Brainard Batters Bonds, Stocks, Bullion, & Bitcoin With ‘Fast & Furious’ QT Threat

Well that escalated quickly…

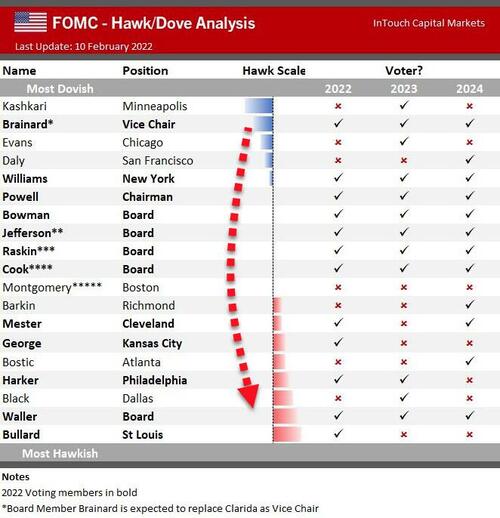

Vice-Chair-to-be Lael Brainard tore off the ‘Yellenish’ mask that she wore for years and went full ‘Bullard’ today…

…and everyone knows you never go full ‘bullard’…

The Federal Open Market Committee “will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting,” adding that she “[expects] the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19.”

Later in the day, SF Fed’s Mary Daly also piled on the same narrative, noting that “The Fed could start balance-sheet reduction as early as May.“

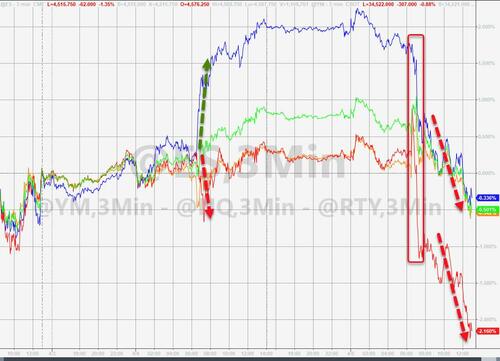

It appears The Fed – having seen stocks soar back near record highs – is managing expectations that QT is imminent and investors are far over their skis, as stocks erased all of yesterday’s excited gains…

…with Nasdaq and Small Caps leading the plunge today…

VIX jumped back above 21…

‘Growth’ stocks puked relative to ‘Value’ today…

Source: Bloomberg

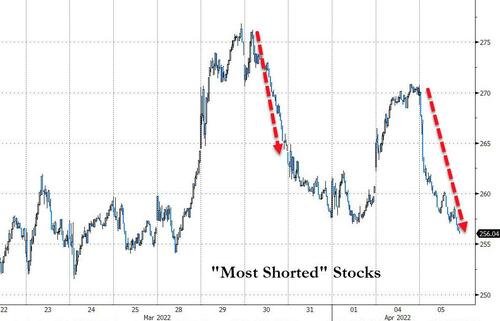

Perhaps most worrying for those waiting to be rescued, “Most Shorted” stocks suffered their biggest single-day plunge today since Feb 2021…

Source: Bloomberg

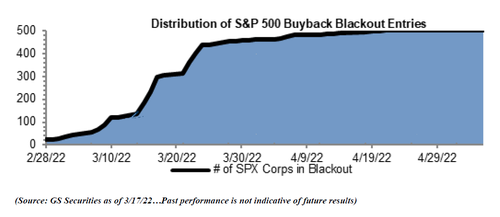

And there’s no support for stocks from buybacks for the rest of the month…

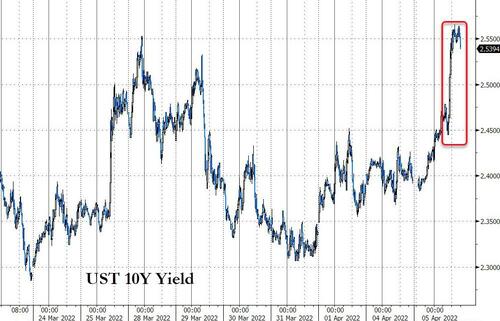

Bonds were clubbed like a baby seal today with the belly underperforming but everything hammered higher in yields…

Source: Bloomberg

Today saw 10Y Yields spike most since March 2020

Source: Bloomberg

For some context, yields are utterly exploding higher…

Source: Bloomberg

The yield curve did what everyone hoped wouldn’t happen… it started to steepen – which is the start of the ‘consequences’ (not the inversion)…

Source: Bloomberg

The dollar surged higher back to pre-FOMC levels…

Source: Bloomberg

Cryptos tumbled as Bitcoin failed for the 3rd time to take out its 200DMA as $47k seems like an important resistance level for now…

Source: Bloomberg

Gold ended lower on the day…

After yesterday’s rebound, today’s US hawkishness (demand) and more bad news from China (demand) were more than enough to offset anxiety over EU, US sanctions threats (Supply) and WTI dropped back to a $100 handle…

Finally, do stock investors really think they can just skate through the next year’s 9 rate-hikes, fast-and-furious QT, and recession and ‘hold on’ for the inevitable ‘easing’ plan from The Fed for everything to be back to normal?

Source: Bloomberg

Good luck with that plan!!!

Tyler Durden

Tue, 04/05/2022 – 16:00

via ZeroHedge News https://ift.tt/F7rsQz2 Tyler Durden