Fed’s ‘Volcker Moment’ Slams Bonds, Stocks, Crypto, & Crude

The big headline from today was the mainstream media ‘finally’ getting the joke that we first warned about weeks ago… that The Fed needs to crash the market to slow/stop inflation. Former NYFed boss Dudley explained it to Bloomberg readers:

Listen to this interview from Dudley, former FRBNY Pres and Chief Goldman US Economist. “Reverse wealth effect” is a policy tool. Fed needs risk assets to go lower to tame inflation. They will keep tightening until it goes lower.

Don’t fight the Fed.https://t.co/LPEQhUtzle

— Joseph Wang (@FedGuy12) April 6, 2022

Which was then confirmed by The Fed Minutes showing fear that they may lose the public’s confidence in their resolve to battle inflation if they don’t act aggressively.

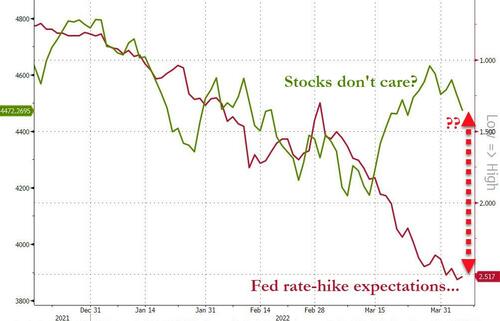

While bonds are broadly priced for The Fed’s rate/QT trajectory, stocks definitely are not and today’s reaction, building on yesterday’s weakness, showed it off (even with dip-buyers trying to rescue things). Nasdaq was hardest hit and The Dow the least lame horse in the glue factory today…

On the week, Small Caps are the biggest loser (-3.5%).

All the US majors broke or are at critical technical levels with the S&P battling at its 200-day moving average…

After the market melt-up in the second half of March – as negative delta (hedges) were unwound en masse – cyclicals have tanked relative to defensives as reality sets in on The Fed’s hawkish path ahead…

Source: Bloomberg

Is it catch-down time?

Source: Bloomberg

Treasury yields were mixed today with the short-end flat while the long-end sold off further (2Y -1.5bps, 30Y +6bps)…

Source: Bloomberg

The yield curve has un-inverted (2s10s now +10bps), which is the actual trigger signal for imminent recession (as opposed to the inversion itself)…

Source: Bloomberg

Notably there was no major shift in rate-hike or rate-cut expectations post-Fed-Minutes (9 hikes and 3-4 cuts priced in)

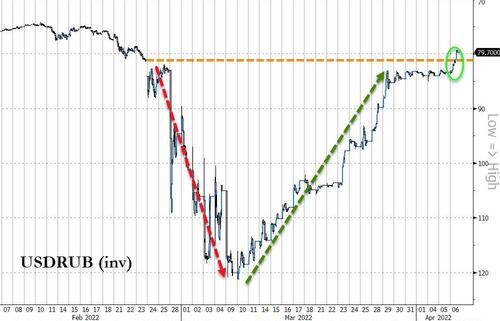

The Ruble extended its rebound back above pre-invasion levels (Yellen brushed it off as not real for some reason)…

Source: Bloomberg

Crypto was clubbed like a baby seal once again with Bitcoin back below $44k, hovering around the post-invasion-spike high levels…

Source: Bloomberg

The dollar surged up to the FOMC day spike highs today after the Minutes confirmed the hawkish bias…

Source: Bloomberg

Gold ended the day unch…

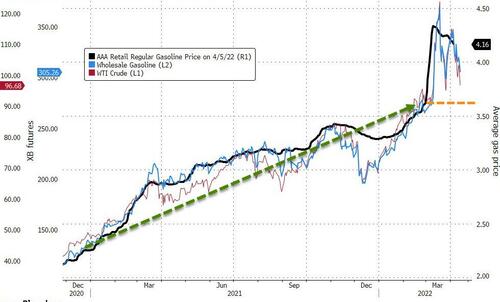

WTI tumbled back below $100…

And finally, the good news – if things stay this way – is that gas prices may just drop a bit… but they remain up dramatically since Biden’s term began…

Source: Bloomberg

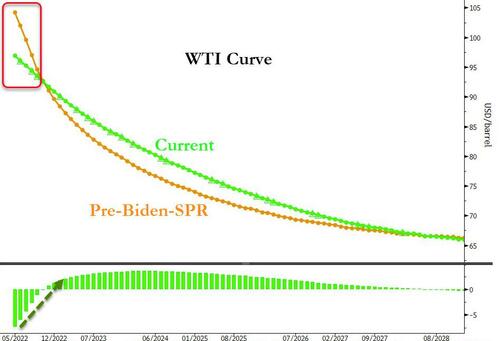

And the SPR release is actually driving up prices in mid-term months as it’s going to need to be refilled at some point…

Source: Bloomberg

But that would be after the Midterms!

Tyler Durden

Wed, 04/06/2022 – 16:00

via ZeroHedge News https://ift.tt/M80zh3t Tyler Durden