Weaker Yen Becoming A Double-Edged Sword For Japanese Stocks

By Hideyuki Sano, Bloomberg Taking Stock markets commentator and analyst

The yen’s weakness has helped fuel a world-beating rally in Japanese stocks. But its impact appears less pronounced this time and may even risk backfiring in an era of rising oil prices and U.S. interest rates.

The broad Topix index has gained 5.6% this month, outperforming most of its major global peers. While the yen’s slide to a more than six-year low has aided some exporters, the main drivers behind the market’s gains were banks and energy trading firms, which have benefited from higher borrowing costs and oil prices, respectively.

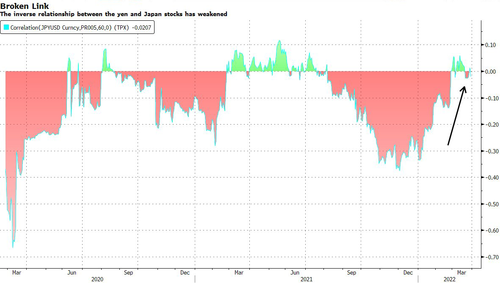

The diminishing correlation between a cheaper yen and higher stocks not only costs Japanese shares a historically reliable catalyst but also reflects an economy increasingly dependent on offshore manufacturing. That has made Japanese businesses benefit less from a competitive currency and more vulnerable to imported inflation.

“In recent years, Japanese corporate earnings have become less responsive to the yen’s moves,” said Hiroshi Watanabe, senior economist at Sony Financial Group Inc. That’s because a strong currency more than a decade ago prompted many firms to shift a large part of their production outside Japan.

12-month forward earnings per share of firms listed on the Tokyo Stock Exchange’s main board closely tracked the dollar-yen exchange rate until 2016, when the link started becoming much more tenuous.

In a sign that a weaker yen is now more of a damper than boost to foreign investors, the latter were net sellers of local shares in the first three weeks of March, according to data compiled by Bloomberg. To these overseas investors, who account for more than two-thirds of brokerage trading in Japan, the yen’s rapid depreciation may lead to huge currency losses.

“Prices of imported food and resources are rising, which will surely slow the Japanese economy because wages remain stagnant,” said Tetsuro Ii, chief executive at Commons Asset Management in Tokyo. “If the yen keeps falling, that may become a net negative.”

Tyler Durden

Tue, 03/29/2022 – 22:45

via ZeroHedge News https://ift.tt/MbIf0NP Tyler Durden