Beige Book Finds Economy Growing At “Moderate Pace”; Spots First Instances Of Demand Destruction, Slowing Wage Growth

With the Fed now telegraphing to markets that a 50 bps rate hike in two weeks is in the bag, moments ago the latest Fed Beige Book validated the cheerful economic outlook, noting that based on information collected before April 11, 2022, US economy activity expanded at “moderate” (no longer “modest”) pace with several Districts reporting “moderate employment gains despite hiring and retention challenges in the labor market.” At the same time, with Covid now a long-gone nanny state nightmare consumer spending accelerated among retail and non-financial service firms, as virus cases tapered across the country.

The report also notes that manufacturing activity was solid overall across most Districts, but the usual suspects – supply chain backlogs, labor market tightness, and elevated input costs – continued to pose challenges on firms’ abilities to meet demand. Worse, the Beige Book also noted that demand destruction from soaring prices is starting to emerge, and notes that “contacts in a few Districts noted negative sales impacts from rising prices. Firms in most Districts expected inflationary pressures to continue over the coming months.”

Some other highlights from the report:

- Commercial real estate activity accelerated modestly as office occupancy and retail activity increased. Districts’ contacts reported continued strong demand for residential real estate but limited supply.

- Agricultural conditions were mixed across regions. Farmers were supported by surging crop prices, but drought conditions were a challenge in some Districts and increasing input costs were squeezing producer margins across the nation.

- Vehicle sales remained largely constrained by low inventories.

- Outlooks for future growth were clouded by the uncertainty created by recent geopolitical developments and rising prices.

Looking at labor markets, employment increased at a moderate pace. Demand for workers continued to be strong across most Districts and industry sectors. But hiring was held back by the overall lack of available workers, though several Districts reported signs of modest improvement in worker availability.

- Many firms reported significant turnover as workers left for higher wages and more flexible job schedules. Persistent labor demand continued to fuel strong wage growth, particularly for footloose workers willing to change jobs.

- Firms reported that inflationary pressures were also contributing to higher wages, and that higher wages were doing little to alleviate widespread job vacancies.

Perhaps most importantly, the Beige Book notes that “some contacts reported early signs that the strong pace of wage growth had begun to slow.” This will surely bolster the “peak inflation” thesis.

Meanwhile inflation, of course, remains the big problem, with the report noting that inflationary pressures remained strong since the last report, with firms continuing to pass swiftly rising input costs through to customers.

- Contacts across Districts, particularly those in manufacturing, noted steep increases in raw materials, transportation, and labor costs.

- In multiple Districts, contacts reported spikes in prices for energy, metals, and agricultural commodities following the Russian invasion of Ukraine, and several noted that COVID-19 lockdowns in China had worsened supply chain disruptions.

- A few reports noted that input suppliers were making use of more flexible contract terms or only honoring price quotes for 24 hours. Strong demand generally allowed firms to pass through input cost increases to customers, for example, via fuel surcharges for freight and airline fares.

The big highlight, however, is that as noted above, several districts noted negative sales impacts from rising prices.

Finally, looking ahead don’t expect a big drop in inflation: firms in most Districts expected inflationary pressures to continue over the coming months.

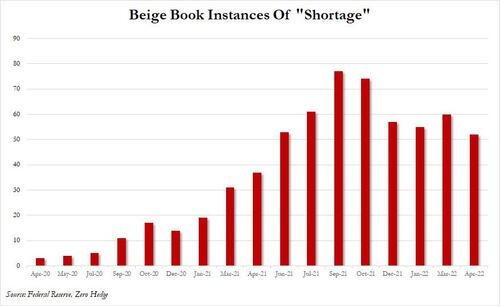

Elsewhere, several months of improvement (i.e. reduction) in mentions of shortages, recall that the March Beige Book saw a modest deterioration, with “mentions” of shortage rising from 55 in January to 60 in March. Well, not so much in April, when the word “shortage” was used just 52 times, the fewest since April of 2021.

