Solid 7Y Auction Tails Despite Spike In Foreign Demand

After a strong 2Y, and a subpar 7Y auction earlier this week, we end the week’s coupon issuance with an auction of $44BN in 7Y paper which came in just right.

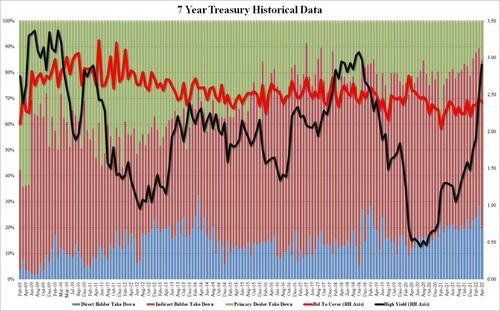

The high yield of 2.908% was a whopping 41bps higher than the March auction and was the highest since Nov 2018, just before the Fed panicked and ended its tightening (of course, inflation back then was well lower). And even though yields have been grinding higher all day, the auction tailed the 2.891% When Issued with a “decent” 1.7bps tail, the biggest since December.

The 2.41 bid to cover was in line with recent prints, and while it dipped from last month’s 2.44, it was above the 2.34 six-auction average.

Finally, the internals were more impressive with Indirects taking down a solid 64.95%, a big jump from 60.9% last month and the most since Nov 2020 and one of the highest on record. And with Dfirects taking down a decent 19.8% (below last month’s near record 28.55%), Dealers were left holding 15.2% of the allotment, right on top of the recent average of 15.4%.

Overall, a solid if not spectacular auction, and one which priced pretty much on top of expectations, which is why it had absolutely no impact on the rest of the curve.

Tyler Durden

Thu, 04/28/2022 – 13:20

via ZeroHedge News https://ift.tt/NjelPCM Tyler Durden