Futures, Treasuries Tumble On Fed Tightening Fears As FOMC Minutes Loom

There is a scene in My Cousin Vinny where Joe Pesci’s puzzled wannabe-lawyer character asks the judge if he was really serious ’bout dat.

On Tuesday and overnight, incredulous algos and 15 year old hedge fund managers had a similar question to the Fed about its market-crushing, rate-hiking intentions, after yesterday the Fed’s in house permadove and Hillary Clinton donor, Lael Brainard, shocked markets when she not only made the case for accelerated rate hikes but also a faster balance sheet drawdown after she said that curbing inflation is “paramount” and the central bank may start trimming its balance sheet rapidly as soon as May.

As a result, investors once again feared out that a more restrictive U.S. central bank could end up tipping the world’s largest economy into a downturn, or even a recession, something which is now Deutsche Bank’s base case for 2024. The virus resurgence in Asia and the war in Ukraine are also clouding the outlook for prices and growth.

“Market participants finally acknowledged that central banks are serious and will raise interest rates significantly to bring inflation rates down,” Florian Spate, a senior bond strategist at Generali Investments, wrote in a note. “We expect the selloff to lose momentum but the general trend for yields is likely to point still upwards.”

It also meant a plunge in both US stocks and bonds, and a continuation of this selloff across global markets overnight, which then fed back into US future weakness again this morning and saw tech companies lead U.S. index futures lower on Wednesday as concerns mounted over the pace of the Federal Reserve’s monetary tightening and a worsening pandemic in China.

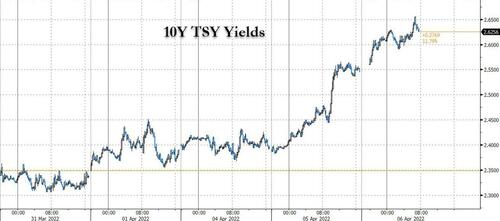

Futures on the Nasdaq 100 were down about 1.5% and contracts on the S&P 500 slid -1% with tech heavyweights among the worst performers in premarket trading. Global stocks and bonds also fell. The Stoxx Europe 600 index was down more than 1%, with travel, carmakers and tech leading declines. 10Y yields soared as high as 2.65% and a gauge of the dollar’s strength rose to a three-week peak.

Tesla, Nvidia, Applied Materials, Amazon, Alphabet, Qualcomm and Boeing were among the worst performers in premarket trading. Starbucks slipped after the company announced the ousting of its top lawyer. Here are some other notable movers:

- Shares of Spirit Airlines (SAVE US) fall 2.6% in U.S. premarket, erasing some of prior day’s steep gains after the budget carrier received a $3.6 billion takeover offer from JetBlue (JBLU US) that topped a competing bid by Frontier Group. JetBlue -4.3%.

- Twitter (TWTR US) slips 1.3% after two-day surge of about 30%. Elon Musk refiled the disclosure of his stake to classify himself as an active investor, making the change after taking a seat on the social media company’s board.

- Array Technologies’ (ARRY US) strong order book and better-than-expected FY22 guidance were welcomed by analysts, however they also highlight margin pressure and potential impacts from an antidumping and countervailing duties (AD/CVD) investigation. Array gains 11% premarket.

- Tech companies led U.S. index futures lower on Wednesday as concerns mounted over the pace of the Federal Reserve’s monetary tightening and a worsening pandemic in China. Apple (AAPL US) -0.8%.

- Gogo (GOGO US) gains 11% premarket on news that it will join the S&P Smallcap 600 Index before trading opens April 8, according to S&P Dow Jones Indices.

- US-listed Chinese stocks fall in premarket trading Wednesday, tracking Asian peers, as a selloff in bonds pressures tech shares. The decline in Chinese ADRs follows a 3.8% drop in Hang Seng Tech Index, the most in more than a week, with Alibaba and JD.com among the biggest decliners In premarket trading, Alibaba drops 2.2%, JD.com falls 2.5% and Pinduoduo declines 2.8%; Baidu -1.6%, while Bilibili -1.2%. Among electric carmakers, Nio -2.4%, Li Auto -2% and XPeng -2.4%.

