Bond/Stock Bloodbath Leads To Worst Start To A Year On Record

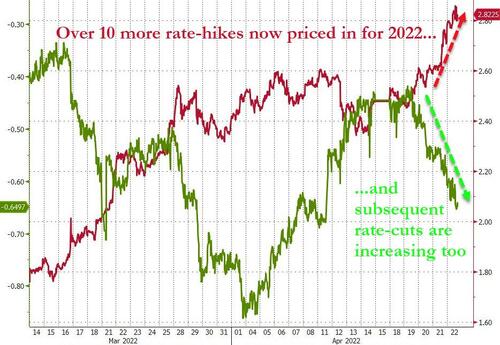

Ultra-hawkish FedSpeak (from them all) sent rate-hike expectations this week (with 50bps fully priced-in for May, and a 35% chance of a 75bps hike in June now)…

Source: Bloomberg

For bonds and stocks that meant – STFD!

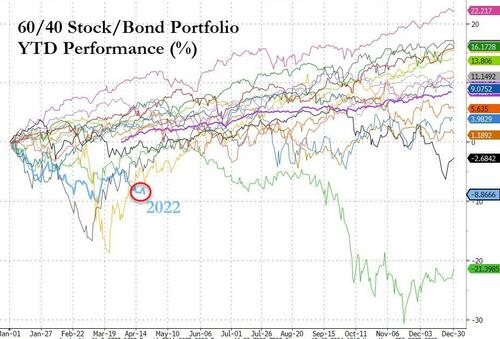

This is the 3rd week in a row that a ‘balanced’ portfolio of stocks and bonds has been monkeyhammered lower…

Source: Bloomberg

This is the worst start to a year for a ’60/40 Stock/Bond’ index since record began (worse then 2009 and 2020)…

Source: Bloomberg

It seems cash is not trash after all!

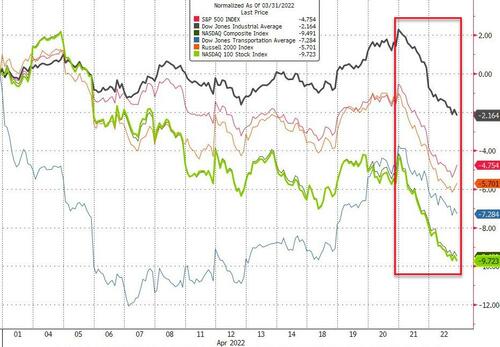

Today was a bloodbath for stocks broadly with no divergence as all the majors tumbled over 2.5%…

The Dow fell over 1000 points from high to low today…

That led to a 4th straight weekly loss for The Dow (and 3rd for the rest of the majors) and today was the worst days for The Dow since early March. Nasdaq was the week’s biggest loser though…

All the majors broke below critical technical support levels this week…

All the majors are now underwater for April…

Source: Bloomberg

Energy was worst on the week while Staples were the only sector to close green…

Source: Bloomberg

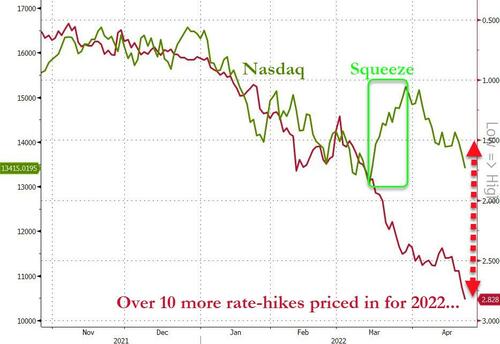

Stocks are just starting to wake up to STIRs reality…

Source: Bloomberg

The ‘reopening vs inflation’ debate was on display with earnings across a range of sectors. And as Goldman’s Chris Hussey notes, there was a stark contrast in outcomes in two post-pandemic beneficiaries: hospitals vs airlines. Healthcare stocks hammered today after HCA cut guidance continue to plunge as the Airline industsy rebounds…

Source: Bloomberg

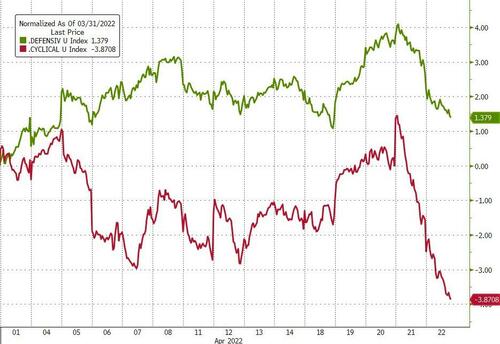

After the late-March meltup in cyclicals, April has seen Defensives dominate and long-duration growthy stuff was clubbed like a baby seal the last two days…

Source: Bloomberg

Credit markets cracked wider this week and equity risk finally started to play catch up (after the late March meltup in equities that credit ignored)…

Source: Bloomberg

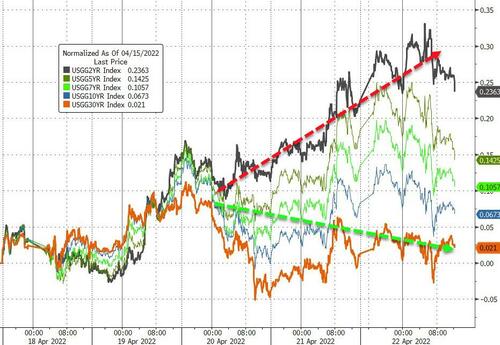

Bonds were dumped this week with the short-end utterly destroyed amid a massive bear flattening…

Source: Bloomberg

The yield curve re-inverted this week (3s10s)…

Source: Bloomberg

The Dollar continued to surge higher this week (3rd weekly gain in a row) to its highest since May 2020…

Source: Bloomberg

The Chinese Yuan crashed this week in a stealth devaluation…

Source: Bloomberg

Cryptos were all lower on the week as they tracked risk assets down the last two days…

Source: Bloomberg

Bitcoin managed to trade up to $43k during the week, only to tumble back below $40k today…

Source: Bloomberg

Commodities were broadly lower on the week with Silver and crude suffering most…

Source: Bloomberg

Front-month WTI (June) ended the week around $102 – basically unchanged since Biden unleashed the SPR…

Gold ended the week lower – after tagging $2000 during the week – but remains well above $1900 pre-Putin…

Finally, we note that despite this week’s carnage in stocks (well the last two days) and bloodbath in bonds, Treasuries are at their cheapest relative to stocks since 2011…

Source: Bloomberg

TINA is dead and The Fed killed her!

Tyler Durden

Fri, 04/22/2022 – 16:01

via ZeroHedge News https://ift.tt/6dYVsCe Tyler Durden