Futures Flat On Last Day Of Dismal Quarter, Oil Tumbles As Biden Preps Massive SPR Release

US equity futures were muted and flat on the last trading day of the month and quarter, fading a modest overnight gain as the underlying index headed for its first quarterly decline in two years on worries about surging inflation, hawkish monetary policy and an economic slowdown. Contracts on the S&P 500 were down 0.1% at 730 a.m. ET while Dow futures were little changed and Nasdaq 100 futures rose 0.2%, while European stocks fell, heading for the first quarterly decline since 2020. Asian equities retreated on lackluster Chinese PMI data and regulatory concerns. Treasuries held gains with the 10Y yield dropping to 2.31% (from 2.50% earlier this week when the 2s10s inverted) and the dollar ticked up against almost all G-10 peers. Fed watchers will be focused on the PCE deflator, which may have sped up in February.

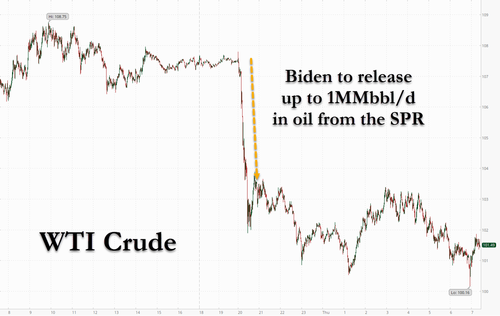

The big overnight action was in oil, which plunged following the news late on Wednesday that the White House was (again) mulling a plan to release roughly a million barrels a day from reserves to combat crashing Democrat approval rating ahead of the midterms as a result of soaring gasoline prices coupled with supply shortages in response to US sanctions of Russia. The proposal, which includes 180 million barrels being freed over several months, may help the market rebalance this year but won’t solve a structural deficit, Goldman said.

The reserve release news came just hours ahead of an OPEC+ supply meeting, where the cartel is expected to stick with its strategy of a modest output boost in May.

Equities globally are poised for their worst quarter since the early days of the pandemic on concerns about tightening monetary policy, red-hot inflation and a looming recession. While stocks remained resilient to the historic rout in bond markets this month, some strategists see little room for them to rally this year, partly as high costs threaten corporate profits. French inflation accelerated more than expected to reach another record, following unexpectedly high readings on Wednesday from Germany and Spain.

“Our base case now is for only modest upside for stocks,” said Mark Haefele, chief investment officer at UBS Global Wealth Management, adding that he expects the S&P 500 to end the year at 4,700, about 2% higher than current levels. He also trimmed his estimate for global earnings growth to 8% from 10% for 2022.

“Aside from quarter-end considerations, oil is very much the center of attention,” Simon Ballard, chief economist at First Abu Dhabi Bank, wrote in a note to investors. Still, “all the usual suspects are still in play, keeping the market in check, including the specter of the Fed pursuing an aggressive path of monetary policy normalization over the coming months.”

Elsewhere, officials from Ukraine and Russia are set to resume talks via video conference on Friday, according to a Ukrainian negotiator, though there was no immediate confirmation from Moscow. Friday’s video discussions between Ukraine and Russia would follow in-person talks this week in Turkey that didn’t produce a short-term cease-fire or major progress toward a broader peace deal. Ukraine’s negotiator said the hope was to have enough agreed on paper in another week to be able to move toward a meeting between President Vladimir Putin and President Volodymyr Zelenskiy.

Going back to the US market, shares in big U.S. energy companies slumped in premarket trading along with crude prices drop (Exxon Mobil -1.9% and Chevron -1.5% premarket, Occidental Petroleum -2.6%, Gran Tierra Energy -3.1%, Imperial Petroleum -3.8%, Camber Energy -4.3%). Bank stocks are also lower putting them on track to fall for a second straight day as the U.S. 10-year yield falls to 2.31%. Goldman Sachs warned that stagflation could make bank stocks less profitable. U.S.-listed Chinese stocks slipped in premarket trading as Securities and Exchange Commission Chair Gary Gensler dialed down prospects of an imminent deal to allow Chinese firms to keep trading on American exchanges. Russian equities advanced as the nation partly lifted the short-selling ban on local stocks on Thursday, removing one of the measures that helped limit the declines in the market after a record long shutdown. Other notable premarket movers include:

- Vipshop ADRs (VIPS US) rise 8.4% in premarket trading after the Chinese online retailer announces a $1b share buyback plan.