Even more hawkish surprises from the Fed may be on deck: according to Swissquote analyst Ipek Ozkardeskaya, the Fed minutes expected on Wednesday afternoon may hint at a 50 basis-point hike at the next meeting. The latest comments from policy makers, surging inflation, strong jobs data and rising wages all support an accelerated tightening campaign, she said. “The market risks remain tilted to the downside,” said Ozkardeskaya. “If there is a good time for the Fed to hit the brakes on its ultra-lose policy, it is now.”

The selloff was broad based and also hammered rates, with the 10-year Treasury yield rising as high as 2.65%, taking it back into the ranges traded in 2018 and 2019. Money-market traders are betting on the steepest Fed tightening in almost three decades following Brainard’s comments. Sovereign debt across Europe retreated after bonds in Australia and New Zealand tumbled.

“The QE honeypot looks close to being empty now,” Jeffrey Halley, a senior market analyst at Oanda, wrote in a note. “I’m not sure we will get a soft landing, and nor am I sure the FOMO gnomes of the equity market will be able to continue ignoring reality, particularly if U.S. yields continue to rise.”

In Europe, automotive, travel, technology and consumer companies were the worst performers, leading declines in the Stoxx Europe 600 Index which dropped 1.5%. Delivery Hero sank 5% in Germany. Imperial Brands rose 3.1% after the U.K. cigarette producer forecast a slight increase in profit this year. Here are some of the biggest European movers today:

- Chr. Hansen shares rise as much as 5.5%, leading gains on the Stoxx 600 and the Health Care sub-index, after the nutritional ingredients manufacturer reported consensus-beating 2Q earnings.

- Imperial Brands shares climb as much as 3.5% after the company said its FY outlook is in line with the revised guidance issued last month. It’s been a solid start to the year, RBC says.

- IWG shares rise as much as 6% after the stock is raised to buy from hold at Peel Hunt, with the broker seeing multiple ways the flexible offices firm could create value.

- Avio shares rise as much as 15% the most intraday in a year after the stock was raised to buy from neutral at Banca Akros after Amazon’s “massive order” for Ariane 6 launches.

- Huber + Suhner shares climb to a record high after UBS upgrades to buy from neutral, citing “under-appreciated” prospects for the maker of radio- frequency and fiber-optic technology.

- Semiconductor stocks lead European tech stocks lower on Wednesday as a selloff in bonds steepens amid hawkish commentary from Federal Reserve Governor Lael Brainard.

- Among semiconductor stocks, ASML drops 3.4%, ASM International -5%, Infineon -3.7%, Nordic Semi -7.6%, BE Semi -4.8%

- Royal Mail shares fall as much as 4.6%, hitting the lowest since Dec. 21, as Barclays cut its PT on the postal group to 400p from 640p with FY23 likely to be a challenging year.

- Stroeer shares drop after HSBC cut the advertising firm’s rating to hold, saying the stock may find it difficult to withstand cyclical headwinds as the Ukraine war weighs on economic growth.

- Avon Protection shares drop as much as 25% with Jefferies saying the protective-equipment maker’s latest update is “disappointing.”

Earlier in the session, Asian stocks traded lower across the board following the losses on Wall Street as Mainland China returned from its long-weekend. ASX 200 conformed to the downbeat tone which isn’t helped by the RBA’s hawkish hold yesterday. Japan’s Nikkei 225 saw most of its construction and machinery-related names with losses. KOSPI was pressured by its large tech exposure. Hang Seng was also weighed on by its tech exposure as yields continued to rise overnight. The Shanghai Comp returned for the first time this week following its domestic holiday and saw less pronounced losses, with the Real Estate sector feeling relief from reports that over 60 Chinese cities ease policies on housing purchases to support the market.

