Xi’s “Maradona Theory” Of Policy Making Needs Tweak

By Ye Xie, Bloomberg Markets Live commentator and analyst

Five weeks after Russia’s invasion of Ukraine, European stocks have fully recouped their losses and their U.S. counterparts have done even better. In contrast, benchmarks in mainland China and Hong Kong are sitting on the bottom of the performance-ranking table along with Russia, Sri Lanka and Latvia.

Soothing words from Chinese policy makers have stopped the panic. But it will require decisive actions for markets to dig themselves out of the hole. Simply following the “Maradona Theory” of policy making to manage expectations isn’t enough.

Oil tumbled, equities rallied and inflation expectations ebbed Tuesday as the latest round of Russia-Ukraine talks sparked optimism that there’s a path toward peace. It’s far from certain that a cease-fire is within reach or that sanctions will be rolled back. Still, it seems that risk premium stemming from the war has been fading across markets.

Except, of course, for Chinese equities. The CSI 300 Index remains down about 11% down since the war started. The fear that sanctions against Russia may somehow embroil China may be exaggerated, but rolling lockdowns due to Covid outbreaks also are taking a toll on the economy.

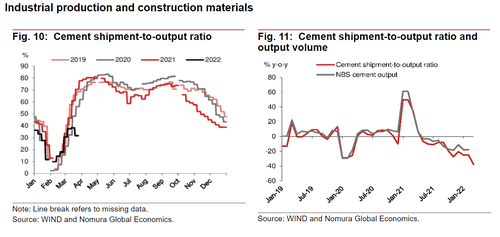

Almost all high-frequency activity data tracked by Nomura point to a worsening slowdown in recent weeks. For instance, the average movie box-office revenue in the week through March 26 was 63% below the year-ago levels. The weekly shipment-to-output ratio for cement was down 54% from a year ago, and weekly new-home sales across 30 cities have halved.

Since Vice Premier Liu He and his colleagues at the Financial Stability and Development Committee vowed to stabilize capital markets two weeks ago, actions to counter the slowdown have been conspicuously missing. It’s as if Beijing is a loyal follower of the “Maradona Theory.”

That theory stems from a speech in 2005, when then-Bank of England Governor Mervyn King cited a spectacular solo goal scored by Diego Maradona at the 1986 World Cup to show how a central bank can reach its goal by simply guiding expectations, without actually moving interest rates. The Argentinian legend dumbfounded five English players to score despite running in a straight line. King’s point was that England’s defense expected Maradona to swerve, so he didn’t have to. Likewise, if investors expect the central bank to adjust policies, markets will react accordingly, and the bank doesn’t have to act.

The crucial element backing the theory is policy makers’ credibility. Managing expectations is part of modern finance. But at this point, the Chinese economy needs Beijing to throw its weight behind its words, including accelerating infrastructure spending and credit growth, easing borrowing costs, and supporting small business affected by lockdowns.

The longer it waits, the more likely Beijing scores an “own goal” instead.

Tyler Durden

Wed, 03/30/2022 – 17:40

via ZeroHedge News https://ift.tt/FhL984o Tyler Durden