Real Yield Surge Above Zero Looks Unlikely To Hold Out

By Akshay Chinchalkar, Bloomberg Markets Live commentator and reporter

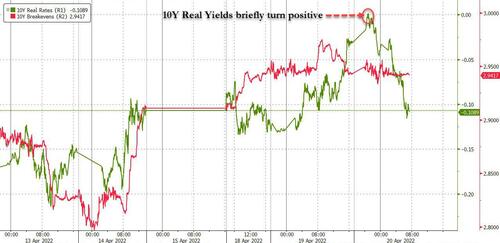

Ten-year U.S. real yields have flipped to positive territory for the first time since 2020. However, staying there though does not have history on its side.

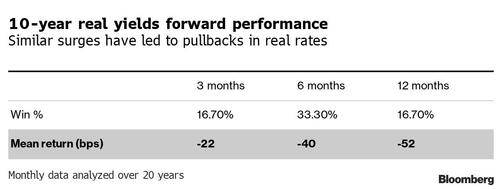

So far this month, real yields are up nearly 50 bps compared to the end of March. A 20-year backtest that measures where they ended three, six and 12 months out after monthly surges of similar magnitude shows that expecting a further climb would have been a losing proposition, as summarized below.

The win percentage shows in how many instances the real yield was even higher three, six, and 12 months out after surging 50 bps or more over the previous month’s close. The low win percentage in all three cases shows that in the overwhelming number of cases, the real yield was lower in these time frames.

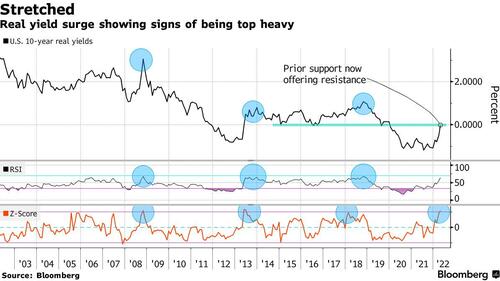

Similar insights can be drawn when looking at the 14-month RSI and the 12-month z-score for the same date range. Notice that the current RSI reading has some room left for it to head into its past “topping area.” The z-score has already crossed above the 2.5 standard deviation threshold, which historically has led to some sort of a stall or pullback.

It remains to be seen whether investors will now prefer bonds relative to more risky assets such as stocks and credit as real yields turn positive. With aggressive rate hikes by the Fed now completely priced in, it will take something completely unexpected for real yields to continue marching higher, even after the current, near vertical surge.

Tyler Durden

Wed, 04/20/2022 – 11:40

via ZeroHedge News https://ift.tt/NmgODQ0 Tyler Durden