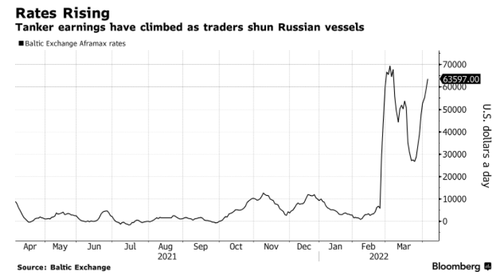

Oil Tanker Rates Climb As Traders Shun Russian Vessels

Since Russia invaded Ukraine, many Western countries have banned Russian crude imports. Now, however, countries and companies are shunning the use of Russia’s massive fleet of oil tankers, which has driven up tanker rates, according to Bloomberg.

Shipping analyst Peder Nicolai Jarlsby at Oslo-based Fearnley Securities wrote that Sovcomflot PJSC, a state-controlled company with the largest Aframax-class fleet in the world, has been shunned by global oil traders. The result is fewer oil tankers available to haul crude, which has pushed up tanker rates.

Rising freight costs add to inflationary headwinds for the energy market that will only boost costs for refineries and, in return, continue to increase the costs for producing crude products, such as gasoline and diesel.

Even though Aframaxes are one of the smallest oil tankers (move about 700,000 barrels), Sovcomflot’s “largely untouchable” fleet is driving up daily rates for larger tankers as well, such as very large crude carriers, or VLCCs.

The analyst said VLCCs are replacing Aframaxes as there is greater demand for the shrinking number of available vessels.

And there could be more bullish catalysts ahead for tanker rates, as the next round of US and EU sanctions could be imminent.

“Were Europe to escalate its sanctions to a formal ban on Russian oil, then more exports would likely sail to Asia, further eroding the availability of ships as they will have to travel further,” the analyst noted.

As the war in Ukraine drags on, impending Western sanctions could make the availability of tankers decline even further, which would continue to add to inflationary pressures.

Tyler Durden

Thu, 04/07/2022 – 05:45

via ZeroHedge News https://ift.tt/mb5IBsy Tyler Durden