Russian April Oil Output Drops Most In Two Years Even As Cargoes Of Far East Sokol Crude Sell Out

In the month-and-a-half since Russia invaded Ukraine and at a time when most western energy companies have self-imposed purchasing embargoes on Russian oil which has led to record discounts for Russian Urals crude oil amid increasingly more aggressive sanctions, energy traders have been closely watching flows in the oil market to see what happens next: will Russian oil output tumble as a result of sanctions (and lead to eventual capping of Russian pipelines as domestic storage overflows), or will Russia find enough demand from “friendly” countries such as India and China to offset the lack of demand from Western nations.

Today we got an important update: first, we learn that overall Russian oil output dropped the most in almost two years in early April as some buyers looked elsewhere for their energy supplies following the invasion of Ukraine. According to Bloomberg, if this is maintained for the whole of the month, it would be a decline of about 500,000 barrels a day from March, the most profound drop in Russia’s output since it made deep cuts alongside OPEC+ in the initial stages of the Covid-19 pandemic.

Data from the Energy Ministry’s CDU-TEK unit seen by Bloomberg showed that Russia pumped an average 1.436 million tons a day of oil from April 1-6, equivalent to some 10.52 million barrels per day, and a reduction of 4.5% from the March average of 11.01 million barrels per day, according to Bloomberg calculations, a number which was confirmed by Deputy Prime Minister Alexander Novak, who told Interfax that Russia’s oil production this month may decline 4%-5% from March “due to changing logistics of crude shipments and potential issues with tankers.” Russia’s domestic demand for oil products has also dropped amid uncertainties over the country’s economic growth. That double blow has forced refineries to reduce their processing volumes amid overstocking as discussed here.

Comparing this drop to the global post-covid lockdown, in May 2020, the first month of the post-pandemic agreement between the Organization of Petroleum Exporting Countries and its allies, Russia cut production by a historic 17.1%.

While only a handful of countries, including the U.S. and the U.K., have explicitly banned purchases of Russian oil and petroleum products with most European nations leaving a sanctions loophole open for critical Russian energy, some traditional buyers are shunning the fuel with self-imposed sanctions, even as others, Asian buyers, continue to aggressively purchase the country’s energy supplies.

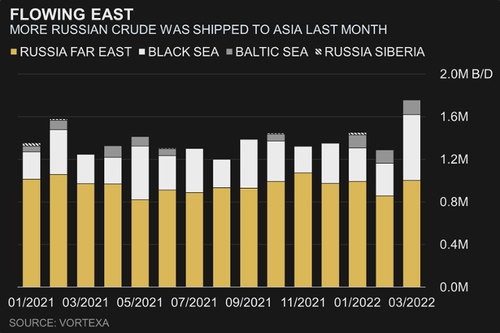

Which brings us to the next point: while overall Russian oil exports are down, far more Russian cargoes are now heading to China, India, Korea and Japan, where customers either can’t resist the temptation of cheaper crude – recently Russian Urals brent was offered at a nearly $40 discount to spot – or are struggling to find replacement barrels. A tangent here: as the US is draining its strategic petroleum reserve to score political points for the Democrats, China is busy stocking up on its own crude in what Zoltan Pozsar hinted may be preparation for war.

And after an initial tentative period where Chinese banks were said to balk at providing letters of credit, it appears that concerns have largely been swept under the rug, and cargoes of Russian Sokol crude from the Far East have sold out for next month in a sign that Russian shipments not only continue to find buyers but have in fact risen substantially. According to Bloomberg, May-loading cargoes from the Sakhalin-I project will be delivered to buyers in Japan, South Korea, China and India on a spot or term basis. Sokol yields a lot of diesel, and it can be shipped to nations in north Asia within a week.

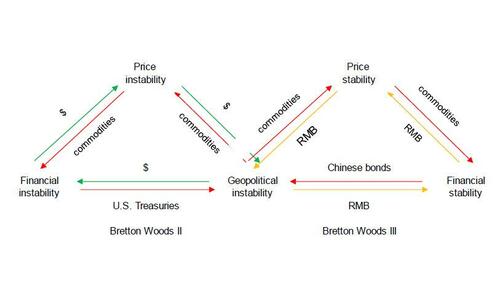

The number could rise even more: during a conference call on Thursday, Band of America’s energy analyst Francisco Blanch said China could “arguably” import an extra 2m b/d of crude oil from Russia (presumably once all the covid-related lockdowns are removed) which would more than make up for all losses of western demand so far. It would also accelerate the shrinkage of the petrodollar now that Russia and China have an agreement to transact in yuan and/or rubles.

And speaking of (interrupted) Chinese demand, Bloomberg also writes that tankers carrying 22 million barrels of Russian, Iranian and Venezuelan oil are piling up off China, according to Kpler, as the country battles a virus outbreak that’s sapping demand and causing logistics problems. China is the world’s largest crude importer, and has been one of the only buyers of sanctioned Iranian and Venezuelan oil over the last few years, openly flaunting US sanctions on Iran then, and Russia now.

Of course, sooner or later Chinese ports will reopen and its economy will be in overdrive (especially now that Beijing has conceded to more monetary stimulus). That will only exacerbate the latest inflationary trend – according to Bloomberg analysis, the war in Ukraine is starting to drive up the cost of transporting oil around the world. While the invasion caused an immediate surge in the price of hauling Russia’s own barrels, the rally is increasingly filtering through to other oil trade routes, in part because companies are avoiding hiring the nation’s giant tanker fleet. Surging freight would be just another example of how the war is roiling oil, energy and commodity markets, and is an example of one of the side-effects of the Bretton Woods 3 world described by Zoltan Pozsar.

Finally, speaking of Bretton Woods, Russian coal and oil paid for in yuan is about to start flowing into China – several Chinese firms used local currency to buy Russian coal in March, and the first cargoes will arrive this month, Chinese consultant Fenwei Energy Information Service said.

Perhaps realizing that the world is finally splintering in a half that is still reliant on the petrodollar and another half that isn’t, and also realizing that it has already lost China, overnight Joe Biden’s top economic adviser said the administration has warned India against aligning itself with Russia, and that U.S. officials have been “disappointed” with some of New Delhi’s reaction to the Ukraine invasion. “There are certainly areas where we have been disappointed by both China and India’s decisions, in the context of the invasion,” said the director of the White House National Economic Council, Brian Deese. In response, India pointed out that when it followed sanctions against Iran, the US looked the other way while China consistently broke them.

Because in the end, what goes around, comes around.

Tyler Durden

Thu, 04/07/2022 – 13:05

via ZeroHedge News https://ift.tt/NIZgsQ4 Tyler Durden