Why Treasuries Are Unlikely To See A Wall Of Money From Japan

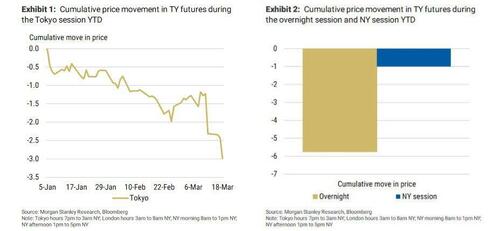

While the bond bloodbath of the first quarter has been among the worst in history, it is easy to forget that just one year ago bonds saw a similar (if slightly less bad) selloff (consider this article from last March “2021’s Bond ‘Bloodbath’ Is The Worst In Decades“.) And while much ink had been spilled one year ago in hopes of identifying the source of the relentless Q1 2021 bond selling, it was research from Morgan Stanley which found that the bulk of selling a year ago emanated out of Japan, where local funds where liquidating positions ahead of fiscal year-end on March 31.

Furthermore, once Q1 2021 was in the history books, we saw a reversal in flows with Japanese funds aggressively buying the very same Treasurys they were selling just days earlier.

So will history rhyme this time, and will Japanese buying be the catalyst for a sharp drop in yields following the historic Q1 rout?

Maybe not this time, because as Bloomberg’s Masaki Kondo writes this morning, investors in Treasuries expecting a wave of inflows of Japanese money look set for disappointment.

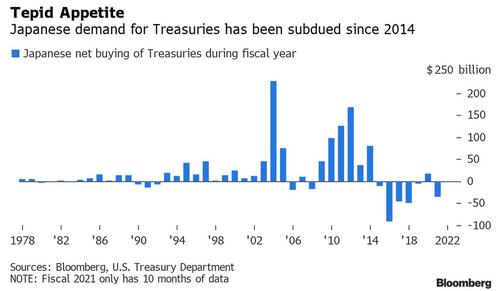

Echoing what we said above, Kondo writes that with Japan’s new fiscal year kicking off, global bond investors are wondering whether funds will step up their purchases of Treasuries. Rising inflation and Federal Reserve policy tightening that have been widening yield differentials are traditionally conducive to Japanese inflows: “That would mark a step up after years of tepid demand for the securities from the East Asian nation.”

But unlike last year, when we did in fact see a reversal in Japanese flows, there’s a good chance Japan’s giant life insurers turn their focus to Europe instead.

The main reason for this is that a deeply inverted USD/JPY forward curve suggests hedging costs for investments stateside will continue to climb as the Fed raises the policy rate. EUR/JPY’s forward curve is much less inverted, suggesting those costs are less likely to be an issue for Japan funds heading to Europe.

And Australian and Canadian bonds may also appeal to those who are concerned about the impact on the euro zone from the war in Ukraine.

Of course, life insurers can choose to buy Treasuries without hedging given persistent yen weakness, but such flows will be far more limited than hedged ones.

And a potential source of demand from Japan’s new 10 trillion yen ($80.6 billion) university fund is unlikely to provide more than minimal support to Treasuries, as it has just a 35% allocation to bonds, according to its reference portfolio.

Tyler Durden

Wed, 04/06/2022 – 12:05

via ZeroHedge News https://ift.tt/ISRMTZn Tyler Durden