- Robinhood Markets (HOOD US) shares rise 1.4% in U.S. premarket trading, set to extend the previous day’s 24% gains after the online brokerage announced plans to expand the trading day by four hours, while Morgan Stanley begins coverage of the stock with an equal-weight rating.

- Energy companies decline in premarket trading as crude prices drop. The U.S. is considering tapping its reserves again in a potentially massive release aimed at managing inflation and supply shortages. Exxon Mobil (XOM US) -1.9%, Chevron -1.5% (CVX US).

- U.S.-listed Chinese stocks are heading for a lower open after Securities and Exchange Commission Chair Gary Gensler dialed down prospects of an imminent deal to allow Chinese firms to keep trading on American exchanges. Alibaba (BABA US) fell 1.7% in premarket, while its e-commerce rival JD.com (JD US) lost 2.8%.

- Advanced Micro Devices (AMD US) shares fall 1.3% in U.S. premarket trading, after the semiconductor maker is downgraded to equal- weight from overweight at Barclays, which says that the growth story “needs a pause.”.

- IZEA Worldwide (IZEA US) shares surge 27% in U.S. premarket trading after the influencer marketing company reported fourth-quarter earnings and saw total revenue increase 62% to a record of $10.3m.

In Europe, the Stoxx 600 reversed initial gains and dropped 0.3%, the Euro Stoxx 50 fell 0.2%, and other major indexes trade flat to slightly lower with retailers, telecoms and energy the worst performing sectors. Retail and telecom stocks led declines while utilities and insurance sectors outperformed. Some notable premarket movers:

- Brewin Dolphin shares rise as much as 62% and trade slightly below the agreed bid for the firm from RBC Wealth Management. The transaction, being carried out at a high premium, highlights the attractiveness of the U.K. wealth sector, analysts say.

- Orpea shares climb to their highest level in almost 2 months after Societe Generale says that allegations of mistreatment at its facilities are likely to have “limited” financial impact.

- Fresenius SE shares rise as much as 3.3% on news that the company’s Kabi intravenous drug unit has bought a majority stake in mAbxience SL and acquired Ivenix.

- Pernod Ricard shares rise as much as 2.6% as Citi says 3Q sales are likely to beat expectations, also lifting its which lifts EPS estimates and PT, as well as opening a positive catalyst watch.

- Tate & Lyle shares gain as much as 3.7% after saying it would buy Quantum Hi-Tech, a prebiotic dietary fiber business in China. The deal enhances Tate & Lyle’s portfolio, Goodbody says.

- Pearson shares rise as much as 3.5%, rebounding from Wednesday’s losses after private equity firm Apollo Global Management said it won’t make an offer for the education publisher.

Earlier in the session, Chinese data and regulatory concerns weighed on Asia stocks. China’s NBS manufacturing PMI declined to 49.5 in March from 50.2 in February, missing estimates, likely due to Covid-related restrictions and geopolitical tensions. The output sub-index in the NBS manufacturing PMI survey fell by 0.9 points in March, and the new orders sub-index fell by 1.9 points. The NBS non-manufacturing PMI fell to 48.4 in March from 51.6 in February, also missing expectations, and entirely driven by the decline of services sector due to recent Covid outbreaks in multiple provinces. Separately, Bloomberg reported that Chinese authorities are considering a plan to raise several hundred billion yuan for a new fund to backstop troubled financial firms.

