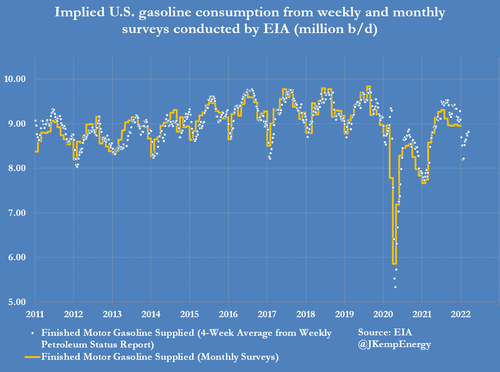

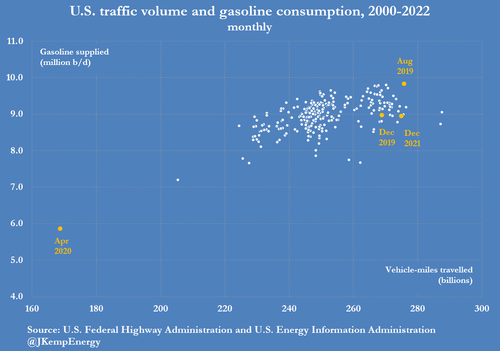

Gasoline consumption has recovered to pre-pandemic rates, though use is a little lower than might be expected based on miles-driven, which is increasing the pressure on already-stretched global petroleum supplies.

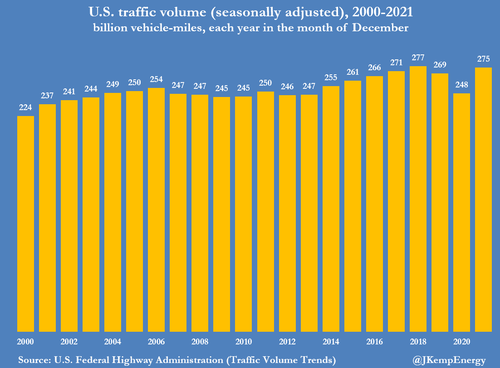

U.S. cars and trucks drove 275 billion vehicle-miles in December 2021, after seasonal adjustments, according to the results of local traffic surveys compiled by the Federal Highway Administration.

Vehicle-miles travelled were up from 269 billion in December 2019, on the eve of the pandemic, and approaching the record of 277 billion set in December 2018.

There was a slight dip in seasonally adjusted traffic in January 2022 as a result of local work-from-home orders and business closures. But with most areas rapidly exiting epidemic controls, volumes are likely to reach record levels over the next few months.

Traffic volumes are still well below where they would have been in the absence of the pandemic if they had continued increasing on the pre-2020 trend. But gasoline consumption, as measured by the volume of fuel supplied to retailers and end-users, had recovered to pre-pandemic levels by the end of last year.

Like traffic flows, gasoline use was hit temporarily by the reintroduction of local work from home orders and business closures at the start of this year. Nonetheless, gasoline consumption is on course to exceed the pre-pandemic cyclical high this summer as a result of high levels of employment and leisure driving.

Gasoline inventories held by refineries, blenders and wholesalers stand at 238 million barrels, slightly below the pre-pandemic five-year seasonal average of 241 million barrels.

U.S. refineries are producing 9.8 million barrels per day (bpd) of gasoline compared with an average of 9.7 million bpd at this point in 2015-2019.

With diesel stocks more than 20% below the pre-pandemic average, however, refiners have no scope to alter the gasoline-diesel production mix.

Higher gasoline consumption this summer will therefore translate directly into higher refinery crude processing rates and intensify upward pressure on crude prices.

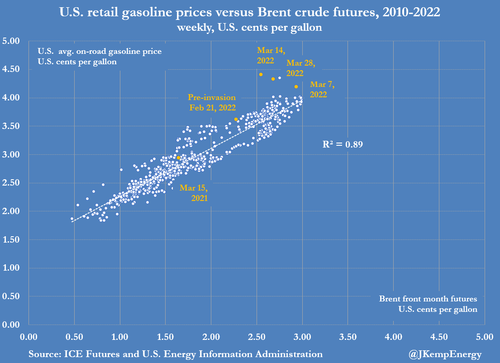

Gasoline and especially diesel prices have been rising rapidly, even faster than crude, signalling the need for slower growth in fuel use.

Slower fuel consumption is most likely to come from a slowdown in manufacturing activity and freight movements since distillates are the most cyclically sensitive part of the fuel system. At the margin, however, the steep rise in gasoline prices will also discourage discretionary driving by encouraging more working from home and less leisure travel.

More importantly, if the business cycle slowdown causes a fall in employment and incomes it would directly reduce traffic volumes and fuel consumption.

Tyler Durden

Wed, 03/30/2022 – 08:06

via ZeroHedge News https://ift.tt/Ybtm4RG Tyler Durden