Busting The Myth That The Fed Can Control Or Predict The Economy

Submitted by Jon Wolfenbarger, Founder and CEO of Bull And Bear Profits, an investment website.

The Federal Reserve states that it “conducts the nation’s monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy.”

Let’s look at how well the Fed has done that job since its founding in 1913.

Economy And Long-Term Interest Rates

Since 1913, the US unemployment rate has ranged from 2.5% in the early 1950s to 25% during the Great Depression. Inflation has ranged from positive 24% to negative 16%. Inflation is currently 7.9%, well above the Fed’s 2% target. While the Fed has some influence over money supply, they have no control over money demand or how money is spent, which has a significant impact on employment and inflation.

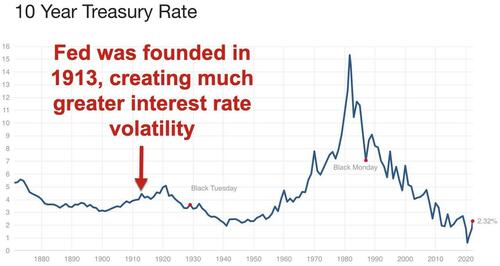

The Fed’s goal to “moderate long-term interest rates” below free market levels is a form of price fixing. Since price fixing never works for long, it is no wonder the Fed has been unsuccessful in this goal. Since 1913, 10-Year Treasury rates have ranged from 0.5% in 2020 to 16% in 1981. Interest rates have been much more volatile than before the Fed, as shown below.

Money Supply And Short-Term Interest Rates

Maybe the Fed can’t control the economy, but at least they can control the money supply and short-term interest rates, right? Wrong.

The Fed controls the Monetary Base, which is currency plus bank deposits at the Fed. But the popular M2 money supply measure is 3.6 times larger than the Monetary Base. The broader money supply is driven by the desire of commercial banks to lend and people to borrow from them. The Fed has no control over that.

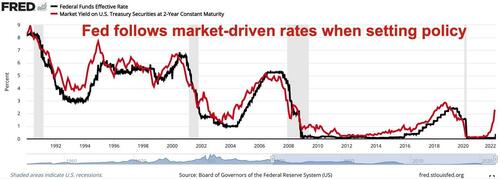

The Fed also controls the Federal Funds Rate, which is the interest rate at which commercial banks borrow and lend to each other overnight. But as shown below, the Fed follows market driven interest rates, such as the 2-Year Treasury rate (red line), when setting the Federal Funds Rate (black line), since they have no way of knowing where rates should be.

The Fed’s Real Purpose

The Fed’s real purpose is to enable banks to make loans by creating money out of thin air and then bail them out when their loans go bad. It has been successful in that goal, as we saw with the bank bailouts during the Great Recession.

As Murray N. Rothbard explained: “Banks can only expand comfortably in unison when a Central Bank exists, essentially a governmental bank, enjoying a monopoly of government business, and a privileged position imposed by government over the entire banking system.”

The Fed’s other main purpose is to help the US government borrow. They have been very successful at this, as the government debt to GDP ratio has more than tripled in the past 40 years to over 120%.

The Fed Succeeds In Lowering Living Standards

Two of the main negative consequences of Fed money creation is inflation and the boom and bust business cycle, both of which lower living standards significantly. Inflation raises living costs and erodes savings, while the business cycle wastes scarce resources allocated to bad investments.

Since the Fed’s founding in 1913, the US dollar has lots 97% of its purchasing power.

The Fed helped engineer the Great Depression of the 1930s and the Great Recession of 2008-2009. Austrian Business Cycle Theory explains how the business cycle is caused by banks creating money out of thin air, which leads to an unsustainable boom that eventually turns into a bust, since newly created money does not create the scarce resources (land, labor and capital) needed to complete all the projects businesses have undertaken with the newly created money.

As Ludwig von Mises explained: “The wavelike movement effecting the economic system, the recurrence of periods of boom which are followed by periods of depression is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion.”