Asian stocks retreated after a two-day advance, as the U.S. securities regulator’s tough stance on a potential delisting of Chinese firms and weak China manufacturing data worried investors. The MSCI Asia Pacific Index declined as much as 0.8%, and was poised to finish its worst quarterly performance in two years, with Taiwan Semiconductor Manufacturing and Tencent among the biggest drags. Benchmarks in Hong Kong and China underperformed regional peers. Japanese equities headed for a second day of declines while Australia stocks retreated after seven straight day of gains in response to a stimulatory federal budget. The U.S. Securities and Exchange Commission’s chief said Chinese firms need to fully comply with audit requirements in order to stay on American exchanges. Meantime, China’s manufacturing contracted in March, underscoring the growing toll of lockdowns. Investors are also watching how a tumble in oil prices can alleviate inflation risks and affect corporate earnings.

“If you look at the PMIs there’s an obvious explanation for why PMIs are weak, which is China pursuing zero-Covid strategy,” Kieran Calder, head of Asia Equity Research at Union Bancaire Privee, said in an interview with Bloomberg Television. “The reality of Covid-19 versus the response in China, the mismatch is too strong right now and I think that’s the biggest worry for us.” For the quarter, Asian stocks were poised for nearly a 7% loss, the worst performance since early 2020 when the emergence of the pandemic shocked investors. Investors had to grapple with a U.S. rate hike, a war in Ukraine and continued regulatory risks out of China, which caused huge volatility

Japanese equities fell for a second day following a rally in the yen. Electronics makers and banks were the biggest drags on the Topix, which fell 1.1%. Recruit and SoftBank were the largest contributors to a 0.7% loss in the Nikkei 225. The yen was little changed after gaining 1.6% against the dollar over the previous two sessions. Both key gauges still capped their first monthly gains of the year. The Nikkei 225 rose 4.9% in March, the most since November 2020, while the Topix climbed 3.2% on the month.

India’s benchmark equity index clocked its best monthly advance since August, as buying by local funds amid war-induced volatility supported sentiment. The S&P BSE Sensex fell 0.2% to 58,568.51 in Mumbai, trimming its gain for March to 4.1%. The NSE Nifty 50 Index also slipped 0.2% on Thursday. Stocks swung between gains and losses several times during the day ahead of the expiry of monthly derivative contracts Thursday. Institutional investors in India have bought $5 billion worth of shares this month, while foreign investors are set to extend their selling to a sixth consecutive month. Reliance Industries Ltd. was the biggest drag on the 30-share Sensex, which saw an equal number of shares closing up and down. Twelve of the 19 sectoral indexes compiled by BSE Ltd. gained, led by a gauge of telecom stocks. S&P BSE Healthcare Index was the worst performing sub-index. “Markets took a breather on a monthly expiry day and ended the last day of the financial year on a flat note,” said Ajit Mishra, vice president of research at Religare Broking Ltd. “We reiterate our positive yet cautious stance citing lingering geopolitical tension between Russia-Ukraine and its impact on the global markets.”

In rates, Treasuries extended this week’s rally with yields richer by up to 5bp across belly of the curve, which continues to outperform vs wings. Wider bull-steepening move grips bunds and gilts, as central-bank rate-hike premium is pared. Oil futures are sharply lower, weighing on energy stocks, following reports that Biden is considering a massive release of crude from U.S. reserves to fight inflation. The 10-year yield was around 2.31%, richer by ~4bp vs Wednesday’s close, underperforming bunds in the sector by ~4bp while keeping pace with gilts. Long-end swap spreads are sharply tighter, with 30- year dropping as low as -19.5bp.

Euro-area, bonds extended their advance as money markets pare central bank tightening wagers. French bonds underperformed bunds as EU-harmonized CPI rose 5.1% from a year ago in March — the most since the data series began in 1997 — and above the 4.9% median estimate in a Bloomberg survey of economists. The belly of the German curve richened 6-7bps, leading gains. Peripheral spreads are mixed: Italy tightens, Portugal and Spain widen to core. Money markets trim rate hike pricing.

Japanese government bonds extended their advance as the central bank’s aggressive bond purchases this week reassured players that an excessive rise in yields won’t be tolerated. Yen was little changed in choppy trade. Bank of Japan’s offer to buy an unlimited amount of 10-year government bonds at fixed yields recorded no takeup, the central bank said.

