Inversions And Recessions

By Philip Marey of Rabobank

Summary

-

Yield curve inversions are often seen as warning signals of a recession, but a statistical analysis based on a logit model suggests that these signals should be interpreted with care.

-

If we consider a reasonable lag between inversion and recession, the yield curve has given false signals in the past. To a certain extent, we can remedy this by estimating threshold levels for inversions.

-

However, it still remains the case that an inversion beyond the threshold should be interpreted in terms of probabilities; it only means that the probability of a recession is larger than 50%.

-

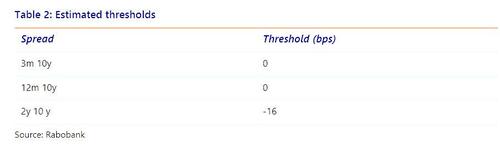

For 3m–10y and 12m–10y spreads the threshold is not statistically different from zero. However, for the 2–10y spread an inversion does not raise the recession probability above 50% until the spread is below –16bps.

-

The current spreads indicate that the probability of a recession is still below 50%, but we provide the thresholds that would indicate a probability higher than 50% for each spread of choice. While the 2–10 has inverted again, the empirical evidence suggests that a 2–10 inversion should be taken with a grain of salt, of about 16 bps.

Introduction

Currently, several segments of the US treasury yield curve are inverted, which many observers interpret as a signal of an impending recession. Today, a strong Employment Report supporting Powell’s view that 50 bps rate hikes are feasible, led to a re-inversion of the 2-10 segment of the yield curve. Is this a valid signal or not?

In this special we look at the empirical evidence for using inversions to forecast recessions. We focus on three inversions that have received most attention as harbingers of inflation: the spread between 3 month Treasury bills and 10 year Treasury notes, the spread between 12 month Treasury bills and 10 year Treasury notes, and the spread between 2 year and 10 year Treasury notes. For each spread we estimate a logit model that explains recessions (as dated by the NBER) as a function of a specific yield spread.

The results confirm that a lower spread is associated with a higher probability of a recession. However, our estimation results show that simply looking at whether a spread is positive or negative can be misleading and that we can use the estimation results to derive thresholds that are specific to each spread of choice. For example, it turns out that the 2-10 spread turning negative is not sufficient to signal a recession. We also explain that while the forecast of the yield curve is binary in terms of its outcome (recession or no recession), we should think in terms of the probabilities of these outcomes when we forecast a recession. In particular, the recession probability rises with the size of the inversion.

False signals

If a yield curve inversion takes place, we should expect a recession with a plausible time lag. The academic literature which investigates the relationship between inversions and recessions usually takes a one year horizon. But if a recession follows much later, we should conclude that an inversion gave a false signal. What is the track record of yield curve inversions of preceding a recession within a reasonable time frame? Consider three spreads that have been investigated in the academic literature, the spread between 3 month Treasury bills and 10 year Treasury notes, the spread between 12 month Treasury bills and 10 year Treasury notes, and the spread between 2 year and 10 year Treasury notes. Note that currently, only the 2-10 segment has inverted, the other two spreads have remained positive.

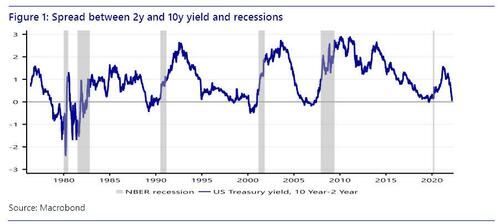

Consider the spread between 2 and 10 year US treasury notes. Indeed we see the spread turning negative before each recession. However, let’s take a closer look at the period leading up to the 2001 recession. The 2-10 spread turned negative from 2 February 2000 thru late December 2000. The subsequent recession was dated by the NBER to have started in April 2001. So the February 2000 inversion took place 14 months in advance, which is in line with standard thinking that inversions precede recessions by about a year.

However, there was also an earlier inversion, in most of June and July 1998, 2 years and 10 months in advance. The largest inversion was -7 bps on 25 June. This is well beyond the 12 month horizon that is often used in practice. In business cycle terms, this looks like a false signal. Also note that the 2-10 spread came close to negative even earlier, in late December 1994, when the spread was only 9 bps. This suggests that the 2-10 spread may give false signals. This is important to keep in mind if we interpret the current inversions.

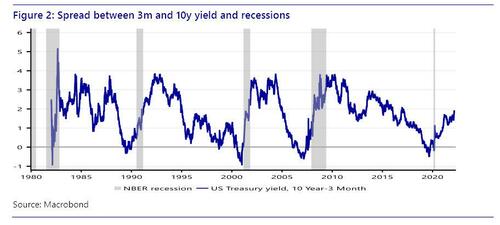

Now let’s turn to the spread between 3 month Treasury bills and 10 year Treasury notes. It is clear that this spread gave a similar false signal prior to the 2001 recession. In September 1998 there was a premature inversion (the largest was -13 bps on 21 September 1998), only later in April and most of the second half of 2000 did we see an inversion that can plausibly predict the recession of 2001. So this spread may also give misleading recession signals.