In rates, the Treasuries selloff extended with the curve steepening sharply out to the 10-year sector after Tuesday’s aggressive selloff — spurred by hawkish Fed comments — was extended during the Asia session. Wednesday’s focal points include the March FOMC minutes release, expected to feature balance-sheet runoff details. Yields are higher by as much as 8bp after the 10-year rose as much as 11bp to nearly 2.66%, highest since March 2019; The 2s10s curve is steeper by ~4.5bp on the day near 7bp, while 2s10s30s fly cheapens around 5bp follows Tuesday’s 9bp jump wider; 10s30s curve spread is back around 2bp after briefly inverting for first time since 2006. Into the selloff, long-end swap spreads have widened, 10- and 30-year by 1bp-2bp.

In FX, Bloomberg dollar spot index fades a push higher to trade flat. GBP and NZD are the strongest performers in G-10 FX, CHF and JPY underperform.

In FX, a gauge of the dollar’s strength rose to a three-week peak.

In commodities, WTI crude rose above $103 a barrel, before stalling near $104 . Worries remain that Russia’s growing isolation over the war in Ukraine may further disrupt commodity flows. Fresh sanctions on Russia are expected, including a U.S. ban on investment in the country and a European Union proscription on coal imports. Most base metals trade in the red; LME lead falls 0.7%, underperforming peers. Spot gold rises roughly $6 to trade near $1,929/oz.

Crypto markets experienced sudden selling pressure overnight with Bitcoin losing USD 45k, a level it has

acquired a foothold on during the European session

Market Snapshot

- S&P 500 futures down 1% to 4,475.00

- STOXX Europe 600 down 0.9% to 458.77

- German 10Y yield little changed at 0.66%

- Euro little changed at $1.0912

- Brent Futures up 0.9% to $107.63/bbl

- MXAP down 1.4% to 179.00

- MXAPJ down 1.2% to 593.59

- Nikkei down 1.6% to 27,350.30

- Topix down 1.3% to 1,922.91

- Hang Seng Index down 1.9% to 22,080.52

- Shanghai Composite little changed at 3,283.43

- Sensex down 0.8% to 59,672.08

- Australia S&P/ASX 200 down 0.5% to 7,490.09

- Kospi down 0.9% to 2,735.03

- Brent Futures up 0.9% to $107.63/bbl

- Gold spot up 0.0% to $1,923.71

- U.S. Dollar Index little changed at 99.50

Top Overnight News from Bloomberg

- Money-market traders are betting the Federal Reserve will implement 225 basis points of interest-rate hikes by the end of the year. Factoring in the hike already delivered in March, that would mean an increase of 2.5 percentage points for the whole year. The Fed hasn’t done that much tightening in one year since 1994, a famously brutal year for bond investors that even included a 75 basis-point hike

- The Bloomberg Global Aggregate Index fell below a measure of so-called par value Tuesday, with its price falling to 99.9 — under the key 100 level at which bonds are often sold to investors. It’s the first time since 2008 that the gauge has traded at a discount to face value

- The Federal Reserve will unveil details of its likely plans to shrink its massive balance sheet with the release of minutes of the U.S. central bank’s March meeting, as policy makers confront the highest inflation in four decades

- Leaving the European Central Bank to fight the current bout of energy-driven inflation alone would only work at a steep cost to society, according to Executive Board member Fabio Panetta

- German factory orders fell in February, dropping for the first time in four months in the runup to Russia’s invasion of Ukraine and underscoring concerns over slower growth in Europe’s largest economy

- Turkey’s Recep Tayyip Erdogan approved on Wednesday a set of changes to the country’s electoral rules that would bolster his party’s prospects and consolidate the shift toward an all- powerful presidency set to be tested at the ballot box next year

- The U.S., European Union and Group of Seven are coordinating on a fresh round of sanctions on Russia, including a U.S. ban on investment in the country and an EU ban on coal imports, following the discovery of civilian murders and other atrocities in Ukrainian towns abandoned by retreating Russian forces

