Blockbuster 20Y Auction: Record Bid To Cover, Record Indirects; Record Stop Through

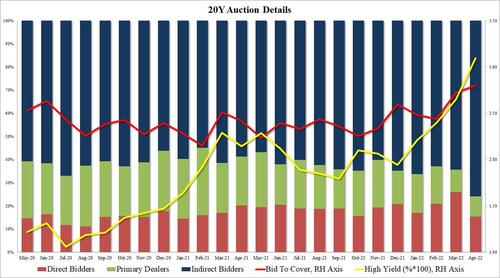

With yields tumbling all day after the 10Y seemingly peaked just south of 3.0%, many expected that today’s 20Y reopening (of 19Y-10M cusip TF5) would be a tail due to the lack of concession. Well, they were wrong, because moments ago the Treasury announced that it sold $16BN in 20Y paper at a high yield of 3.095%, which while almost 150bps higher compared to the March high yield of 2.651%, stopped through the When Issued 3.125% by 3.0bps, the biggest strop through in the (brief) history of the 20Y auction.

The bid to cover jumped to 2.80, up from 2.72 in March, and also a record high.

The internals were also record, with Indirects taking down a whopping 75.9%, up a whopping 11.5% from March’s 64.4%, and the most on record, not to mention well above the six-auction average of 63.9.%. And with Directs awarded 15.3%, modestly below the recent average, Dealers were leff holding just 8.7%, also the lowest on record!

Overall, a stellar auction, and one which has seen yields drop even more, with the 10Y yield tumbling to session lows below 2.84%, down 14bps from overnight high…

… and 20Y sliding below 3.08%…

… after what can only be described as the strongest auction in a long time.

Tyler Durden

Wed, 04/20/2022 – 13:21

via ZeroHedge News https://ift.tt/FdPXl3w Tyler Durden