Bear Traps: “This Is Not About The 2s10s, There Is Far, Far More Going On… We See 20-30% Near-Term Downside”

By Larry McDonald, author of the Bear Traps report

When we think about the hard assets vs. financial assets debate — clearly, we can see a “first-second inning” shift in play — but what takes the trade to the next level? We still have not seen even the slightest indication of real financial asset selling. What will give the hard asset value equity thesis real, sustainable legs? It all comes down to the dollar. As we stressed in our March 10th note —“a Secular C change for the Greenback” – for much of the last 20 years the U.S. political leadership has been weaponizing its currency. One could say they have –“gone to this well” too many times, indeed. Keep in mind, today ´s sanctions roulette has a far different gene pool.

BEFORE the war in Ukraine — inflation in the U.S. was already running near 8%. Now the United States has chosen to bring out its sanction’s sword yet again — but this time up against a country that has regional control — influence over 10-15% of the global commodity complex.

We are NOT sure the risk-reward has been meticulously thought through here. The risks of a self-inflicted wound are sky high and complacency around these risks is even higher. At the very end of the day, U.S. sanctions and counter attacks from Putin – push inflation’s roots much deeper below the surface and make higher price pressures far more sustainable than any time in recent memory. This mess gives “unintended consequences” a whole new meaning.

As we stressed in the summer of 2020 the “Cobra Effect” coming from a fiscal and monetary policy overdose delivers many surprises wrapped in inflationary pressures. But sanction games raise these stakes to a whole new level. “Our currency your problem” becomes “our commodities your problem” (to paraphrase Zoltan Pozsar).

Globally, the lights on the “USD weaponization” stage have NEVER been brighter. Even one of the U.S.’s most trusted allies – The Kingdom of Saudi Arabia – is looking at ways to lay off dollar risks and possibly trade their dark crude in red China yuan (CNH). We are NOT saying the U.S. dollar will lose its world’s reserve currency status this decade – that is absurd – but make NO MISTAKE a near term diversification away from the greenback is certain – all coming with HIGH impact on rates, inflation and hard assets.

* * *

There are times when developments pile up so fast late in the week that the street doesn’t have time to process the significance of the data. The Wall Street research community has always been “slow on the draw” – but we believe strategists and analysts will be confronted with a “come to Jesus” moment in the weeks ahead.

What is the state of play you ask? We have a U.S. equity market that has been led by Utilities (XLU up 15% since late November vs. 3% for the S&P 500 over the same period) and Consumer Staples XLP for nearly five months now.

In the U.S., ISM Manufacturing fell in March to 57.1 vs. 59 est. and 58.6 in prior month lowest since September 2020. Above all, new orders light blue above) plunged from 61.7 to 53.8 At the same time, the Dow Jones Transports had one of the sharpest one day declines in years on Friday following a warning from FreightWaves CEO that a freight recession looms. Classic economic bellwethers like Union Pacific UNP dropped 8% day over day at one point; US banks (Citi) and consumer plays (GM and Home Depot) are 30-35% off their highs with the U.S. Treasury curve moving deeper into inversion territory.

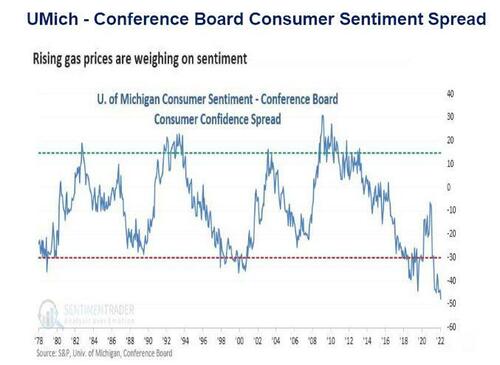

CLEARLY this is NOT all about 2s-10s and the rates curve. There is FAR FAR FAR more going on. AND the divergence between UMichigan and the Conference Board consumer data is screaming “stagflationary recession” as well. We see 20 30% near term downside for the Nasdaq.

* * *

The Fed Has to Convince the Market of What?

In essence, the Federal Reserve has convinced the market of two things: 1) rate raises will be higher than formerly believed; 2) such raises will do little to cure inflation, at least over the near term. Breakevens (the yield of an inflation-protected bond minus the yield of a non-inflation-protected bond of the same maturity) were at 3.42% at the start of the Fed’s March meeting. On Friday, that got to 3.57%.

So, traders decided that inflation was actually worse after the Fed meeting than before the Fed meeting. It is now at a record high, in fact.

Furthermore, the bear market rally shows that the stock traders do not believe they are fighting the Fed. Ultimately, stocks believe that for all the clamor around higher rates, net-net monetary policy is and will continue to be loose, just less loose than it was. Loose money means Fed Funds after inflation are negative. Since inflation is running near 8%, no reasonable person thinks Powell will make Fed Funds actually positive after inflation.

This explains the rise in yields on the 10 year: traders are trying to get more vig given ongoing inflation. It also explains the rise in gold, which in addition to its safe have bid is also an inflation hedge. So yes, the markets were surprised by a more hawkish Fed, but no, the markets don’t believe inflation is going away.

We still think that aggressive tightening will lead to recession, assuming one hasn’t already gotten underway. We still believe we are either in or about to enter stagflation (depending on one’s definition of the term). So faster hikes but inflation still rages – in our view – the S&P 500 will be 20 30% lower in this world.

Dollar Ceiling and Cash at the Treasury

Cash Balances at the Treasury are relatively high at the Treasury vs. prior pre Covid years, and well off the lows of a few months ago. Dollar seems to be near a congestion zone of potential supply.

If Treasury cash balances decline, the dollar may soften up a bit … With the HIGHEST conviction we believe we are in the middle of a secular change for the U.S. dollar. U.S. sanctions are FAR more of a dollar threat then most realize and they make sustained inflation FAR FAR FAR more certain.

UMich – Conference Board Consumer Sentiment Spread

Look at this spread and then look at the dates and events around it historically. The UMich survey is more ‘inflation-sensitive’. There is a higher weighting towards durable goods, whereas job conditions is more important in the Conference Board survey. The Conference Board survey (correlated with unemployment rate) tends to stay optimistic for much longer than the U Michigan survey, which is more about affordability and people’s perceptions of job security. So, the U of Mich survey is more of a leading indicator and the Conference Board survey is more of a real time coincident indicator. The UMich survey usually leads the Conference Board survey down into recession.

Tyler Durden

Sun, 04/03/2022 – 19:30

via ZeroHedge News https://ift.tt/zS9REUA Tyler Durden