Wait-Times For Semi Chips Rise As China Lockdowns Re-Ignite Supply Chain Congestion

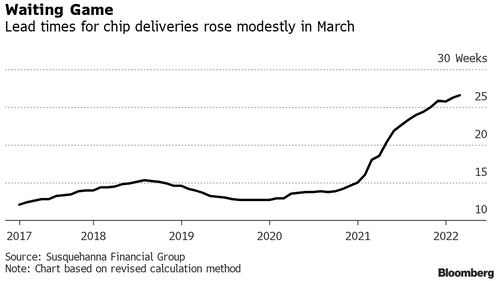

In March, the wait times for semiconductor deliveries increased again, an ominous sign that shortages persist and global supply chains remain congested.

Lead times — the lag between when a semiconductor chip is ordered and delivered — increased by two days to 26.6 weeks last month, according to Bloomberg, citing new data from Susquehanna Financial Group.

Susquehanna blamed increasing wait times on lockdowns in China and an earthquake in Japan that reduced the ability of major semiconductor manufacturers to increase output. In January, the group reported delays were diminishing, one of the first signs of improvements since 2019. However, that has since reversed as lead times rose in February.

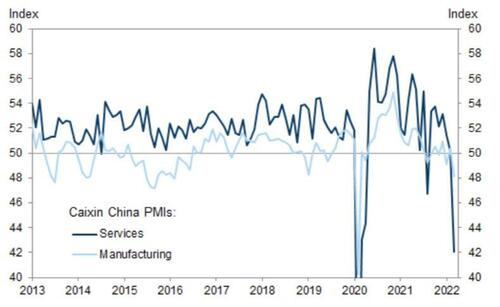

China’s Zero-COVID policy and resulting lockdown since mid-March have sparked economic turmoil as China’s Caixin Services PMI crashed to 42.0 in March from 50.2 in February, the largest single-month decline since February 2020.

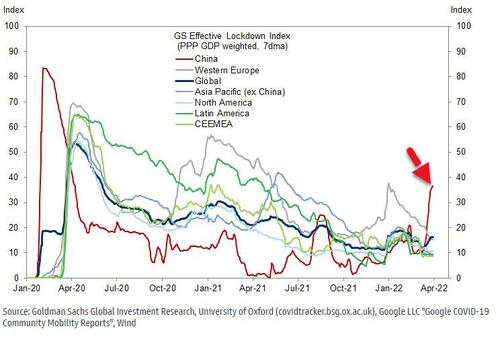

Taking a look at Goldman Sachs’ proprietary Effective Lockdown Index increased by more than ten points on average in March from February as tens of millions of people are in lockdown and factories are shuttered.

Susquehanna analyst Chris Rolland said lead times for power management, microcontrollers, analog, and memory chips increased the most. He said the Ukraine conflict, COVID lockdowns in China, and an earthquake in Japan “will have a short-term impact in the first quarter but may have lingering effects on the severely constrained supply chain through the year.”

The global shortage of semiconductors began more than two years ago in early 2020, driven mainly by the virus pandemic as the government showered Americans with helicopter money and work-at-home became widespread, pushing people to buy consumer electronic goods. Then there was a scarcity of chips as COVID shutdowns in China shuttered factories. At this rate, and considering the new developments at play, such as the war in Ukraine and China lockdowns, chip industry executives are now saying lead times might not alleviate until 2023.

As lockdowns were being implemented in China last month, our analysis suggested the world should brace for more supply chain pain.

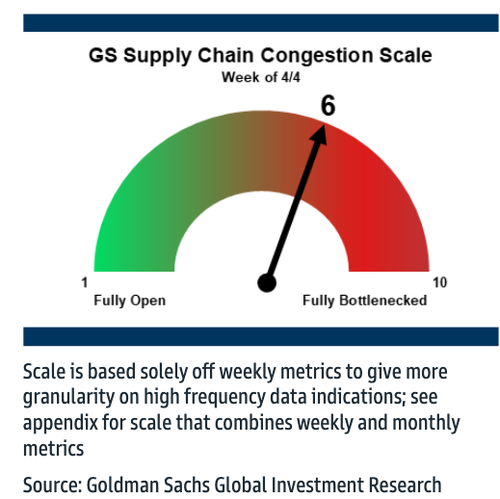

Goldman Sachs’ transportation and logistics analyst Jordan Alliger wrote in a recent note to clients that weekly bottleneck metrics of the global supply chain remain elevated.

Alliger remains “somewhat concerned over the recent Covid lockdowns in China — while ports remain open, the impact to warehouses and trucking (i.e., driver testing requirements) could create some near term backlog in loading ships/sending them to the USA, which could eventually cause the West Coast to see renewed backups if too many ships leave China all at once.”

Even though Goldman and others had said global “bottlenecks have eased versus ‘peak’ levels in December/January (when our scale was at ’10’), we are still far from ‘normal’ congestion levels.” It appears congestion (but maybe not as severe) will be sticking around for the remainder of this year.

Tyler Durden

Wed, 04/06/2022 – 19:20

via ZeroHedge News https://ift.tt/ZTOydHL Tyler Durden