- The European Union’s foreign policy chief described a summit with Chinese President Xi Jinping as a “deaf dialog,” casting doubt on how much cooperation the Asian nation will offer to end the war in Ukraine

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac markets traded lower across the board following the losses on Wall Street; Mainland China returned from its long-weekend. ASX 200 conformed to the downbeat tone which isn’t helped by the RBA’s hawkish hold yesterday. Nikkei 225 saw most of its construction and machinery-related names with losses. KOSPI was pressured by its large tech exposure. Hang Seng was also weighed on by its tech exposure as yields continued to rise overnight. Shanghai Comp returned for the first time this week following its domestic holiday and saw less pronounced losses, with the Real Estate sector feeling relief from reports that over 60 Chinese cities ease policies on housing purchases to support the market.

Top Asian News

- Hong Kong Chief Secretary John Lee Resigns, Government Says

- China Backs Ex-Security Chief to Lead Hong Kong, SCMP Says

- Singaporeans Need $73,549 Just for Right to Buy a Car

- EU’s Top Envoy Calls Summit With China’s Xi a ‘Deaf Dialog’

European bourses deteriorated further from a tepid cash open, in-fitting with the Wall St./APAC handover, Euro Stoxx 50 -1.6% Such downside was exacerbated by weak Construction PMIs and as yields continue to make further advances ahead of ECB’s Lane & FOMC Minutes. As such, the NQ -1.0% is the morning’s laggard, though price action thus far has seen the ES give-up 4500 ahead of the 200-DMA at 4484.

Top European News

- U.K. Covid Cases at Highest Level as Immunity Wanes, Study Finds

- Erdogan Changes Turkey’s Electoral Laws to Bolster His Rule

- BNP Allows Staff in Europe to Work From Home Half the Time

- Infineon, STMicro Attractively Valued Despite Softer 2023: Citi

In FX, dollar fades fast following rapid rise to fresh 2022 high post-hawkish Fed Brainard and pre-FOMC minutes – DXY reaches 99.759 before retreat to sub 99.500. Swedish Krona outperforms after latest comments from Riksbank member Floden upping the ante for a near term repo rise, EUR/SEK capped below 10.3000. Franc lags as yield and policy divergence weigh and EUR/CHF cross rebounds in a fashion that suggests official intervention, USD/CHF tests 0.9350 and EUR/CHF close to 1.0200 vs sub-1.0150 at one stage. Euro and Pound take advantage of Buck pull back and some chart support to recoup losses, EUR/USD and Cable back on 1.0900 and 1.3100 handles after dip through 1.0895 Fib and 1.3050. Yen reverses more repatriation gains as BoJ maintains YCC, USD/JPY hovering beneath 124.05 peak.

In commodities, WTI and Brent are firmer, shrugging off the tepid tone and benefitting from geopolitical premia. amid ongoing sanction announcements/ discussions. However, the benchmarks are once again in relatively thin ranges of circa. USD 3.00/bbl at present. US Private Energy Inventory Data (bbls): Crude +1.08mln (exp. -2.1mln), Cushing +1.791mln, Gasoline -0.543mln (exp. +0.1mln), Distillate +0.593mln (exp. -0.8mln). Gas flows via Yamal-Europe pipeline resume eastward, according to Gascade data, according to Reuters; however, subsequently reported that such flows have stopped. Spot gold/silver are modestly firmer, benefitting from the general risk tone and as the USD takes a breather from recent advances.

Central Banks

- ECB’s Wunsch said the inflation target is essentially met and expects the deposit rate to be raised to zero by year end. He said the ECB’s rate could rise to 1.5-2% in the longer term, but caveat that even within the ECB there has been no discussion about raising interest rates, according to Reuters.

- ECB’s Panetta says they would not hesitate to tighten policy if supply shocks fed into domestic inflation, not seeking any de-anchoring of inflation expectations. Asking the ECB to bring down high inflation in the near-term would be extremely costly.