In FX, Bloomberg dollar spot index snapped two days of losses after rebounding in early European session; the dollar advanced versus all of its Group-of-10 peers and commodity currencies were the worst performers. The euro gave up earlier gains after earlier touching a four-week high versus the greenback. Norway’s krone slumped by as much as 1.6% versus the greenback after the central bank announced a ramp-up of FX purchases on behalf of the government. The pound declined for a third day against the euro, touching its weakest level versus the common currency since Dec. 23. A report from the British Retail Consortium gave another glimpse into the cost-of-living crisis, showing prices in U.K. shops rose in March at the fastest annual pace since September 2011. Japan’s factory output eked out its first gain in three months in February, offering only a tepid sign of resilience amid fears the economy has slipped back into reverse. Production inched up 0.1% from the previous month. The Australian dollar declined against most of its Group-of-10 peers as oil prices tumbled on news that the Biden administration is weighing a massive release of crude from U.S. reserves. Sales of Aussie back into euro have seen option-related Australian dollar bids attached to large option strikes get filled, according to Asia-based currency traders

In commodities, crude futures hold Asia’s losses triggered by reports that the White House may make an announcement on the U.S. oil reserve release as soon as Thursday. WTI drops over $6.50 near $101.10. European natural gas faded an initial drop after Germany signaled Russia is softening its demand for ruble payments. Precious metals and much of the base metals complex traded heavy.

Looking to the day ahead now, data releases include German retail sales for February and unemployment for March, French and Italian CPI for March, and the Euro Area unemployment rate for February. From the US, there’s also February’s personal income and personal spending, the weekly initial jobless claims, and the MNI Chicago PMI for March. Otherwise, central bank speakers include ECB Vice President de Guindos, Chief Economist Lane, and New York Fed President Williams.

Market Snapshot

- S&P 500 futures up 0.1% to 4,601.75

- STOXX Europe 600 down 0.2% to 459.49

- MXAP down 0.7% to 180.37

- MXAPJ down 0.6% to 591.98

- Nikkei down 0.7% to 27,821.43

- Topix down 1.1% to 1,946.40

- Hang Seng Index down 1.1% to 21,996.85

- Shanghai Composite down 0.4% to 3,252.20

- Sensex down 0.2% to 58,590.32

- Australia S&P/ASX 200 down 0.2% to 7,499.59

- Kospi up 0.4% to 2,757.65

- German 10Y yield little changed at 0.62%

- Euro down 0.3% to $1.1130

- Brent Futures down 3.6% to $109.40/bbl

- Gold spot down 0.4% to $1,924.94

- U.S. Dollar Index up 0.24% to 98.03

Top Overnight News from Bloomberg

- The Biden administration is weighing a plan to release roughly a million barrels of oil a day from U.S. reserves, for several months, to combat rising gasoline prices and supply shortages following Russia’s invasion of Ukraine, according to people familiar with the matter

- Bank of Japan Governor Haruhiko Kuroda is determined to stick with targeting long-term bond yields near zero, even as it leaves him increasingly at variance with global peers and propels a depreciating exchange rate

- The yen has taken a beating in recent weeks but technicals suggest that it may be on the road to a recovery. Japan’s currency may rebound to 116 per dollar in the coming months after sliding as low as 125.09 on Monday, the weakest in almost seven years, an analysis by Bloomberg shows

- Russian President Vladimir Putin said that European buyers could continue making gas payments in euros, according to a German readout of a call he had with Chancellor Olaf Scholz

- Russian government bondholders would be left with no viable path to recover their money if the country defaults, according to one of the top global lawyers in sovereign debt litigation

- Hungary kept its key interest rate unchanged after the forint staged the second-biggest emerging-market currency rally this week, relieving pressure on policy makers to deliver more monetary tightening

- China’s cabinet vowed to stabilize the economy and called on officials to avoid measures that harm market expectations as the government struggles to control Covid outbreaks across the country including in the financial center of Shanghai

