FOMC Preview: Full Details Of Balance Sheet Runoff And The Coming 50bps Rate Hike

First, the good news: after yesterday’s unexpectedly hawkish comments from Fed resident liberal, Hillary supporter and uber-dive, Lael Brainard, the potential for another hawkish surprise from today’s FOMC minutes has been largely eliminated. As a result, investors now anticipate an even more aggressive baseline on how the Fed will run down its balance sheet and that’s likely bearish for Treasuries. That’s because Brainard made it quite clear: “the Committee will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.” Also, she said that she expects “the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19.”

By endorsing (an accelerated) May balance-sheet runoff timing, she telegraphed what investors will likely learn at the May FOMC and that’s exactly how the Fed intends to reduce the size of its balance sheet in the coming quarters.

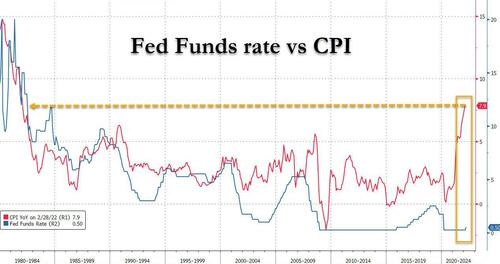

Of course, the bad news is that the Fed – which remains woefully behind the inflation curve…

… may surprise with even more hawkish pronouncements in today’s Minutes, which is why as Bloomberg’s Alyce Andres writes, “it’s tempting to sell the rumor and plan to buy the fact, but the problem is that Fed Chair Jerome Powell and team continue to deliver hawkish surprises.“

With that in mind, here is a preview of what Wall Street consensus expects today, courtesy of Newsquawk

SUMMARY: The FOMC Minutes will be critical for gauging the parameters of the balance sheet runoff process after Fed Chair Powell told us more details would be available within the release. Details eyed include the pace of the runoff, where expectations for the maximum monthly caps lie between USD 60-100bln per month of Treasuries and MBS. Whether the caps start small and grow or begin immediately at the max will be key, particularly for signalling, given the formal announcement will likely be made alongside an expected 50bps rate hike at the May FOMC. Other details include the asset composition of the runoff, any size or calendar guide for completion, and the Fed’s appetite for outright asset sales. On rates, with market pricing for a 50bps May hike at 80%, and probabilities of more ‘double’ hikes at future meetings also growing, commentary on the debate for the larger increments will be eyed given the appetite seen in some Fed Speak in recent weeks.

MARCH FOMC: The FOMC raised rates by 25bps to 0.25-0.50%, as the market had expected; Bullard dissented, calling for a larger 50bps move. Updated projections envisage the FFR target rising to 1.75-2.00% by the end of the year, and rates are expected to rise to 2.75-3.00% next year, staying at that level in 2024 before falling. The Fed lowered its estimate of the longer-run rate by one-tenth to 2.4%, implying a front-loaded rate hike cycle. The Committee introduced language explicitly referring to the Ukraine situation, noting its uncertainties to the economy, but could present upward risks to the inflation profile. Inflation forecasts were raised in the short term, while the median growth forecast for 2022 was cut.

BALANCE SHEET (B/S): The market will be looking to the minutes for any discussion on B/S reduction after Powell said at his Q&A that he is “sure there’ll be a more detailed discussion of our [B/S reduction] in the minutes”. The Fed is largely expected to make the formal announcement at the May FOMC. The March FOMC didn’t provide many new details aside from a light calendar guide, saying the Committee “expects to begin reducing its holdings… at a coming meeting.” Chair Powell even said plans could be finalised as soon as May. Powell was coy about going into too many details then but he did say the runoff could look very similar to the Fed’s prior B/S reduction, but faster, whilst assuring that the Fed would be mindful of the broader financial context, and would avoid adding to the uncertainty. Analyst expectations for the runoff process lie between USD 60-100bln per month total of Treasury and MBS. The Fed will also likely maintain optionality, noting they can adjust the pace as required. While these are the expected maximum monthly caps, it will be interesting to see if there will be a run-in period or whether the max caps will begin immediately. Other factors to watch out for include the composition (pace of Tsys vs MBS), if it will let its USD 300bln plus of T-Bills runoff (or maintain its bill holdings and just reduce coupons), any size/calendar guide for QT completion (BBG survey saw B/S at USD 8.5tln by 2022-end and 7.5tln by 2023-end, but not clear on final size), and debate around asset sales given a few Fed officials have been calling for MBS sales in the future. Meanwhile, with expectations for May leaning towards a 50bps move from the Fed, it raises the possibility of a run-in period for the monthly caps to refrain from being viewed as overly hawkish. While many Fed officials have said they are on board with hiking rates and implementing B/S runoff at the same meeting, the magnitudes of both will be key. Fed’s Brainard spoke on Tuesday, essentially cementing the May balance sheet reduction announcement while she also said it will be at a “rapid pace”. Brainard said she expects significantly larger caps and a much shorter period to phase-in maximum caps compared to 2017-2019, implying there will be a phase-in period, but a fast one.