- RBA’s Deputy Governor Bullock notes Australian labour market is tight, was seeing some response in wages, with unemployment at 4.0%. Expects some revision upward in inflation forecasts; are now seeing more underlying inflation pressures.

- Riksbank’s Floden says inflation will be much higher in the coming year than predicted in February. We must raise the policy rate much earlier than previously planned. Evident we must reassess and substantial adj. monetary policy plans.

US Event Calendar

- 07:00: April MBA Mortgage Applications, prior -6.8%

- 14:00: March FOMC Meeting Minutes

Central Banks

- 09:30: Fed’s Harker Discusses the Economic Outlook

- 14:00: March FOMC Meeting Minutes

DB’s Henry Allen concludes the overnight wrap

DB Research have released a significant World Outlook document yesterday, in which we’ve updated our views on the global economy and financial markets given developments since the start of the year. In terms of the key takeaways, we’ve downgraded our growth forecasts, with an out-of-consensus view that a US recession is now the base case by the end of next year, since higher inflation will require a more aggressive tightening in monetary policy from central banks, and we now see the Fed moving much faster, with 50bp hikes at the next 3 meetings, and a terminal rate of 3.6% by mid-2023. The outlook has been further dampened by Russia’s invasion of Ukraine, which has pushed up energy prices and led to further disruption for key commodity markets and supply chains.

With the outlook moving in a more stagflationary direction, we expect growth to slow materially in the second half of 2023, tipping the US into recession by the end of that year. Indeed historically, there’s been just 2 occasions over the last 70 years when the Fed has raised rates by 300bps and left inflation on a downward trajectory without causing a recession. And as we’ve written many times in the EMR, the recent inversion of the 2s10s curve has on average preceded the start of a recession by around 18 months (see more in our recent chartbook here). Over in the Euro Area, we’re also forecasting a more aggressive tightening cycle, with the ECB raising rates by 250bps between this September and December 2023. But unlike in the US, we think Euro Area growth will be modestly above zero in the winter of 2023-24. Along with the updated call for US recession, Jim’s also expecting credit spreads to widen out by the end of next year. See the full credit update from him here.

Many of those themes we wrote about in the World Outlook were echoed in markets over the last 24 hours, with a massive bond selloff that was turbocharged by some hawkish rhetoric from Fed Governor Brainard (who’s also been nominated to become Vice Chair). Among the headlines, she said the FOMC would “continue tightening policy methodically” and would start reducing the balance sheet “at a rapid pace as soon as our May meeting.” Furthermore, she went on to say that she expected the balance sheet “to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017-19.” Today’s FOMC minutes should give more detail about what QT may look like, which our US econ team and Tim from our team covered here. And there was also a comment that inflation was “subject to upside risks”. Brainard is typically perceived to be dovish, that the comments came from her left little doubt about the consensus of the entire committee voting bloc.

Those remarks saw market pricing shift to expect even more aggressive moves from the Fed over the rest of the year. In fact by yesterday’s close, futures were pricing in an 83% chance of a 50bps move at the next meeting in May, whilst the amount of tightening priced for 2022 as a whole hit its highest yet as well, with 220bps worth of further hikes on top of the 25bps from last month. If realised, that would be the largest amount of Fed tightening in a single calendar year since 1994, when they moved Fed funds up by 250bps, and remember that our economists’ latest forecasts now see the Fed matching that 250bps worth of hikes this year as well. Terminal rates are also repricing higher, with 1y1y OIS rates hitting their highest level this cycle at 3.17%, up from 1.11% at the start of the year.

These expectations of a more aggressive Fed led to a major selloff in Treasuries across maturities, with yields on 10yr Treasuries up by +15.2bps to 2.55% by the close, echoing the volatility in yields we saw at the start of last month as Russia’s invasion of Ukraine got underway, and marking the largest daily rise in the 10yr yield since the Covid-induced volatility in March 2020. That also marks the first time the 10yr yield has closed above 2.5% since May 2019, and the move went alongside a large rise in real yields (+9.7bps) as well, which at -0.31% put it at levels not seen since March 2020 as well. Another feature of yesterday was that the big rise in yields at the long end of the curve proved enough to un-invert the 2s10s curve, which ended the day in positive territory for the first time since last Wednesday, at 2.5bps. And this morning those moves have gained added momentum, with the 10yr Treasury up another +7.1bps to 2.62%, and the 10yr real yield up +5.8bps to -0.25%.

