“Info That Is Confidential Is Getting Out”: WSJ Finds 58% Of Stocks Underperformed Benchmark Before Block Trades

In what we’re sure will just be written off as another Wall Street “coincidence” before being swept under the rug, a new report this week found that information about block trades “routinely leaks out ahead of time”.

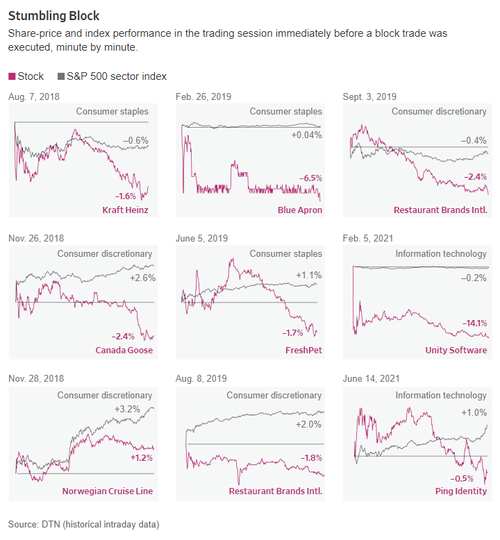

The Wall Street Journal analyzed about 400 trades over the course of 3 years between 2018 and 2021, and found that “58% of the time, the share price declined in the trading session immediately beforehand”. In the world of biotech, that figure would be known as “statistically significant”.

The moves lower in stocks benefits the banks who usually buy the stocks and comes as a detriment to those who are selling. The Journal reported that sellers would have received $382 million more if stocks had performed inline with their benchmarks leading up to the sales.

“Information that should be confidential is getting out,” the Journal said, not mincing words. And it looks as though they’re right: the data speaks for itself.

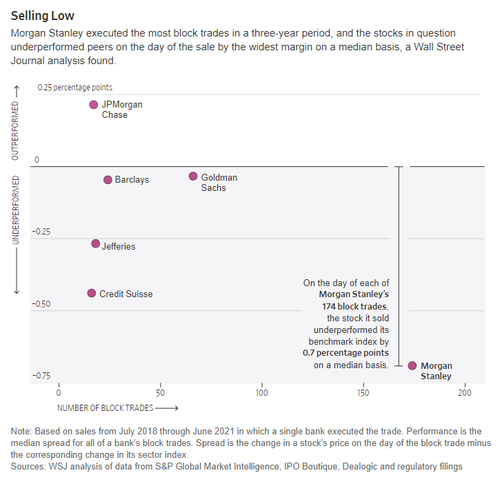

The analysis is telling and comes at a time when both the U.S. Justice Department and the Securities and Exchange Commission are looking into the potential of banks tipping off favored clients in advance of these trades. That investigation appears to be centered around Morgan Stanley, the report says.

The Journal found that “when Morgan Stanley executed a block trade by itself, the median stock trailed its peers by 0.7 percentage point in the trading session leading up to the deal, meaning half performed worse than that”.

It marked the “worst record” of any of the big banks the Journal dug into.

In the vast majority of trades identified by the WSJ, there was “no obvious reason” for stocks to have underperformed ahead of the trades. The Journal offered up one such example with 3G Capital:

Most resemble what happened to 3G Capital, a private-equity firm known for its investments in household brands. Between 2018 and 2021, 3G executed at least three block trades to trim its stakes in two of them—Kraft and Restaurant Brands International Inc., the parent company of Burger King. Each time, it hired Morgan Stanley to sell the shares, and each time the price moved against it.

On Aug. 7, 2018, shares of Kraft climbed all morning, outperforming the S&P index of other big consumer-products companies. At 12:26 p.m.—right around the time that sellers of block trades typically engage banks—the stock price started to fall sharply. It closed down 1.6%, lagging the index and costing 3G Capital some $13 million in lost proceeds.

In another 3G block trade a year later, shares of Restaurant Brands cratered at noon and closed down 1.8% on a day the index rose. The famously penny-pinching investment firm—which pioneered a style of cost management and requires employees to get permission for color photocopies—lost out on $56 million in proceeds, according to the Journal’s analysis.

Because of the risky nature of block trades – buying large quantities of stock while trying to gauge whether or not underlying market support for the current price has a firm enough foundation to hold up – buyers have obvious incentive to try and gain every advantage possible over other potential buyers when engaging in such trades.

Tyler Durden

Thu, 03/31/2022 – 09:26

via ZeroHedge News https://ift.tt/IKuCVpO Tyler Durden