WTI Jumps After Biggest Crude Draw Since Jan 2021

Oil prices limped higher overnight (as industrial activity in virus-hit China picked up, and API reported an unexpected decline in U.S. crude stockpiles), then gave back all their gains after US equities opened as the NFLX effect rippled through all markets (and the reality of the recent IMF and World Bank growth pessimism sinks in).

“All of this is fuelling concerns about demand on the oil market, which had recently taken somewhat more of a back seat as supply risks dominated the headlines. And yet both OPEC and the IEA had already adjusted their forecasts for oil demand down significantly last week – something that market participants failed to give sufficient attention, if not to say ignored completely,” Commerzbank analyst Carsten Fritsch said in a note.

Supply is also expected to rise as the Black Sea oil terminal operated by the Caspian Pipeline Consortium, returns to full capacity after a storm damaged the terminal in February. The terminal ships about 80% of Kazakhstan’s crude oil production, Reuters reported.

But for now, all eyes on Crude stocks and gasoline demand for signs of demand destruction and global slowdowns.

API

-

Crude -4.496mm (+2.533mm exp)

-

Cushing +93k

-

Gasoline +2.933mm

-

Distillates -1.652mm

DOE

-

Crude -8.02mm (+2.533mm exp) – biggest draw since Jan 2021

-

Cushing -185k

-

Gasoline -761k

-

Distillates -2.664mm

After the previous week’s huge build, last week saw US crude stocks tumble over 8mm barrels – the biggest draw since Jan 2021. Cushing stocks fell and products saw inventory draws…

Source: Bloomberg

Gasoline demand rose back to ‘average’ for this time of year, suggesting no significant demand destruction is evident yet.

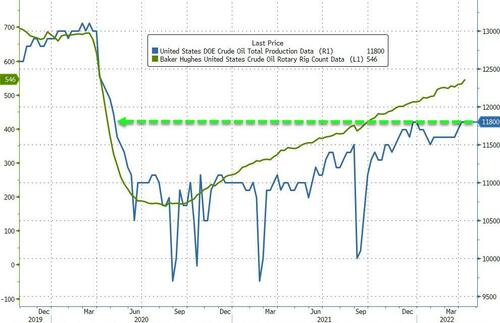

US crude production was flat WoW – at 2 year highs…

Source: Bloomberg

WTI hovered back down at around $102 ahead of the official data release and rallied higher after the big draw…

Of course, the big item to watch is what will happen to US gas prices at the pump. This week’s rapid retracement offers President Biden another chance at redemption…

Source: Bloomberg

But what happens when the ‘Putin Price Hike’ is erased and still gas prices are up dramatically since he was elected? Who will get the blame then?

Tyler Durden

Wed, 04/20/2022 – 10:37

via ZeroHedge News https://ift.tt/TFgXp89 Tyler Durden