That selloff in Treasuries was echoed in Europe too yesterday, with yields on 10yr bunds (+10.8bps), OATs (+14.9bps), BTPs (+19.3bps) and gilts (+10.7bps) all seeing similarly big rises. From Europe, one interesting point to note is that the spread of French 10yr yields over bunds widened to 54bps yesterday, which is its widest level in almost 2 years. That came amidst a broader underperformance in French assets yesterday, with the CAC 40 index losing -1.28% as the tightening polls ahead of the first round this Sunday have led to increasing doubt as to whether President Macron will win another term in office. He’s still ahead in the polls for now, but the gap between himself and his main challenger Marine Le Pen has narrowed in Politico’s polling average from a peak of 30%-17% less than a month ago to just 27%-21% now. Furthermore, the second round average is at 54%-46%, which is also significantly tighter than Macron’s 66%-34% victory over Le Pen in 2017.

US equities were also affected by the more hawkish rhetoric from Governor Brainard, and the S&P 500 fell -1.26% as investors continued to price in higher interest rates. Cyclical sectors were among the worst performers, and technology stocks lost significant ground with the NASDAQ (-2.26%) and the FANG+ index (-3.28%) both undergoing serious declines. In Europe the situation was somewhat better, although the main indices there closed before the later decline in the US, meaning that the STOXX 600 still advanced +0.19%. As mentioned however, that masked serious regional divergences, with the FTSE 100 advancing +0.72%, whilst the Germany’s DAX (-0.65%) and France’s CAC 40 (-1.28%) both lost ground.

Staying on Europe, there were further developments on Russian sanctions yesterday, with the EU proposing a 5th package of measures that would include an import ban on Russian coal, among others. Commission President von der Leyen said that they were working on further sanctions “including on oil imports”, but there wasn’t yet a discussion about banning either oil or gas, with differing opinions among the member states on such a move.

That pattern of losses has been seen overnight in Asia as well, where equity markets are trading in negative territory amidst that continued rise in Treasury yields overnight. The Nikkei (-1.89%) is leading losses across the region with the Hang Seng (-1.69%) trading sharply lower as the index reopened after a holiday. Stocks in mainland China are also struggling with the Shanghai Composite (-0.29%) and CSI (-0.52%) both down after their own reopenings following holidays, which also comes as the Caixin services PMI dropped to 42.0, its lowest level since February 2020 and beneath the 49.7 reading expected by the consensus. Looking ahead, equity futures are pointing towards further losses today, with contracts on the S&P 500 (-0.04%) and the DAX (-0.41%) both falling.

Data releases took something of a back seat yesterday, but we did get the release of the final services and composite PMIs from around the world, with many European countries having upward revisions relative to the flash readings. For example, the Euro Area composite PMI came in at 54.9 (vs. flash 54.5), whilst the UK composite PMI came in at 60.9 vs. flash 59.7). The US was one of the few exceptions, where the composite PMI was revised down to 57.7 (vs. flash 58.5), and the ISM services index also came in modestly beneath expectations at 58.3 (vs. 58.5 expected), although that did mark a rebound following 3 consecutive months of declines.

To the day ahead now, and the release of the FOMC minutes from the March meeting will be one of the main highlights later. Otherwise, central bank speakers include ECB Vice President de Guindos, Chief Economist Lane, and Philadelphia Fed President Harker. Data releases include the UK and German construction PMIs for March, German factory orders for February, and Euro Area PPI for February.

Tyler Durden

Wed, 04/06/2022 – 08:03

via ZeroHedge News https://ift.tt/lNQHwtP Tyler Durden