Goldman: We Enter The Quarter With A Set Of Glaring Disjunctions

By Tony Pasquariello, head of hedge fund sales at Goldman Sachs

Q1 is in the books; boring, it was not.

After setting all-time highs on the first business day of 2022, by late February US equities were tracking for one of the worst starts to a new year on record — as stock operators wrestled with a reckoning of post-COVID demand, a considerably more hawkish Fed and a geopolitical disaster — resulting in a down 5% quarter.

The twists and turns of S&P, however, belie the presence of a very few significant underlying trends that are apt to stay with us:

-

i. One year ago, the yield on US 2-year notes was 15bps; today, they’re marked at … 2.38%. One year ago, the FOMC expected the Fed Funds rate to be 0% at the end of 2023; today, the dot plot suggests they expect to be at 2.75% by the end of 2023. what I’m trying to say here: the Fed has a lot of wood to chop, they’ve just begun that chopping, and on any given Sunday, you’d be excused for wondering what the consequences of that chopping could be.

-

ii. On October 6th of 2020, Jeff Currie in GIR remarked, “I’m the most bullish I’ve been on commodities since 2003/2004.” the Bloomberg commodity spot index was trading at 350 back then; today, it’s marked at 625. despite the magnitude of that rally, as you saw very clearly over the past few months, the commodities market is a small one — very, very small in the grand scheme of things — and is likely to remain a high velocity space.

-

iii. In April of 2020, GMD colleague Pete Bartlett argued that “in 2017, the aggregate market cap of cryptocurrencies went from basically zero to ~ $750bn dollars … importantly, this was all done without any significant institutional participation. the fear-of-missing-out on an upwardly trending chart turned about to be enough for retail to take a massive leap of faith into an asset with no earnings, no dividends or coupons, and very few existing use cases … it helps illustrate the capacity of retail, when aggregated, to trade in massive size, move assets to levels that don’t seem to jibe with fundamentals, and to trade on hope.” since this remarkably prescient comment, the US retail investor has been the single largest sponsor of the domestic equity market, and absolutely remained on the bid throughout Q1; whether they can sustain that demand is one of the single most important questions for the balance 2022.

In addition, we enter the quarter with a set of glaring disjunctions, reflective of a very uneven world that’s been subject to a series of jolts.

-

You can easily see a wedge in positioning data: professionals continue to de-risk, while households have kept the hammer down

-

You can easily see a wedge in the macro data: U-M consumer sentiment is on decade lows, while ISM remains in the upper 50s

-

You can easily see a wedge in COVID case count and response function: the US and UK feel back to normal, while China continues to lock down some of the world’s largest cities.

This again underscores the challenges of money management within a cycle that is going to look and feel different from what came before — and, where the biases we accumulated from 2009 through 2021 are the enemy now.

In the end, it was an action-packed quarter that rewarded pattern recognition, experience and gut instincts — thus playing to the strengths of both systematic managers and the discretionary macro community.

Looking ahead, I have a feeling those big trends — upward pressure on US rates, upside convexity on commodities and the big footprint of the US retail investor — while they are arguably extended in the short-term, I believe they will remain with us for a while longer.

* * *

1. Before yesterday, the question of “how is it that stocks trading so well off the lows” was coming up 444 times a day. Unto itself, this is a reflection of how negative professional sentiment was coming into March. More elementally, simply judging from price action in the VIX and RUB, there’s been a major easing of asset market risk premia on the prospect of geopolitical de-escalation (I worry this truncation of downside tails has perhaps gone too far). Alongside this, again, the easiest story I can tell is flow-of-funds have skewed clearly positive: part of this is model-driven/non-discretionary strategies (~ $8bn/day), part of this is the aforementioned retail investor (witness the GS retail favorites basket — ticker GSXURFAV — is up 20% over the past two weeks), part of this has been forced short covering of underwater hedges. For a more fulsome read, GIR’s Peter Oppenheimer put out a punchy note with seven takes on the recent strength: link; my favorite line: “equities are a real asset with a claim on nominal GDP.”

