Chinese Markets Stare Into The Abyss After Lost Decade

By George Lei, Bloomberg Markets Live Commentator and reporter

China announced on Thursday a 50% reduction to the clearing fee on stock transactions in another piecemeal effort to prop up financial markets. Investors, however, increasingly sense a doomsday scenario for both the real economy and equities. As senior leaders gather for a critical meetingin the coming days, quick, bold measures are urgently needed to stop the downward spiral.

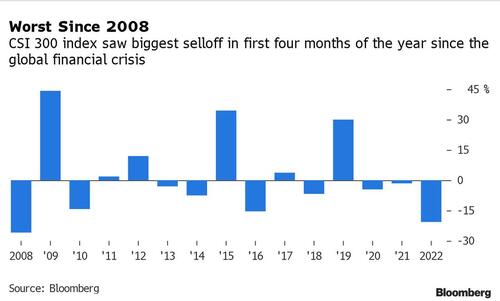

China’s CSI 300 Index rallied a total of 3.6% on Wednesday and Thursday, trimming its year-to-date loss to less than 21%. Performance for the first four months of 2022 is poised to be the worst start to a year since 2008.

Back then, at the height of the global market rout, then-Premier Wen Jiabao famously proclaimed that “in front of crisis, it is critical to have courage and confidence, which are even more important than gold.” Today, however, confidence among China-focused investors is sorely lacking.

Banxia, a Shanghai-based asset manager which topped local rankings in 2020, cut its equity exposure to zero in anticipation of a worsening economy and further market rout. “This year could be even worse for fund managers than 2008” in the sense that “it’s now very difficult to find a place where they can make money,” founder Li Bei told Bloomberg.

Weijian Shan, founder and chair of Hong Kong-based private equity fund PAG that manages more than $50 billion, also diversified away from China and was being “extremely careful” about portfolios in the country, the Financial Times reported. “We think the Chinese economy at this moment is in the worst shape in the past 30 years,” Shan said in a video of a meeting, adding that “market sentiment toward Chinese stocks is also at the lowest point in the past 30 years.”

For an asset manager operating in U.S. dollars, the MSCI China Index has delivered an inferior return than the change in waste paperprices in the U.S. producer price index over the past decade. The performance gap becomes more pronounced over a five-year time span, with the China gauge doing worse even when factoring in reinvested dividends.

The watershed moment was 2021, when policy and regulatory risks — wrapped in political slogans — came front and center for China Inc. “Homes are for living in, not for speculation,” President Xi’s famous catchphrase, led to an aggressive de-leveraging bid named “three red lines” and culminated in the Evergrande debacle as well as a crisis-ridden real-estate sector. The “common prosperity” drive to prevent “disorderly expansion of capital” smashed valuations for Internet and tutoring firms. And finally, almost all industries face the chilling economic consequences from Covid Zero.

To be fair, Beijing has moved to rein in some of its policy excesses with efforts to salvage housing and ease tech crackdowns after months of economic pain. Amid unprecedented capital flight, however, neither institutional investors nor individuals making daily business decisions may have deep enough pockets or strong enough patience to wait for any eventual loosening of Covid measures.

“China feels to us like the U.S. and Europe in 2008,” according to PAG’s founder Shan. What policy makers do in the next few months will largely determine the path ahead: a U.S.-style recovery or yet another lost decade in the case of Europe or Japan.

Tyler Durden

Thu, 04/28/2022 – 21:20

via ZeroHedge News https://ift.tt/bPmUsgx Tyler Durden