Goldman Updates Blockchain-Exposed Equities Basket As Bitcoin-Stocks Correlation Hits Record High

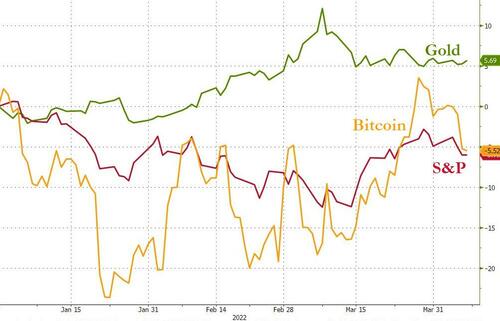

In a world of heightened risks, investors often lean into ‘stores of value’ as a way to insulate capital from elevated volatility. So far, in 2022, gold has once again proven to be a preferred ‘store of value’ with the commodity gaining 5.7% YTD (even as the S&P has lost 6% of its value).

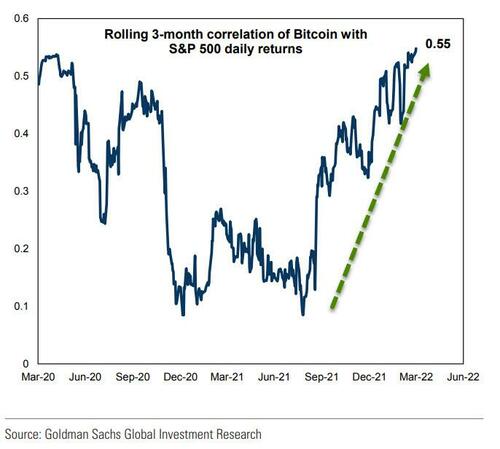

However, as Goldman’s Chris Hussey notes, as we leg further into the digital age, it is tempting to think that the world may increasingly gravitate towards digital stores of value like Bitcoin, in place of gold (a metal that has been used to shield against volatility for thousands of years now). But Bitcoin has done little to shield investors from the volatility, equally as weak as stocks year-to-date, suggesting that the cryptocurrency is still being used as a proxy for risk rather than a shield.

Against this backdrop, Goldman’s David Kostin and team have refreshed their blockchain stock basket.

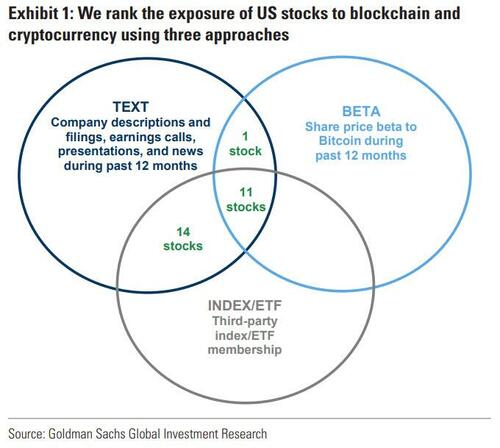

Goldman combines three approaches to screen for US stocks with blockchain and cryptocurrency exposure.

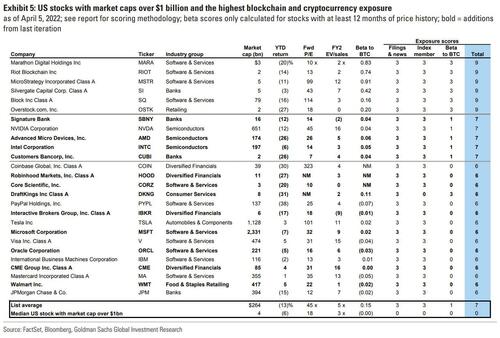

Their approach results in a screen of 26 US stocks with market caps over $1 billion and high exposure to blockchain technology and/or cryptocurrency.

On average, these stocks have underperformed the S&P 500 by 8 percentage points YTD (-13% vs. -5%)

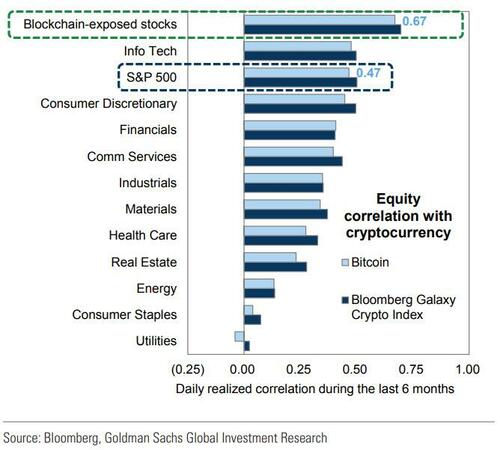

While the stocks on this list are correlated with Bitcoin…

…Bitcoin itself has become increasingly more correlated with equity index returns in recent months…

What will break that correlation? When The Fed flip-flops back to QE?

Tyler Durden

Fri, 04/08/2022 – 05:45

via ZeroHedge News https://ift.tt/s3m8H5G Tyler Durden