- For the first time in more than a decade, China’s yield advantage over Treasuries may be erased. The yield spread between the benchmark bonds of the world’s two biggest debt markets has narrowed to around 40 basis points from 150 a year ago, well below the People’s Bank of China’s “comfortable” range

- Australia will invest more to find new buyers for its exports in an effort to ease trade dependence on China, its treasurer said, in the face of “economic coercion” from Beijing that shows little sign of abating

A more detailed look at global markets courtesy of Newsquawk

Asia=Pac stocks traded cautiously at month-end following the weak lead from the US due to increased Russia-Ukraine scepticism and as the region digested disappointing Chinese PMI data. ASX 200 was kept afloat by outperformance in the mining and materials industries although upside was capped as the tech sector suffered from profit-taking and with energy hit by a drop in oil prices. Nikkei 225 traded indecisively amid a choppy currency and after Industrial Production data missed forecasts. Hang Seng and were subdued following the weak Chinese PMI data and with the mood inShanghai Comp. stocks not helped by the US SEC chief casting doubt regarding an imminent deal to avert a delisting of Chinese stocks.

Top Asian News

- Thirteen-Hour Power Cuts Get Sri Lanka to Shorten Stock Trading

- Effissimo Would Tender Toshiba Shares in Event of Bain Bid

- BOJ Looks Ready for a Victory Lap With Yields on the Retreat

- BOJ Boosts Bond Buying in April-to-June Quarter

European equities (Eurostoxx 50 -0.3%) kicked the final trading session of the month off on the front foot before drifting towards the unchanged mark. Sectors in Europe exhibit a mostly positive tilt with airline names cheering the declines in the energy space as the Energy sector suffers. The biggest laggard in the region is the retail section following a disappointing Q1 update from H&M (-8%). Futures in the US are modestly firmer as the NQ (+0.5%) marginally outpaces the ES (+0.1%) with inflation set to continue to remain in focus today, with the release of US PCE metrics for March; core PCE is seen rising to 5.5% Y/Y

Top European News

- Iron Ore Futures Advance as Outlook for Demand Brightens

- Sorrell’s S4 Capital Audit Delay No Longer Down to Covid

- EU Commission Confirms Raids in Germany’s Natural Gas Sector

- Pearson Shares Rebound; Barclays Sees a ‘Resilient Business’

In FX, Dollar finds its feet as month, quarter and fiscal year end approach, albeit with a helping hand from others – DXY back on the 98.000 handle, narrowly. Commodity currencies reverse course alongside underlying prices, with crude crushed on reports of US SPR and IEA opening reserve taps – Usd-Cad rebounds through 1.2500 after sliding to new y-t-d low sub-1.2450 only yesterday. Yen choppy amidst residual repatriation flows and more BoJ action to cap JGB yields – Usd/Jpy circa 122.00 within a 122.45-121.35 range. Euro fades into 1.1200 vs Buck again as option expiries and tech resistance impinge, but Aussie may derive traction from expiry interest at 0.7500 – EURUSD now eyeing support at 1.1100 after tripping stops.

In commodities, WTI and Brent remain firmly on the backfoot in the wake of reports suggesting that the Biden administration is considering a ‘massive’ SPR release.

- The news has sent May’22 WTI and Jun’22 Brent to respective lows of USD 100.53/bbl and USD 107.39/bbl to leave them a few dollars above their weekly lows of USD 98.44/bbl and USD 102.19/bbl respectively.

- US President Biden’s administration is considering a ‘massive’ release of oil to combat inflation and may release up to 1mln bpd for months from the strategic reserve in which the total release could be 180mln , according to Bloomberg.bbls

- Goldman Sachs says a potentially large SPR release would ease the situation but wouldn’t resolve the structural deficit in the oil market. Says adjustments for SPR release, Iran supply delays would lower H2 22 Brent forecast by USD 15, to USD 120/bbl – still above market forwards.

