Bond Market Volatility Here To Stay If Fed Has Way

By Edwards Bollingbroke, Bloomberg Markets Live analyst and reporter and former rates trader.

Until investors receive some clear and concise guidance on the Federal Reserve’s target for its policy path, bouts of bond market volatility are likely to stick around.

Harry Truman once said: “If you can’t convince them, confuse them” — an apt description of the current relationship between the Fed and interest-rate traders. Rates volatility has surged over recent weeks on a clouded outlook for monetary policy, as traders adjust positions based on expectations for Fed interest-rate hikes and balance-sheet reductions.

Yet still no one knows — not least the Fed — what is the so-called terminal rate, or the level of interest rates where the economy can cruise along without needing a policy change to speed up or slow down. This lack of precision has stretched rates volatility to multi-year highs, and in some cases through levels seen in the March 2020 liquidity crisis.

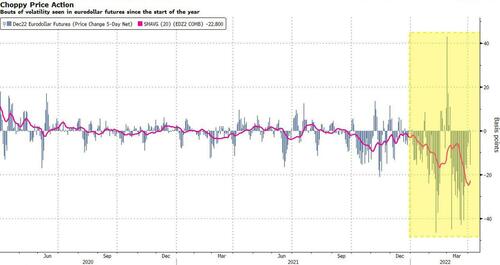

December 2022 eurodollar futures, contracts that closely align the perceived path of the policy rate, dropped as much as 14 basis points during that peak selloff on Tuesday following comments from Fed Governor Lael Brainard on shrinking the balance sheet as early as May.

Bouts of volatility have gathered pace this year, with the biggest rally sending December 2022 futures to close up 22 basis points on March 1 following capitulation of hawkish positions. That was followed the next day by a selloff that pushed it down 28 basis points after Fed Chair Jerome Powell expressed openness to 50 basis-point rate hikes.

Such moves have helped drive net weekly changes to among the highest levels over the past decade and make the contracts extremely hard to trade, especially within a liquidity shock backdrop.

While rates markets grapple with price swings, strategists are penning an array of projections, albeit somewhat conditional, for the end-game of the policy path.

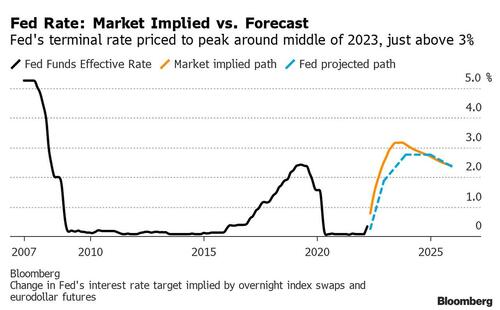

Deutsche Bank recently forecast the terminal rate for this cycle “could” be in the 3.25% to 4.25% range, compared with a rate of around 3% and 3.25% from strategists at both Goldman Sachs Group Inc. and Bank of America Corp.

The Fed sees the target rate peaking at 2.75% in 2023 and 2024 then falling to its neutral or long-term rate of 2.375% the following year, based on median estimates in its dot-plot projections from the March meeting.

Minutes of that meeting released Wednesday noted that participants “judged that it would be appropriate to move the stance of monetary policy toward a neutral posture expeditiously”.

Investors are currently trading the terminal rate above 3.00% by mid-2023, pricing in cuts by the end of next year, based on interest-rate swaps.

Speaking last weekend, Fed New York Bank President John Williams called for a sequence of rate hikes to curb inflation while monitoring the economy’s progress, noting “clearly, we need to get something more like normal or neutral, whatever that means.”

Obviously, a cautious, flexible approach is warranted to rein in inflation while protecting economic growth. But such a lack a clarity in the policy narrative means unprecedented price swings are likely here to stay as traders reposition for the next anticipated lurch in Fed steps.

Tyler Durden

Thu, 04/07/2022 – 10:25

via ZeroHedge News https://ift.tt/xbpioBU Tyler Durden