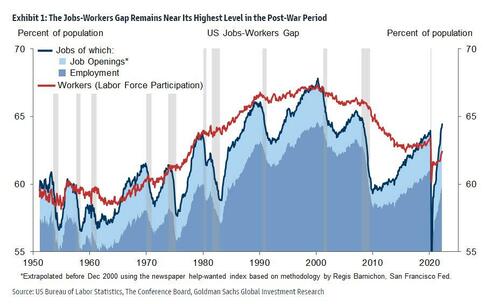

2. Another key ballast in recent months has been ongoing strength in the US labor market; The big picture: we’re witnessing the widest gap between US labor supply and labor demand in the post-WWII era. Wwhile acknowledging that labor market data is classically regarded as a lagging indicator, my point here is that it should remain healthy for a while longer; again, we have 7mm unemployed against 11mm job openings, and that wedge isn’t closing tomorrow. furthermore, for all the shocks that households are contending with these days, I have to believe the trends in both jobs and wages are sticky will serve as an ongoing counter-balance. for a differing opinion: link; for an assessment of what the asset markets are pricing: link.

3. Praveen Korapaty, GIR, on yield curve inversion: “when talking about the curve inversion, it is worthwhile specifying which curve we are talking about. while most investors track the 2y10y yield curve, some academic work suggests other curves, such as the 3m10y or a front end forward curve may be a ‘better’ predictor of recessions. Irrespective of the curve being tracked, inversions in the last few decades have been mild. However, we haven’t had a high inflation environment like the one we’re currently in for a while, and our work (link) suggests that curves can get much more inverted in such environments — so rather than a 20-40bp inversion, you could see a greater than 50bp inversion. In the 70s and early 80s, for instance, you saw yield curves invert between 100-200bp ahead of recessions. While we think curve inversion shouldn’t be ignored even in the current environment, we find that mild inversion has in past instances with high inflation has tended to generate more false positive signals for a recession commencing in the subsequent 12 months.”

4. US mega cap tech has traded notably well of late (e.g. ticker GSTMTMEG is up 9-of-13 days for 14%). I presume some of this a function of TINA (to be sure, it’s been the worst start for US Fixed Income in 42 years … see point 13 at bottom). I presume part of this is, yes, thanks to the strong hands of the retail investor (namely AAPL and TSLA). And, to Peter’s earlier point, global real rates remain deeply negative — note that since liftoff commenced at the March FOMC, US financial conditions have actually eased. Going forward, I believe the quality factor — which has a bias towards big cap tech — will remain a stronghold.

5. Earnings: the month of April will feature a hugely important reporting period for Q1 (to commence, in earnest, in three weeks). On one hand, consensus is expecting ~ 5% y/y growth — and, zero growth ex-energy — so, one can argue the bar is low. that said, with inflation this high, it’s reasonably — if remarkably — difficult to forecast sales and margins’ that to me is the biggest open question. Given the significance of external factors at work right now, at the very least I suspect the coming earnings barrage will generate a significant dose of dispersion at the single stock, sector and factor levels of the market.

6. US exceptionalism: to repeat a point from last week, the US is self-sufficient with respect to energy, food and defense. I don’t want to go too far with this argument, as we know the domestic economy is far more complicated (and externally-linked) than that would suggest. Where the home-field advantage does seem to be clearly manifesting is flow of capital, as the US continues to see inflows, while Europe is the funder: link. Given all the challenges in Europe, Asia and select parts of EM, I reckon this trend towards the US will remain in place a while longer.

7. in the context of localization/regionalization, this note from GIR’s Ronnie Walker on reshoring, supply chain diversification and inventory overstocking is highly interesting. The punch line as I saw it: “greater supply chain resilience comes at a price, and some investors worry that these trends will add to inflationary pressures. But the costliest of the three responses — reshoring production to the US — is also the least underway, suggesting that the shifts to date are a second-tier influence on the inflation outlook relative to key macroeconomic forces like labor market overheating” (link).