- US President Biden will deliver remarks today at 13:30EDT/18:30BST regarding the administration’s actions to reduce gas prices in the US, according to the White House. It was also reported that the US mulls permitting, according to Reuters sources.summertime sales of higher ethanol blends of gasoline to ease pump prices

- IEA called an emergency ministerial meeting for Friday, according to the Australian Energy Minister’s office. It was later reported that , according to New Zealand’sIEA countries are to decide on a collective oil release Energy Minister’s office

- OPEC+ JTC replaced IEA reports with Wood Mackenzie and Rystad Energy as secondary sources to assess crude oil output and conformity, according to sources cited by Reuters.

In fixed income, bonds on track to see out extremely bearish month, quarter and end to FY on a firmer note. Curves more even after wild swings between flattening, inversion and steepening.BoJ ramps efforts to maintain YCC via a mostly larger JGB buying remit for Q2.

US Event Calendar

- 08:30: March Initial Jobless Claims, est. 196,000, prior 187,000

- 08:30: Feb. Personal Income, est. 0.5%, prior 0%

- 08:30: Feb. Personal Spending, est. 0.5%, prior 2.1%; Real Personal Spending, est. -0.2%, prior 1.5%

- 08:30: Feb. PCE Deflator MoM, est. 0.6%, prior 0.6%; PCE Deflator YoY, est. 6.4%, prior 6.1%

- 08:30: Feb. PCE Core Deflator MoM, est. 0.4%, prior 0.5%; YoY, est. 5.5%, prior 5.2%

- 09:45: March MNI Chicago PMI, est. 57.0, prior 56.3

DB’s Jim Reid concludes the overnight wrap

After a great deal of optimism in markets on Tuesday following the Russia-Ukraine negotiations in Turkey, the last 24 hours have proven to be much more negative as investor hopes for a de-escalation in Ukraine were dampened by more gloomy comments on the war from both sides. From Russia, the Kremlin spokesman Dmitry Peskov said that they hadn’t seen a breakthrough in the talks, whilst Ukrainian President Zelensky said that “Russia is deploying new forces on our terrain to try to continue destroying us”, and NATO leaders continued to strike a sceptical tone. Indeed, it was reported by Dow Jones that the European Commission was considering new sanctions against additional Russian banks, and UK Prime Minister Johnson said that the UK was “looking at going up a gear” in its support to Ukraine. President Biden expressed similar sentiments, pledging $500 million of additional aid to Ukraine in a call with President Zelensky.

Against this backdrop, oil prices rose again for the first time this week, with Brent Crude up +2.92% to $113.45/bbl, but there’s been a sharp turnaround overnight on the back of news that the US are planning a major release from their reserves, with Bloomberg reporting it would be a million barrels a day over several months. Biden is due to speak about efforts to lower prices at 1:30pm Eastern, so all eyes will be on that, and overnight we’ve seen Brent Crude prices come down by -4.54% to $108.30/bbl, more than reversing their gains from the previous session. However, European natural gas (+9.77%) rose for a third consecutive session to €118.97/MWh, which is its highest closing level in nearly 3 weeks. That occurred amidst a continued dispute about Russian gas payments, which President Putin wants paid for in rubles, but which multiple European countries have rejected as a breach of contract. In response, Germany’s economy minister Robert Habeck activated the “early warning phase” of an emergency law, which could eventually lead to gas rationing if supplies fall short.

With Russia’s invasion having lasted for over 5 weeks now, we’re increasingly seeing the impact reflected in the official inflation numbers, and yesterday’s releases out of Europe gave fresh life to the bond selloff. In terms of the numbers, German inflation rose to +7.6% in March on the EU-harmonised measure, which was up from +5.5% back in February and some way above the +6.8% reading expected by the consensus. It was the same story in Spain, where inflation rose to +9.8% (up from +7.6% in February), which will heighten interest in tomorrow’s flash release for the entire Euro Area. In turn, that’s led to growing expectations of ECB rate hikes this year, with a total of 63bps being priced in by the December meeting, which is the most we’ve seen to date. On top of that, more than 30bps are even being priced in by the September meeting, which surpasses their pre-invasion peak.

