WTI Holds Losses After Unexpected Crude Inventory Build

Oil prices tumbled today after The Fed’s Lael Brainard curb-stomped any US demand rebound hopes with talk of fast and furious QT (even as EU and US announced plans for more sanctions on Russia).

The “U.S. dollar strength likely contributed to late day sell-off,” in the oil market, said Ryan Fitzmaurice, a commodities strategist at Rabobank.

“The threat of European sanctions on Russian oil remains an upside risk for crude prices despite the firm opposition in the short term from certain member states,” said Craig Erlam, senior market analyst at Oanda.

For now, any signs of demand destruction in inventory/production data is key.

API

-

Crude +1.08mm (-2.056mm exp)

-

Cushing +1.791mm

-

Gasoline -543k

-

Distillates +593k

After last week’s product builds (and 2 straight weekly crude draws), API reported an unexpected build in crude stocks (and another build in distillates)…

Source: Bloomberg

WTI is hovering just above $100.50 (off the post-Biden-SPR-plan lows) ahead of the API data and barely budged on the unexpected crude build…

As Bloomberg notes, the possibility of new curbs is offsetting the impact in the global crude market of a vast release from the U.S. Strategic Petroleum Reserves (SPR,) beginning in May, in a bid to tame prices. Other countries have said they’ll also make drawdowns.

“Many who were long oil got out in the last week or so on the basis that the SPR was just too much for the market to handle without some real evidence of dropping Russian crude exports,” said Scott Shelton, an energy specialist at TP ICAP Group Plc.

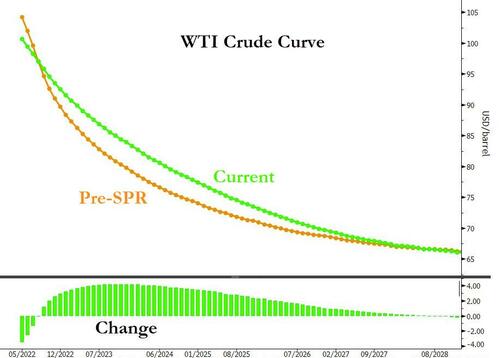

That move has reshaped the oil futures curve, keeping a lid on nearby prices but lifting those further into the future.

But who cares about that… it’s after the Midterms! (and the next government will have to deal with the cost of refilling it at higher prices?)

Tyler Durden

Tue, 04/05/2022 – 16:50

via ZeroHedge News https://ift.tt/qOcSNje Tyler Durden