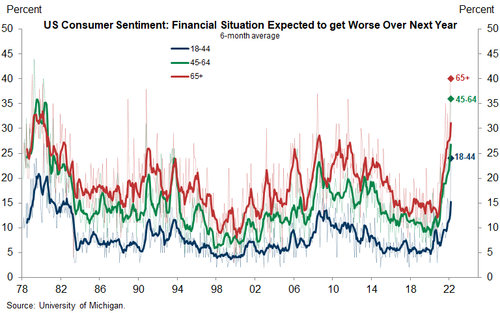

8. Speaking of U-M consumer confidence data, this is an interesting take from Mike Cahill in GIR, which breaks down consumer sentiment by age group. As you can see, older cohorts began reporting significantly worsening expectations last spring. More recently, however, younger respondents started to also get more pessimistic, with a big jump this month (in fact, the most negative younger adults have been since 1980):

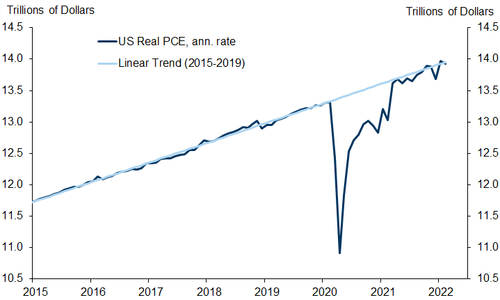

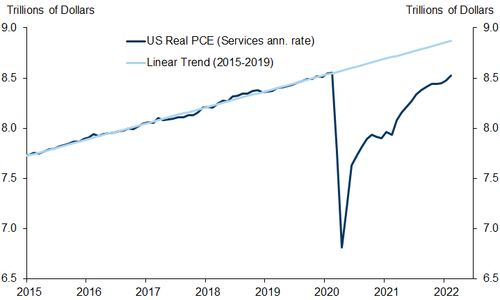

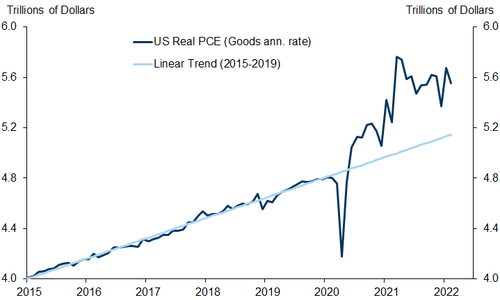

9-a. On the topic of US retail sales, it’s worth revisiting these three charts on US consumption, also credit to Mike Cahill … if you squint, you’ll see a shift from goods to services:

9-b:

9-c.

10. following that sequence, a GS pair trade … long stocks levered to services, short stocks levered to goods:

11. Russia is the world’s largest exporter of fertilizers. this is a generic index of fertilizer prices. I wonder if folks are too complacent about the inherent risks here? As Adam Samuelson in GIR put it to me, “the spike in fertilizer is a major issue underpinning the bullish view on agricultural commodities and why some of the inflationary pressures in the food system won’t abate anytime soon. These kinds of increases don’t fully start flowing to the grocery store until 2H22 and beyond.”

12. The white line is US 10-year note yields; the green line is the ratio of BKX over S&P. what’s going on with this huge divergence? Informal take from Ryan Nash in GIR: “we have seen a major decoupling between interest rates and bank stocks over the past few weeks. while banks benefit from both higher short-term and long-term interest rates and are as sensitive to higher rates as they’ve ever been, this is all about the market worrying about inflation risk and the likelihood of stagflation or a recession. in addition, the investor community has begun to question what the inverted yield curve is telling us and that the fed might have to start cutting at some point, leading to markets pricing in some downside risk.”

13. presented without bias, the aforementioned US Aggregate bond index. the top line is the rolling price of the index; the bottom half is the quarterly rate of change:

Tyler Durden

Mon, 04/04/2022 – 14:45

via ZeroHedge News https://ift.tt/neGfkMz Tyler Durden