Given the strong inflation numbers and the prospect of a more aggressive ECB, European bonds sold off across most of the continent, with yields on 10yr bunds (+1.3bps), OATs (+2.3bps) and BTPs (+1.3bps) all hitting fresh multi-year highs. Furthermore, the 2yr German yield (+5.6bps) closed in positive territory for the first time since 2014, having briefly got there on an intraday basis during the previous session. Unsurprisingly, the latest rise in yields was driven by higher inflation breakevens rather than real rates, and the 10yr German breakeven surged another +6.0bps to 2.71%, its highest level in data available back to 2009, whilst the Italian breakeven rose +4.0bps to 2.53%, its highest level since 2008.

Even as European bonds were selling off once again, it was the reverse story in the United States, where Treasuries recovered somewhat yesterday as we come to the end of one of their worst quarterly performances in decades. Yields on 10yr Treasuries fell -4.6bps to 2.35%, whilst yield curves remained incredibly flat; the 2s10s curve steepened marginally by +1.3bps to 3.6bps, avoiding another inversion, and this morning is up another +0.3bps to 3.9bps.

In terms of other developments this morning, Asian equity markets have followed Wall Street’s lead overnight with the Nikkei (-0.18%), Hang Seng (-0.59%), Shanghai Composite (-0.14%), CSI (-0.26%) all losing ground, though the Kospi (+0.54%) is the exception to this pattern. The weakness in Asian gauges has come amidst declines in the PMI data, with China’s manufacturing PMI down to 49.5, and the non-manufacturing PMI down to 48.4. For reference, that’s the first time that both readings have been below the 50-mark that separates expansion from contraction since February 2020, and comes as multiple cities are undergoing further lockdowns in response to the current Covid outbreak. Additionally, a slide in Chinese tech stocks is weighing on sentiment after the US Securities and Exchange Commission added Hong Kong listed Baidu Inc. to its long list of companies potentially facing delisting from US exchanges. Outside of Asia, stock futures in the US and Europe are pointing to a more positive start, with contracts on the S&P 500 (+0.28%), Nasdaq (+0.56%) and DAX (+0.59%) all trading higher.

Those equity declines overnight in Asia follow a broader decline in risk appetite yesterday given the more negative geopolitical developments, and both the S&P 500 (-0.63%) and Europe’s STOXX 600 (-0.41%) unwound some of their gains from the previous day. More cyclical industries underperformed in general, whilst the German DAX (-1.45%) also put in a weaker performance relative to the other main European indices. The VIX Index of volatility (+0.43pts) also ticked up to 19.33pts, after closing at to its lowest level since Russia’s invasion of Ukraine on Tuesday.

In France, we’re now just 10 days away from the first round of the presidential election, and there are continued signs of a narrowing in the polls, albeit with President Macron still in the lead. In terms of yesterday’s polls (from Opinionway, Harris, Ipsos, Ifop and Elabe), all of them pointed to a repeat of the second-round contest from 2017, with the first-round polling putting President Macron in first place followed by Marine Le Pen in second. That said, they’re also implying a noticeably tighter result in the second round than Macron’s 66%-34% victory against Le Pen in 2017. Looking through the numbers, the second round estimates ranged from a 55%-45% Macron victory (from Opinionway and Ipsos), to a 52.5%-47.5% Macron victory (from Elabe).

Finally on yesterday’s other data, the ADP’s report of private payrolls from the US showed growth of +455k in March (vs. +450k expected). That comes ahead of tomorrow’s jobs report, where our US economists are expecting nonfarm payrolls to have grown by +400k, with the unemployment rate ticking down to a post-pandemic low of 3.7%.

To the day ahead now, and data releases include German retail sales for February and unemployment for March, French and Italian CPI for March, and the Euro Area unemployment rate for February. From the US, there’s also February’s personal income and personal spending, the weekly initial jobless claims, and the MNI Chicago PMI for March. Otherwise, central bank speakers include ECB Vice President de Guindos, Chief Economist Lane, and New York Fed President Williams.

Tyler Durden

Thu, 03/31/2022 – 07:56

via ZeroHedge News https://ift.tt/hwbrqzm Tyler Durden