Unfinished Brexit Business: NATO’s Internal Gold War

Brexitology focused keenly on UK fish but fully ignored the EU´s gigantic gold reserves supposedly still vaulted in custody at the Bank of England. Adding insult to injury, a UK-EU no-deal financial services crash-out divorce went by almost unnoticed… not only without the bang of the still postponed “financial equivalence” protocol… but also without a mere whimper from specialized media and Remainers. Now, the Ukraine crisis with its new payment requirements for the badly needed Russian oil & gas…overlapping with essential yet unfinished Brexit business…will necessarily evolve into a vicious NATO internal gold war.

Paraphrasing James Carville spiced with some traditional British flavor, “It´s the bloody gold, stupid”

Rule Britannia

As UK Prime Minister Boris Johnson would have it, the physical repatriation of the EU gold supposedly still vaulted in London would “mightily” affect the future of Europe with very deep, high-voltage political impact both sides of the English Channel. In this scenario No.10 Downing Street would easily negotiate the EU gold bullion availability only under specific Brexit conditions favorable to the UK. Actually, doing this could turn out to be absolutely necessary and should go far beyond the enormous intrinsic value of the EU gold supposedly still vaulted at the BoE. Let me explain.

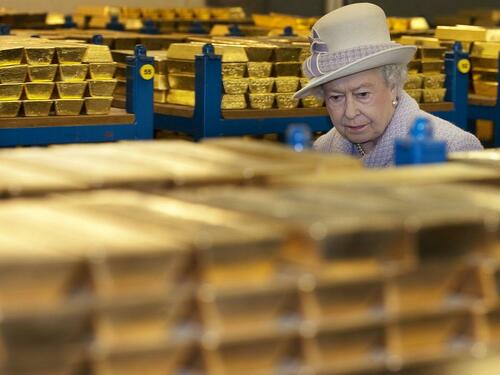

NATO gold in London

Russia´s new rubles or gold payment requirements for any of its goods or services will necessarily prompt a major gold war between the UK and the EU probably resulting in NATO´s first-ever internal head-on gloves-off confrontation. After WW2 the idea was to keep Europe´s gold bullion safely away from the former Soviet Union and Josef Stalin, just in case. So decades ago current EU member states deposited most of their gold in custody at the Bank of England (BoE) in London. Now, the UK will dare to weaponize the approval of EU gold repatriation requests and other gold-related issues as a very convincing bargaining tool for lots of still unfinished yet most important Brexit business. So,

(a) Whitehall could indefinetly delay the EU gold delivery unless Brexit pending issues are agreed in favor of the UK.

(b) Or, quite simply, the BoE would not ever return such EU gold supposedly kept in custody for the past decades because it has been partially or totally sold off or loaned out or compromised as explained below with former UK Prime Minister James Gordon Brown knowing about it all too well.

The Mother of European conflicts

If history is any guide, hostilities will explode the instant the EU member states individually or collectively rightfully demand a yet-non-existent fully independent world-class functionally detailed audit of the EU gold supposedly still in ´custody´ at the BoE. This should take plenty of time and is the perfect excuse for delaying the whole process always under the exclusive perview of London, not Brussels. Or unmanageable problems would arise as soon as EU nations require immediate repatriation of at least some of such ´theoretical´ bullion, most probably all of them at the same time in view of circumstances. Then, either (1) some gold could possibly slowly be returned here and there (albeit with great delay ) but only under very vague London terms and changing the unfinished Brexit aftermath to levels yet unheard of, or (2) no gold would be returned as it has been sold off or compromised in different ways as explained hereinafter. And the UK better not decide to pay Russia even with a single gold coin as the EU would rightly wonder who owns it.

BoE darkness

The London gold and silver markets have always been beyond “opaque” without any significant reporting of transactions or positions. No data has ever been offered either on commercial banks holding accounts at the BoE, or precise technical identification of gold custodies, let alone those belonging to EU members. As Venezuela knows all too well – and EU member states could be next — who may or may not be acknowledged as a valid claimee of anything vaulted in Threadneedle Street or whereabouts is an open subject left to the entire discretion of the Canary Wharf masters, not EU politicians. Same goes for the enormous unallocated gold and silver liabilities of the so-called ´bullion banks´… or any other pertinent data.

The (bad) German experience

Very recently Germany had to wait 5 long years to forcefully and painfully repatriate only a portion of its gold from the BoE and never got back any of the gold bars originally deposited, which clearly explains the delay.

So while the EU freezes to death and its economy stops dead in its tracks, the many pending questions include

(a) does the BoE still have all of the EU´s gold bullion… or has it been sold off or loaned out as many experts insist ?

(b) is the BoE willing and able to immediately return the EU gold it may still have left to legitimate owners, if any ?

(c) who are the legitimate owners of BoE-vaulted gold after decades of European reshuffling of political borders ?

(d) would the ECJ decide gold ownership… or the British Judiciary… or the BoE ? On what basis, exactly ?

(e) has the BoE lent, swapped, re-hypothecated, leased, leveraged or encumbered such bullion now lien with other many alleged legitimate claimees also standing in line with ´fractional un-allocated synthetic´ bullion custodies unfit-for-purpose per “Digital Derivative Pricing Schemes“ thru which no one can know who owns what where (if anything) ?

I kid you not.

Today´s “paper gold” derivative transactions constitute a genuine pure-bred Ponzi scheme exceeding many-fold the real gold bullion theoretically behind them, probably with a 100 to 1 ratio or higher as London´s Square Mile knows all too well. Of course, the ECB, the IMF and the BIS would also claim it actually is “their” gold no ?

British economist Peter Warburton was 100% correct when he described that Westerncentral banks were using derivatives to control commodity prices and protect government currencies against the public’s recognition of currency devaluation. Warburton’s essay “The Debasement of World Currency: It Is Inflation But Not as We Know It” is posted at https://www.gata.org/node/8303

But however it unfolds, the “continental gold” now possibly still vaulted in London will necessarily trigger an internal NATO existential conflict in no uncertain terms (and desperation) in absence of the much-needed audit parameters and still missing gold bar serial numbers records affecting ownership and status claimed by more than one (supposedly legitimate) recipient, plus gold bullion quality and purity data, overdue custody costs, transportation & insurance, etc.

In passing, when push gets to shove (and it will, trust me) per their ´special relationship´ the US Federal Reserve would side with the BoE because it finds itself in exactly the same situation regarding the physical bullion they should still be theoretically vaulting for third parties, sovereigns included. In synchronized lockstep with Anglo-Saxon exceptionalism, the Fed´s gold custodies have never been audited either — as they should have – and the specialized commentariat worldwide is convinced that such bullion is not fully available either. Furthermore, the US would welcome any new additional problems for the EU as that was the whole idea behind provoking Russia into this unnecessary war.

* * *

Jorge Vilches – proud to have been introduced many times as “ the quintessence of the independent columnist ”. Former op-ed contributor for The Wall Street Journal – New York and other financial media, has studied this topic in depth for the past 20 years. WSJ-NY “The Americas” column, editor David Asman today Fox Business News anchor.

Tyler Durden

Tue, 04/05/2022 – 03:30

via ZeroHedge News https://ift.tt/Vjla3zq Tyler Durden