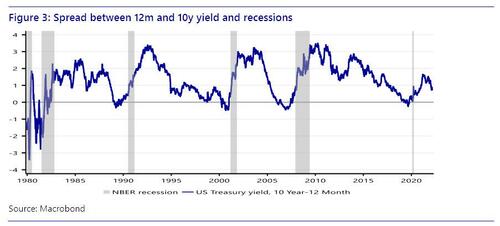

Finally, we take a look at the 12 month-10 year spread, the spread between the 12 month and 10 year US treasury yield. There was an inversion that started on 20 March 2000, about 12 months prior to the recession. But on 21 September 1998 and 5 October 1998 there were also brief inversions (one day) of just -2bps. So this spread also gave false signals, albeit much smaller in size and duration.

Thresholds

The possibility that yield curve inversions may give false signals does not make the yield curve useless as a forecasting tool for recessions. What is also clear from Figure 1-3 is that the premature inversions were much smaller than the later inversions. Consequently, we may improve our forecasting performance by applying thresholds. So we should not a priori see zero as the critical value, but we should think of a threshold below zero. Or more generally, we should think of the threshold as something to be estimated statistically.

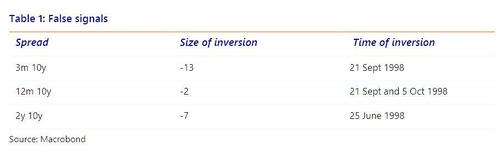

To get a first idea, we could look at the false signals of 1998 to get an idea of the thresholds (Table 1). In terms of realized false signals: if no thresholds are applied the 12m-10y spread comes out as the most reliable: the false inversion was much closer to zero than the other two spreads.

However, if we estimate the threshold with a logit model (Table 2), we find that the threshold for 3m-10y and 12m-10y is not statistically different from zero. In contrast, the threshold for 2-10y is -16 bps. This means that an inversion of the 2-10 segment forecasts a recession only if the spread is below -16 bps (it’s currently -8bps after first inverting just two days earlier). For the other two spreads we can continue to use a critical value of 0, but now we know this is supported by the data.

How do we interpret a yield curve inversion for 3m-10y and 12m-10y? When the spread reaches zero, the probability of a recession is exactly 50%. Hence a small inversion only raises this probability above 50%. This explains why we saw small inversions in 1998 without a recession occurring in a reasonable timeframe. So even if the threshold is zero, an inversion does not imply a recession with certainty. It only raises the probability above 50%. So a recession is more probable than no recession. However, false signals are to be expected. In fact, if we take the statistically established thresholds, the 2-10 actually did not give a false signal. Only if we look at outright inversions, would this have been a false signal. In other words, with a proper statistical analysis the 2-10 spread can be turned into a more reliable signal, by accounting for a nonzero threshold.

Where are we now?

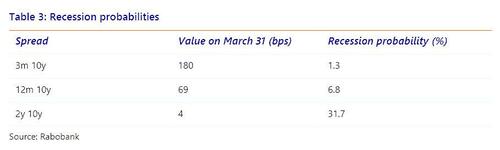

If we take a statistical approach, we can attach a probability of recession to each value of a yield spread. Based on our logit model and the spreads observed at the end of March, we can assign the following recession probabilities in Table 4.

As of March 31, these three popular spreads still indicate that the probability of a US recession is below 50%. However, in Table 2 we have shown which thresholds to use to raise this probability to 50% or higher. While the 2-10 has inverted again today, the empirical evidence suggests that a 2-10 inversion should be taken with a grain of salt, of about 16 bps. Looking at the current inversion, a zero 2-10 spread corresponds with a 35.1% probability of a recession. So today’s re-inversion of the 2-10 segment is not enough to raise the probability of a recession above 50%.

Conclusion

The recent yield curve inversions are cause for concern, but should be interpreted with care. In this report we explained that each spread may have its own threshold. What’s more, an inversion beyond this threshold only raises the probability of a recession above 50%. It is not a certainty. The probability of a recession rises with the depth of the inversion.

Having established that a reliable signal of recession has not yet been given by the current yield curve inversions, the question is whether these are still in store. Given the flattening impact of the Fed’s rate hikes on the yield curve, the hawkish tone of Powell’s NABE speech on March 21 suggests that it is only a matter of time before we see the inversions that do signal a recession probability above 50%.

Tyler Durden

Sun, 04/03/2022 – 11:30

via ZeroHedge News https://ift.tt/56ac9tI Tyler Durden