However, the easing in shortages was more than offset by a surge in what is a clear proxy for inflation. As shown below, as shortages are easing, what is rising is, well, “rising” – yes the word “rising” was used no less than 57 times, almost double the 32 times in March, and – usually in the context of prices or joblessness – indicates that things are getting worse, not better.

Finally, here are the highlights by Federal Reserve District

- Boston: Economic activity expanded at a modest pace on aver-age. Headcounts increased modestly despite significant layoffs by one large firm. Wages and output prices alike increased at a moderate pace, but some nonlabor input prices soared. The outlook remained optimistic, but several contacts perceived an increase in downside risks.

- New York:Growth picked up to a moderate pace in recent weeks, despite supply disruptions, worker shortages, and un-seasonably inclement weather. Tourism, consumer spending, and manufacturing activity all picked up. Businesses continued to report substantial increases in selling prices, input prices, and wages. Overall, business contacts have become less optimistic about the near-term outlook.

- Philadelphia:Business activity continued to grow modestly during the current Beige Book period, and some sectors remained below pre-pandemic levels. Customer traffic resumed and workers began returning to offices, as the lull in COVID-19 cases continued. The labor market remained tight with moderate growth, while wages eased to a moderate pace and prices grew sharply.

- Cleveland:The District’s economy expanded at a moderate pace despite ongoing supply and labor constraints. The war in Ukraine had little meaningful impact on current demand for goods and services, but it added another layer of complexity to supply chains. However, contacts said that the war had significantly increased uncertainty and put further upward pressure on costs, particularly for energy, metals, and agricultural commodities.

- Richmond:The regional economy expanded moderately, but some businesses were concerned that rising energy prices and the war in Ukraine could have adverse effects on business conditions in coming weeks and months. Many Fifth District businesses reported increasing employment and that rising costs of labor, materials, transportation and energy contributed to strong price growth in recent weeks.

- Atlanta:Economic activity expanded at a moderate pace. Labor markets remained tight, and wages continued rising. Nonlabor costs rose. Retail sales were strong. Tourism activity strengthened. Housing demand was strong. Commercial real estate conditions were mixed. Manufacturing activity was robust. Banking conditions were steady.

- Chicago:Economic activity increased moderately. Employment increased strongly, and consumer spending, business spending, manufacturing, and construction and real estate were up modestly. Wages and prices rose rapidly, while financial conditions tightened some. Agriculture markets experienced price increases and substantial volatility related to Russia’s invasion of Ukraine.

- St. Louis:Economic conditions have improved at a moderate pace since our previous report. Prices for food and raw materials increased at a robust pace. The pace of hiring rose slightly, but labor shortages continued to limit output and wage growth remained strong. Consumer spending on services rose, but some softening in retail spending pointed to a mixed outlook moving forward.

- Minneapolis:The region’s economy grew moderately since mid-February. Despite continued price pressures, overall demand in most sectors remained healthy. Meeting that demand, however, was checked by tight labor, supply chain difficulties, and other challenges. Firms expressed rising interest in automation to address persistent pressures on wages and labor availability. Startup loans to Minority- and women-owned business enterprises in rural areas were on the rise.

- Kansas City:Growth in the Tenth District accelerated to a robust pace. Prices increased rapidly and contacts reported changing prices much more frequently than is typical. Labor markets tightened further. The invasion of Ukraine disrupted supply chains and caused input prices to rise, but District businesses reported no effects on demand, hiring or planned capital expenditures.

- Dallas:Economic activity expanded at a faster clip. Growth was broad-based across sectors, but many firms noted sup-ply-chain disruptions as a primary constraint on revenues. Employment and wages rose robustly. Supply-chain issues and energy prices continued to drive up costs. Optimism in outlooks waned, and uncertainty increased because of mounting headwinds.

- San Francisco:Economic activity strengthened moderately over the re-porting period. Employment levels expanded while over-all conditions in the labor market remained tight. Wages and price levels significantly increased. Retail sales and consumer and business services sector activity continued to expand, while the agriculture and resource sectors strengthened a bit. Lending activity was little changed.

The full report can be found here.

Tyler Durden

Wed, 04/20/2022 – 14:26

via ZeroHedge News https://ift.tt/8krqz7S Tyler Durden