50BPS: Money markets are currently pricing a 50bps rate rise in May with around 80% certainty in the wake of the March FOMC, and commentary from other Fed officials, who also seem open to 50bps rate moves at the May meeting– or meetings ahead (plural), to combat high inflation. At the press conference, Chair Powell was upbeat on the economy, arguing that although growth projections were cut, GDP was still seen growing at above-trend rates and strong enough to handle tighter monetary policy. Analysts noted that Powell’s remarks at a separate event after the FOMC meeting sounded more hawkish (note: at the FOMC meeting, Powell is understood to be speaking on behalf of the Committee, whereas when he is delivering remarks outside of the FOMC press conference, his remarks are seen to be more his own views). Powell said that the FOMC was able to move rates in 50bps increments if that is what is required to manage inflation pressures and heavily suggested that this could happen at a coming meeting or meetings, implying more than one 50bp move this year is possible. This was a hawkish upgrade of his views from the FOMC meeting, where he seemingly advocated a “steady” approach. The minutes will thus be eyed to gauge the FOMC’s broader views on moving in larger than 25bps increments.

* * *

Finally, here is a preview of what JPMorgan’s trading desk expects will be unveiled by the Fed today at 2pm.

Wednesday brings the minutes of the March FOMC meeting and the size of the caps on QT. With speaking engagements from both Williams and Daly over the weekend they have very strongly signaled a 50bps hike in May with the start of QT. Brainard is also giving her first public appearance post meeting tomorrow.

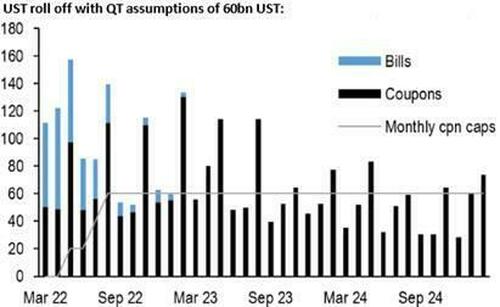

JPM is calling for terminal caps of TSY $60BN/MBS $30BN phased in over 3 meetings with T-bills exempt and allowed to roll off as they mature.

1) Size of QT

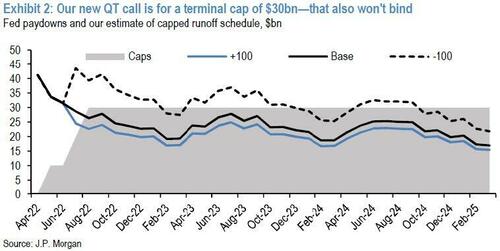

The best guess of JPM’s Michael Feroli is that the Fed will double the size of the previous caps with a terminal size of $60bn Treasuries and $30bn mortgages. Caps will be phased in over 3 meetings (May, June, and July). As you can see from the graphics below, the mortgage cap will very likely not become binding and the Treasury cap will only bind on quarterly refunding months. JPM’s call implies the Fed will be buying zero mortgages starting in mid-August. A 50bps rally would make the $30bn cap briefly binding later this year, implying a small amount of reinvestment, but the base case view is that the Fed becomes a strict source of supply to the private market upon hitting their terminal cap. The below charts show ~400bn total reinvestment through 2024, mostly in 2022/2023.

2. Composition of balance sheet

There has been heavy debate as to what to do with the bill portion of the treasury portfolio which were bought originally to calm repo markets in the Fall of 2019. JPM thinks they will exempt T-bills from caps to allow them to roll off the balance sheet as they mature (blue bars below). Waller has also discussed moving residual MBS reinvestments to USTs only. Here JPM writes that it spent time thinking about the potential to change the current reinvestment strategy of SOMA add-ons proportional to issuance to just front-end but both options may not be worth doing if the caps run up quickly over 3 meetings and rarely become binding.

In the longer run, the Committee intends to hold primarily Treasury securities in the SOMA, thereby minimizing the effect of Federal Reserve holdings on the allocation of credit across sectors of the economy.

3. Outright MBS sales

The hawks on the Committee continue to discuss balance sheet wind-down but most have steered clear of discussing sales directly. Both Mester and Waller have advocated for selling MBS at some point and George last week looked to argue for a more aggressive path. Recall at the last set of minutes they used “many” to describe the number of participants who see either sales or rotation to tsys at “some point” in the future. Given the last month of Fed speak I would expect either the number to be upgraded to “most” or “almost all.” It is also possible they pull forward the timing to be in line with an earlier start to QT.

4. Terminal size of sheet and reserves

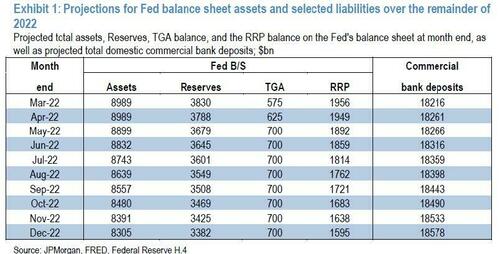

It is difficult to know the final resting size of the Fed balance sheet in this regime so I’ll borrow my favorite line from the Feb TBAC charge question: ”We estimate a wide range for normal, 20%-25% of GDP. Given that it will take at least 2-3 years for the Fed’s balance sheet to near this range, we don’t think it is important for Treasury to try to formulate a more precise view than this.” Combining our MBS and UST runoff assumptions we will arrive at ~20% of GDP with the balance sheet over $5trn towards 2026-2027. In terms of the impact on reserves, assuming TGA continues to grow to something like $700bn we anticipate bank reserves will decrease almost 2x as much as the ONRRP balance (see table below).

* * *

Tyler Durden

Wed, 04/06/2022 – 13:07

via ZeroHedge News https://ift.tt/jMTXHhp Tyler Durden