Fed Predictions

Now that we’ve reviewed the Fed’s failures, let’s see how successful Fed leaders have been at predicting the economy.

Alan Greenspan was Fed Chairman from 1987 to 2006. He presided over the 1987 stock market crash, the S&L crisis, the early 1990s recession, the late 1990s tech bubble, the early 2000s recession and the early/mid 2000s housing bubble. Naturally, the press called him “maestro” for his work at the Fed.

Near the peak of the tech bubble in January 2000, Greenspan bragged about engineering a long economic expansion that he saw no signs of ending. As he said shortly before the NASDAQ stock index collapsed 80% and the early 2000s recession started: “[T]here remain few evident signs of geriatric strain that typically presage an imminent economic downturn.”

In response to the recession he did not see coming, Greenspan slashed the Fed Funds rate from 6.5% in 2000 to 1% in 2003, which helped fuel the housing bubble. Then Greenspan encouraged homeowners to take out adjustable-rate mortgages in early 2004, just before he raised the Fed Funds rate to 5.25% over the next two years, which triggered the housing bust.

In 2007, Greenspan said this about banks lending to subprime borrowers: “While I was aware a lot of these practices were going on, I had no notion of how significant they had become until very late…I really didn’t get it until very late in 2005 and 2006.”

At least Greenspan has been honest about the Fed’s inability to forecast the economy: “People don’t realize that we cannot forecast the future. The number of mistakes I have made are just awesome.” Greenspan also admitted that the market is much larger and more powerful than the Fed: “[T]he market value of global long-term securities is approaching $100 trillion [so these markets] now swamp the resources of central banks.”

Ben Bernanke was Fed Chairman from 2006 to 2014, so he presided over the Great Recession, the worst economic downturn since the 1930s up to that time.

In 2002, in a speech titled “Deflation: Making Sure ‘It’ Doesn’t Happen Here”, Bernanke bragged that the Fed’s legal right to create money out of thin air would prevent deflation: “The US government has a technology, called a printing press, that allows it to produce as many dollars as it wishes at essentially no cost…under a paper-money system, a determined government can always generate higher spending and, hence, positive inflation.” Naturally, given the Fed’s ability to control the economy, “it” did happen in 2009, with prices falling 2% in the wake of the Great Recession.

In 2006, Bernanke dismissed the inverted yield curve, which is known by virtually all economists to be one of the best predictors of a recession: “I would not interpret the currently very flat yield curve as indicating a significant economic slowdown to come.” In June 2008, seven months into the Great Recession, Bernanke said: “The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.”

Janet Yellen was Fed Chair from 2014 to 2018, so she had less time to cause major damage. But true to form, she stated she had no idea the housing bust would lead to a major recession: “I didn’t see any of that coming until it happened.”

Jerome “Jay” Powell has been Fed Chairman since 2018. He helped invert the yield curve in 2019 and has presided over the Covid crash and recession, as well as the highest inflation rates in 40 years.

In early November 2021, when inflation was over 6%, Powell and the Fed were still calling inflation “transitory” and caused by Covid and not the 40% increase in the money supply.

By March 2022, with inflation rising 7.9%, Powell finally raised the Fed Funds rate by 0.25%, with plans to raise rates up to 2.75% by the end of 2023. Ominously, given his forecasting track record, Powell thinks he can raise rates that aggressively and achieve the elusive “soft landing” of slowing inflation without driving the economy into a recession, despite the already flattening yield curve.

Conclusion

The Federal Reserve cannot control the economy or even the money supply and interest rates. And Fed leaders clearly cannot predict the economy, even though the media and Wall Street hang on their every word. But the Fed can lower living standards by destroying the value of the dollar and causing the boom and business cycle. Economic theory and history has proven that government central planning does not work in creating stability or prosperity. That includes centrally planned monetary policy.

Tyler Durden

Sun, 04/03/2022 – 17:40

via ZeroHedge News https://ift.tt/ykagJ6Q Tyler Durden